- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify Shares Pull Back After Price Hike Plans Are Announced

Reviewed by Bailey Pemberton

If you have been watching Spotify Technology’s stock lately, you are probably trying to decide whether to jump in, hang on, or take some profits. After all, the highs of streaming music have been playing out for years, and Spotify’s headline numbers show both volatility and striking outperformance. The price is up a staggering 83.2% over the past twelve months, while 2024’s returns alone have already topped 48.6%. Even if you zoom out, the three- and five-year gains of 673.2% and 172.2% respectively are hard to ignore. Of course, the past month has brought a modest pullback of -2.4%, with an even sharper -5.0% move in the last week, reminding us that not every beat is a hit single.

Some of these moves can be traced to headlines. Spotify has been making waves by indicating price hikes along with new services, signaling a bold push to improve margins and possibly weed out less committed customers. Meanwhile, competitors have not stood still. Apple is making global radio plays, and industry talent is bouncing between Spotify and other big names. Yet analysts are starting to take notice of the value Spotify can offer at current prices, especially after the recent share pullback prompted an upgrade by Phillip Securities.

All of this begs the big question: Is Spotify undervalued right now? According to our valuation checklist, Spotify scores a 1 out of 6, uncovered as undervalued in just one of the six main categories. That is not an automatic green light, but it does not shut the door on opportunity either. So let’s break down the numbers behind that score and see which valuation methods deserve your attention. And stick around, before we are done, I will share the lens I think savvy investors should really use when sizing up a company like Spotify.

Spotify Technology scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Spotify Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tool that estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Spotify Technology, this involves forecasting the company's free cash flow (FCF) for the coming years and determining what that stream of money is worth in today's euros.

Spotify generated €2.8 billion in free cash flow over the last twelve months. Analysts expect that to keep rising, with projections reaching €3.4 billion by 2026 and €5.9 billion by 2029. Looking at the extended outlook, cash flow could even exceed €9.2 billion by 2035. It is important to note that while current analyst estimates only reach about five years into the future, further growth is extrapolated from recent trends and industry expectations.

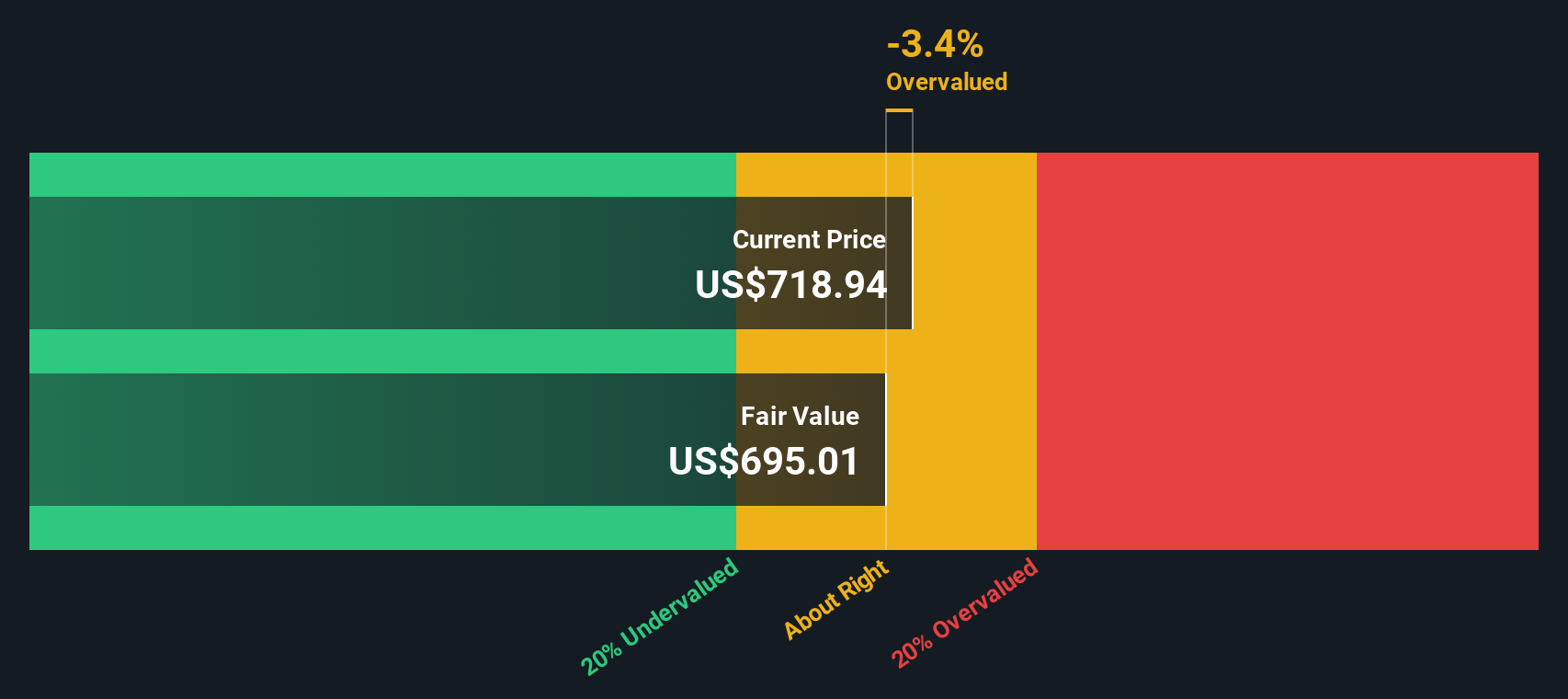

Based on this DCF approach, Simply Wall St estimates Spotify's intrinsic fair value at €697.05 per share. Comparing this to the current trading price, the DCF model suggests the stock is about 2.4% undervalued, which is a modest margin.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Spotify Technology's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Spotify Technology Price vs Earnings

For companies that are generating consistent profits, the price-to-earnings (PE) ratio is often the most meaningful valuation metric. The PE ratio tells investors how much they are paying for each dollar of a company’s earnings. This makes it a direct way to gauge the relationship between a company’s share price and its actual profitability.

A "normal" or “fair” PE ratio depends heavily on expected growth and risk. High-growth, low-risk companies tend to trade at higher PE ratios because investors are willing to pay more for future earnings. Conversely, if a business faces risks or has uncertain growth, a lower PE multiple is justified.

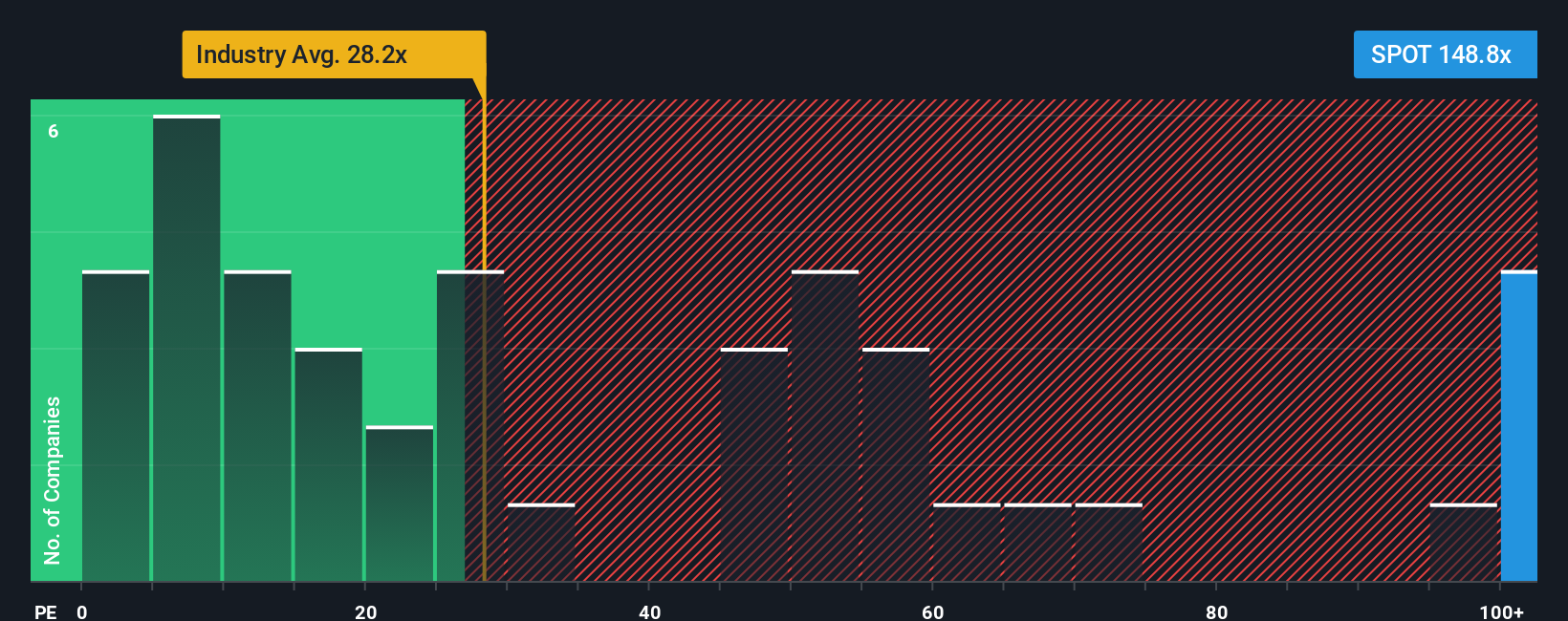

Currently, Spotify trades at a lofty PE ratio of 148x. For context, the average PE for companies in the Entertainment industry is 31x, and similar peers trade around 48x. At first glance, this premium might raise eyebrows. However, Simply Wall St also calculates a “Fair Ratio” for Spotify: 44.2x. This proprietary metric takes into account a company’s earnings growth, risk profile, profit margins, industry trends, and even market capitalization. This gives a more tailored benchmark than simply comparing with peers or the overall sector.

Because the Fair Ratio incorporates more company-specific and market-based data, it offers a more nuanced view than a simple industry or peer comparison. As it stands, Spotify’s PE ratio is still more than triple its Fair Ratio, indicating the stock looks expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spotify Technology Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives.

Narratives are an innovative, user-friendly framework that lets you connect your personal story or perspective on a company, such as your expectations for Spotify Technology's future revenue, earnings, and margins, with actual financial forecasts and an estimated fair value.

Unlike a simple valuation ratio, a Narrative weaves together the company's qualitative journey with quantitative forecasts to produce a dynamic, living estimate of what the business is truly worth. With Simply Wall St’s Narratives tool (available right now on the Community page and used by millions of investors), you can review or create a Narrative for Spotify, adjusting assumptions to match your own view of its future and instantly see how your fair value compares to the current share price.

The real power of Narratives is that they are always up-to-date. Whenever important news breaks or earnings are released, the numbers behind the story are refreshed automatically.

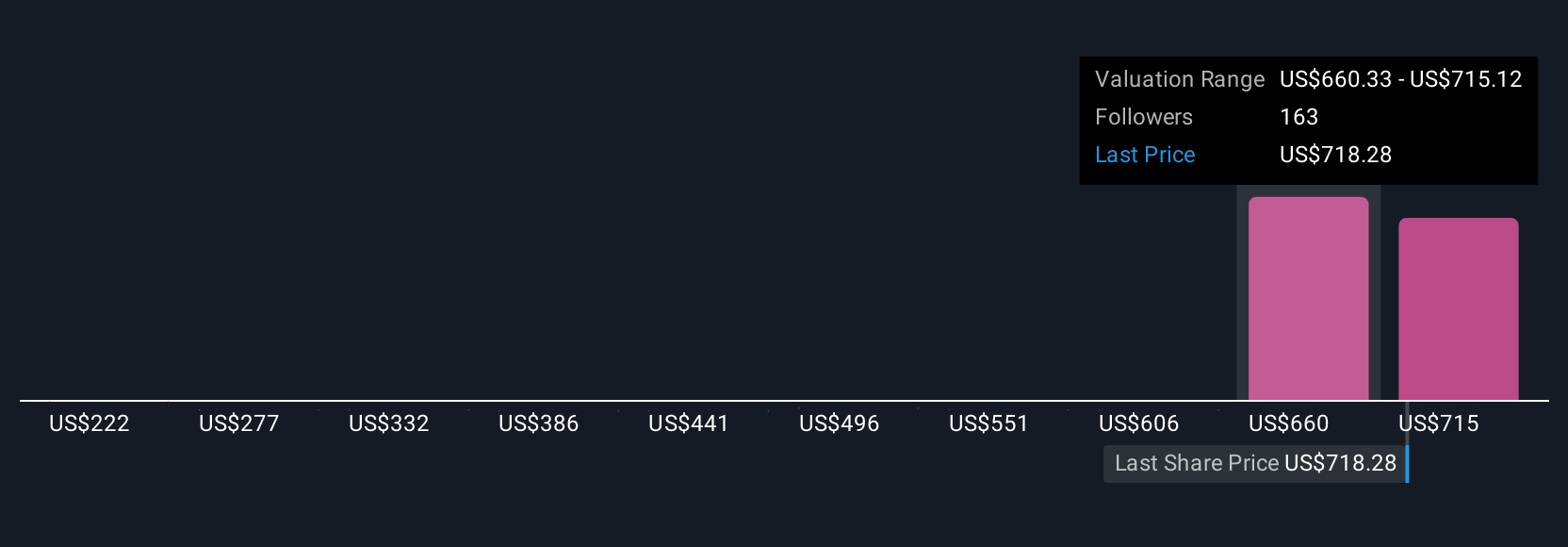

For example, on Spotify Technology, the highest published Narrative projects a value per share above $1,000, driven by confident assumptions around margin expansion and user growth, while the most conservative Narrative puts fair value closer to $485, reflecting greater caution on revenue ramp and competition. This highlights just how much room there is for different perspectives even when looking at the same company.

Do you think there's more to the story for Spotify Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives