- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (NYSE:SPOT) has an Effective Ownership Structure, but there are Reasons Why Investors may not be Jumping In

Every investor in Spotify Technology S.A. (NYSE:SPOT) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. We will also take a look at Spotify's growth opportunities and see if there is something that is reaching the interest of specific shareholder groups.

Spotify Technology is a pretty big company, with a market capitalization of US$43b. This is on the high side for a young company, but technology companies are known to have quite bullish market valuations.

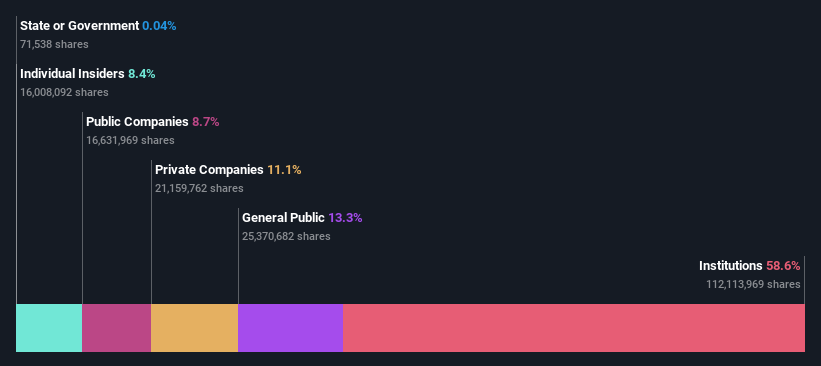

Because we want to know the stake of different shareholder groups in Spotify, we will look at their distribution. Keep in mind that this structure does not update regularly, and the numbers might be a few days off.

See our latest analysis for Spotify Technology

It looks like institutions are the main shareholder in Spotify. We will analyze each group and see what their stake means for the performance of the company.

What Does The Institutional Ownership Tell Us About Spotify Technology?

We can see that Spotify Technology does have institutional investors; and they hold 58.6% of the company's stock. This suggests some credibility amongst professional investors.

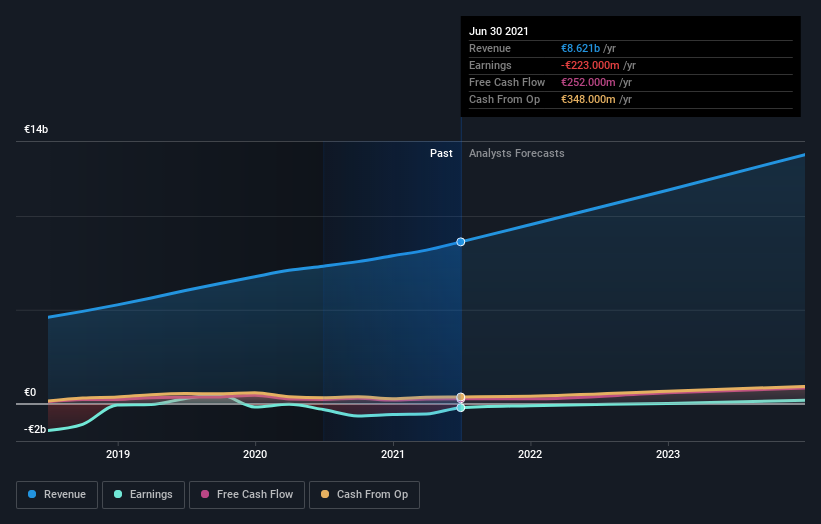

Institutions are driven by the potential upside and fundamental performance of the stock. The have analysts estimating how will the company fare in the future, and we can also use these numbers to see why they might be optimistic on Spotify.

It's therefore worth looking at Spotify's growth history and future estimates below.

There are 2 things we may notice from future estimates:

- Continuous future revenue growth

- Re-entering into profitability

The issue with this is, that while revenue growth is important, it is hard to convert it to cash flows for shareholders. The company is also quite young, and already seems to be focusing on the bottom line, possibly in a bid to improve its standing with investors. Here is the tricky part, young companies are not expected to become profitable before reaching a substantial portion of their market share. Investors are completely fine with watching a young company grow its top-line, while operating at a loss.

One possible interpretation of this picture is that management feels like there may not be too much more room to grow the top line and is starting to focus on profitability. In their last earnings report, we came across this part of managements statement on MAUs (Monthly Active Users):

"The percentage of MAUs that engaged with podcast content on our platform improved modestly relative to Q1." Their guidance also suggests a stable increase in MAUs, between 377 and 382 million in Q3. Investors should also be aware that a major percentage of new users for Spotify may be a function of their marketing spending, which the company has also increased to US$1b and grew by 8% in the last 12 months.

Let's continue with the shareholder structure.

We note that hedge funds don't have a meaningful investment in Spotify Technology. Rosello Company Limited is currently the largest shareholder, with 11% of shares outstanding. In comparison, the second and third largest shareholders hold about 11% and 9.5% of the stock.

The company's CEO Daniel Ek directly holds 8% of the total shares outstanding.

On further inspection, we found that more than half the company's shares are owned by the top 6 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

With a 13% ownership, the general public has very little impact in the future of Spotify.

It seems that Private Companies own 11%, of the Spotify Technology stock. They can use their power to steer the company to a fair extent, and may be part of the force pushing Spotify to focus on profitability. This may be good for traders, but long-term investors can be sidelined.

It appears to us that public companies also own 8.7% of Spotify Technology and have a decent steering power.

Key Takeaways

The fact that the company has 6 stockholders with a bit over 50% of the company suggests that they can have an effective board of directors that can steer the company with shareholders interests at heart.

Some large stakeholder may also have conflicting or short interests with the company, and it might be good to look at a list of top stockholders here.

The CEO is also one of the top shareholders, which is awesome, as it shows that his interest is aligned with shareholders.

A company like Spotify is being tracked by analysts, and the forecasts are optimistic on future growth. However, their last report hints at some signs of a slowdown. Investors have to be mindful that the company is engaged in an industry which doesn't always have a good model for profitability, and a large portion of the user base is at risk because of the low barriers to entry and the possibility for the next "trendy thing" to show up.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives