- United States

- /

- Entertainment

- /

- NYSE:SPOT

How Spotify's Clarification on AI Music Policies May Influence Trust and Future Value for SPOT Investors

Reviewed by Sasha Jovanovic

- In recent days, Spotify proactively addressed public concerns by clarifying that its updated terms of use apply only to listeners, not creators, and detailed new policies for AI-generated music, including industry-standard labeling and enhanced spam detection.

- This direct communication highlights Spotify’s efforts to build trust with artists, partners, and users while adapting fast to emerging music industry technologies and risks.

- We'll explore how Spotify's transparent stance on creator rights and AI content moderation may shape its long-term investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Spotify Technology Investment Narrative Recap

To be a Spotify shareholder, you have to believe the company can continue growing its global user base and boost margins by expanding high-engagement features like AI-driven recommendations, despite still relying heavily on large music labels for content. The company’s recent clarification on terms of use and its new AI content policies do not materially impact its most important short-term catalyst, ongoing subscriber growth through product innovation, but may help reduce some headline regulatory or creator-relations risks. The key risk of elevated content costs and dependence on music licensing remains unaddressed for now.

Spotify’s initiative to label AI-generated music and introduce improved spam filters brings its platform in line with evolving industry standards and may help alleviate creator concerns. As the company works to maintain platform trust and user engagement, these moves support its case for continued user and advertiser growth, key levers for margin expansion.

By contrast, investors should be aware that persistent reliance on record labels could still threaten long-term margin growth if...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's outlook anticipates €23.8 billion in revenue and €3.4 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 12.8% and represents an increase in earnings of €2.6 billion from the current €806.0 million.

Uncover how Spotify Technology's forecasts yield a $756.18 fair value, a 6% upside to its current price.

Exploring Other Perspectives

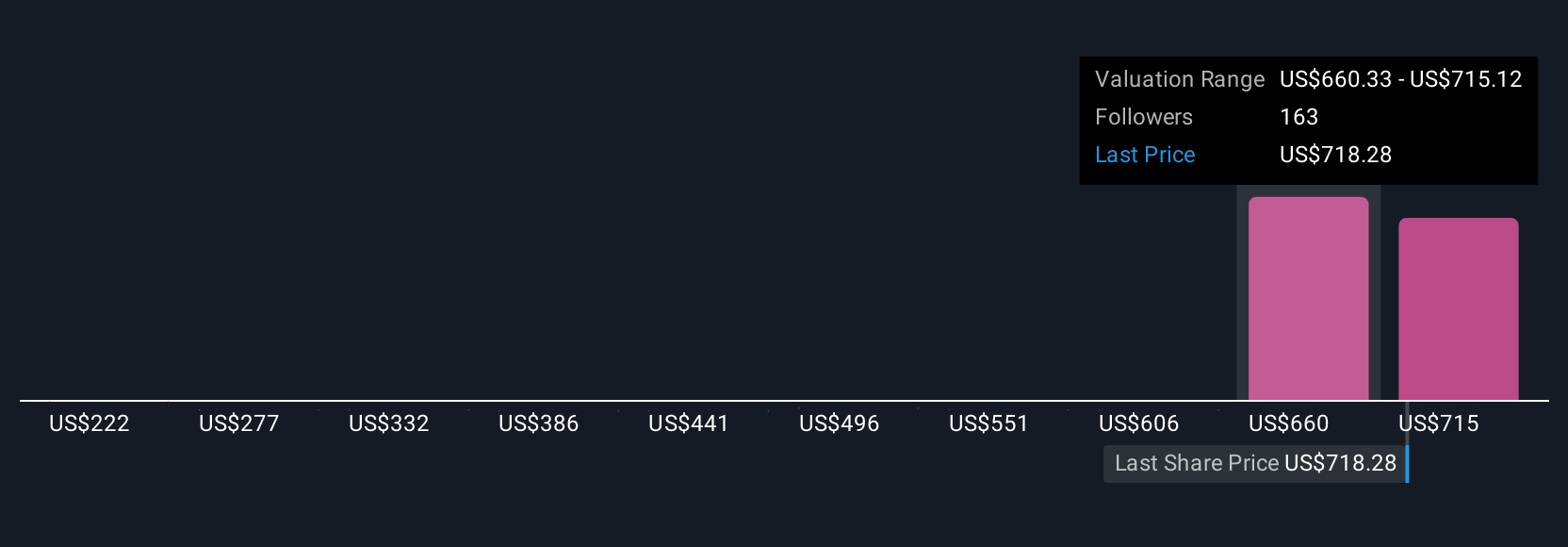

Twenty-four private investors in the Simply Wall St Community currently estimate Spotify's fair value from US$222 to US$769.91 per share. Their views highlight just how much opinions can differ, particularly given Spotify’s growing user base and ongoing challenges reining in content costs.

Explore 24 other fair value estimates on Spotify Technology - why the stock might be worth less than half the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.