- United States

- /

- Entertainment

- /

- NYSE:SPOT

Does Spotify Still Offer Value After Its 621% Three Year Surge and Podcast Push?

Reviewed by Bailey Pemberton

- Wondering if Spotify Technology is still worth buying after its huge run, or if the easy money has already been made? You are not alone in trying to pin down what a fair price really looks like here.

- The stock now trades around $560.97, down 5.4% over the last week and 10.9% over the past month, but still up 22.5% year to date and 621.0% over three years.

- Recently, Spotify has stayed in the headlines as it doubles down on podcasts and audiobooks, including renewing and expanding high profile creator deals while continuing to refine its subscription pricing. At the same time, the company is pushing harder into profitability and new content formats. This helps explain why the market has periodically re rated the shares as expectations shift.

- On our framework, Spotify Technology currently scores a 2 out of 6 on valuation checks, suggesting pockets of undervaluation but also areas where the price looks full. Next, we will walk through the main valuation approaches investors use for Spotify and then finish with a more intuitive way to judge whether the current market story really lines up with the numbers.

Spotify Technology scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Spotify Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For Spotify Technology, this 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about €2.93 billion and then applies analyst forecasts for the next few years, with further growth extrapolated beyond that.

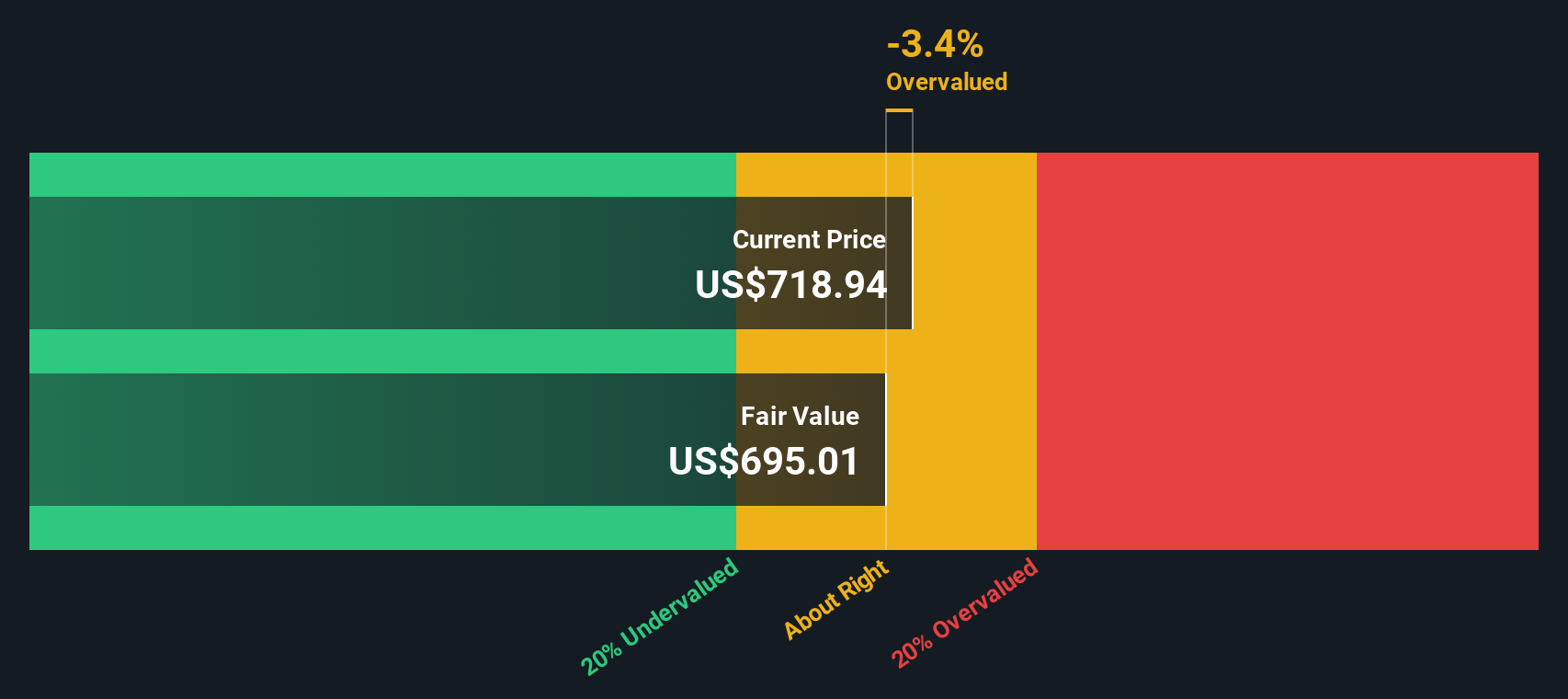

Under these assumptions, Spotify's free cash flow is projected to rise to roughly €5.91 billion by 2029, with longer term projections reaching more than €9 billion a year within the next decade based on gradually slowing growth rates. All of those future cash flows are discounted back into today's euros to produce an estimated intrinsic value of about $683.69 per share.

Compared with the recent market price, this implies the shares are trading at roughly a 17.9% discount, suggesting investors are not fully pricing in Spotify's projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Spotify Technology is undervalued by 17.9%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

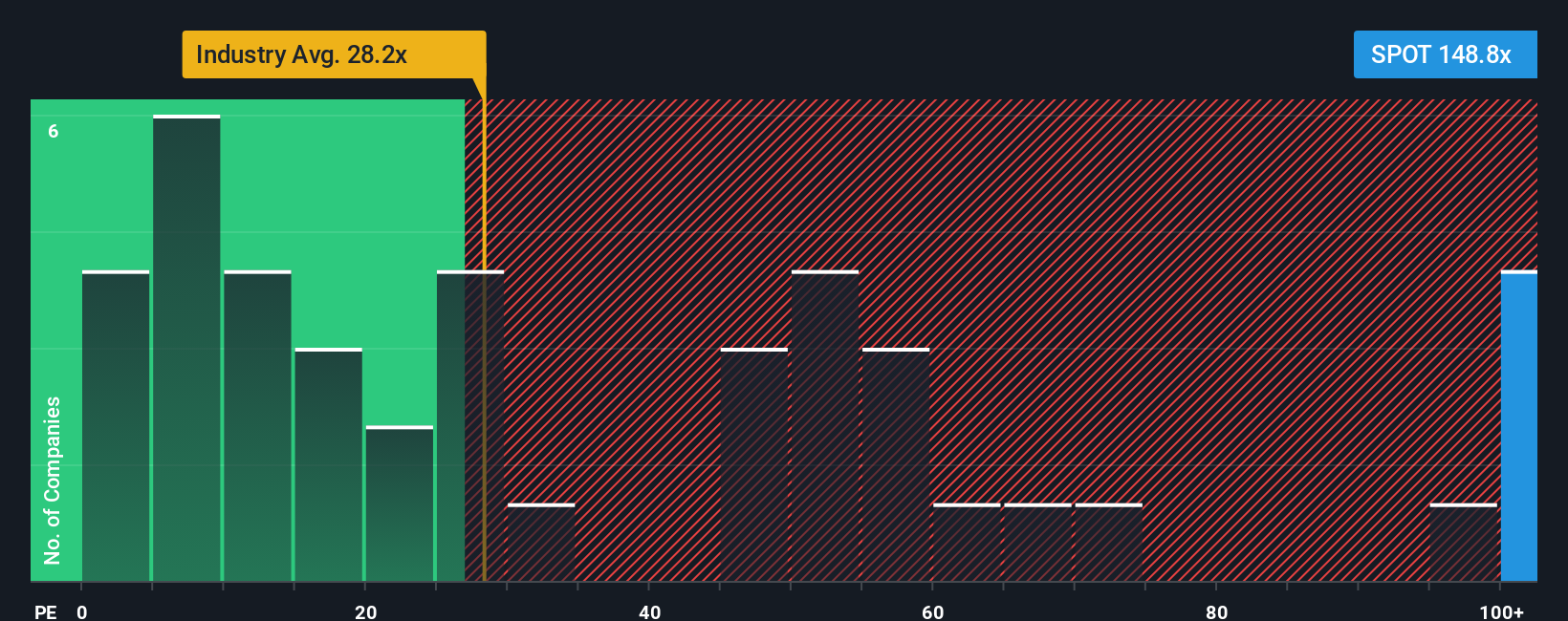

Approach 2: Spotify Technology Price vs Earnings

For profitable companies like Spotify, the price to earnings, or PE, ratio is a useful way to judge valuation because it directly links what investors pay for each share to the profits the business is generating today. A higher PE can sometimes be associated with a company that is expected to grow earnings quickly with relatively low risk. Slower growth or higher uncertainty is often associated with a lower, more conservative multiple.

Spotify currently trades on a PE of about 70.7x, which is broadly in line with the peer average of around 70.5x but well above the Entertainment industry average of roughly 20.9x. Rather than stopping at simple comparisons, Simply Wall St also calculates a proprietary Fair Ratio, which estimates what PE Spotify could trade on given its specific earnings growth outlook, profitability, industry, size and risk profile. For Spotify, that Fair Ratio is about 34.6x, suggesting the shares are priced at roughly double the level indicated by those fundamentals. Because the Fair Ratio adjusts for growth and risk, it can serve as a more nuanced benchmark than raw peer or industry averages and indicates the stock may be expensive at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spotify Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of Spotify Technology's future with a concrete financial forecast and fair value estimate.

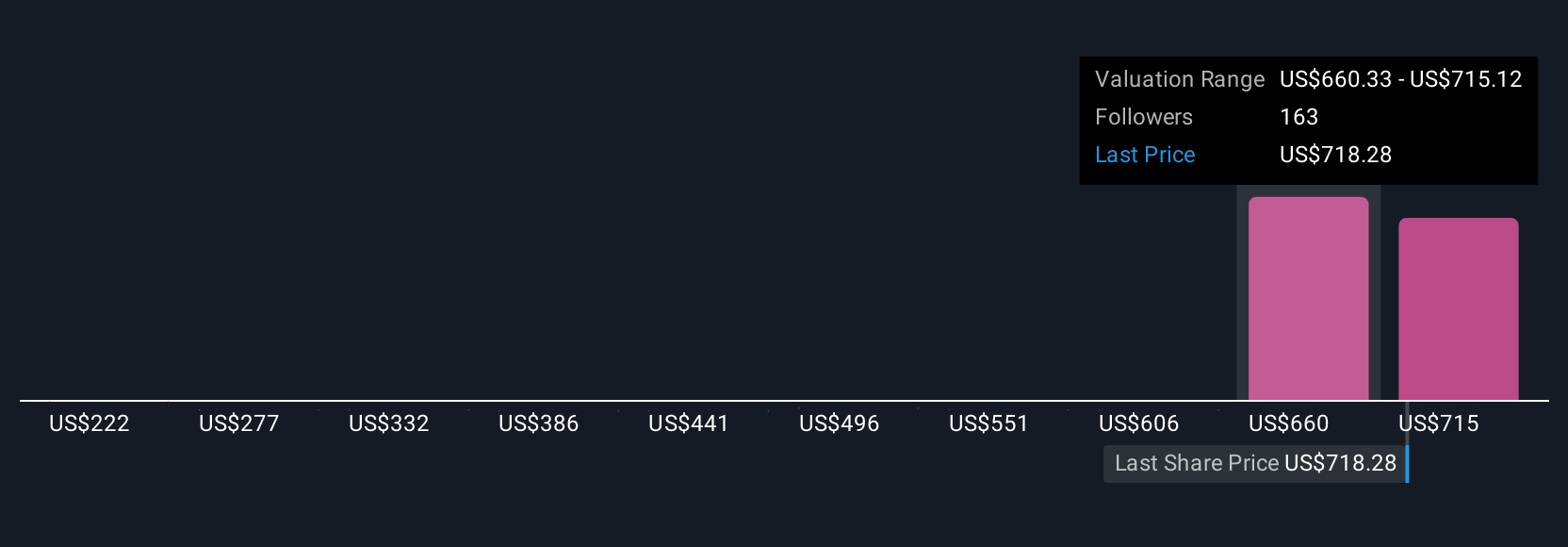

On Simply Wall St's Community page, Narratives let you tell the story behind the numbers by setting your own expectations for Spotify's future revenue, earnings and margins, then automatically linking that story to a fair value that you can compare with today's share price to help frame a decision about whether to buy, hold or sell.

Because Narratives are dynamic and update as new information such as earnings results or major news becomes available, they stay aligned with the latest facts while remaining grounded in your original thesis. This makes it easier to see when the market price has moved too far ahead of, or fallen behind, your expectations.

For example, one investor might believe Spotify will keep compounding users, expand margins and see a fair value near $700 per share. A more conservative investor might focus on licensing costs, competition and execution risks and arrive at a fair value closer to $485. Both can clearly see how their different assumptions drive different outcomes and what would need to change to revisit their stance.

Do you think there's more to the story for Spotify Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026