- United States

- /

- Entertainment

- /

- NYSE:SPHR

Sphere Entertainment (SPHR): Evaluating Valuation as Sphere Immersive Sound Expands to Radio City Music Hall

Reviewed by Simply Wall St

Sphere Entertainment (SPHR) just revealed that its cutting-edge Sphere Immersive Sound system will launch at Radio City Music Hall this fall. The launch will bring advanced 3D audio and new features to the legendary venue for the first time.

See our latest analysis for Sphere Entertainment.

With the Sphere Immersive Sound rollout stirring excitement, Sphere Entertainment’s momentum has clearly picked up. Its share price has surged nearly 52% year-to-date, and investors are enjoying a 37% total shareholder return over the past year. After a powerful 34% share price rebound over the last ninety days, many see this as a sign that optimism is rising as the company’s technology gains wider recognition.

If you’re interested in companies at the intersection of tech innovation and growth, now is the perfect time to discover fast growing stocks with high insider ownership.

With shares at record highs and Sphere Immersive Sound poised for wider adoption, the big question now is whether Sphere Entertainment’s current valuation leaves more room for upside or if the market has already factored in its future growth potential.

Most Popular Narrative: 1.6% Undervalued

Sphere Entertainment’s fair value, according to the most widely followed narrative, sits just above its recent closing price. This close alignment highlights how closely analyst expectations and optimism are focused on the company’s technological advances and growth plans.

The expansion into new markets, particularly the development of both full-size and smaller franchise-model Spheres internationally (such as in Abu Dhabi and potential other cities), directly positions Sphere Entertainment to benefit from the increasing demand for experiential destination entertainment. This supports long-term revenue growth and margin scalability through asset-light models.

Curious what ambitious revenue and profit assumptions are embedded in this valuation? The story hinges on a future filled with rapid expansion and profit margin increases. Discover which bold industry benchmarks and financial targets drive the narrative behind Sphere Entertainment's price target.

Result: Fair Value of $64.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if Las Vegas tourism slows or if Sphere's ambitious expansion faces setbacks. Either of these scenarios could challenge the company's upward narrative.

Find out about the key risks to this Sphere Entertainment narrative.

Another View: Multiples Suggest a Premium Remains

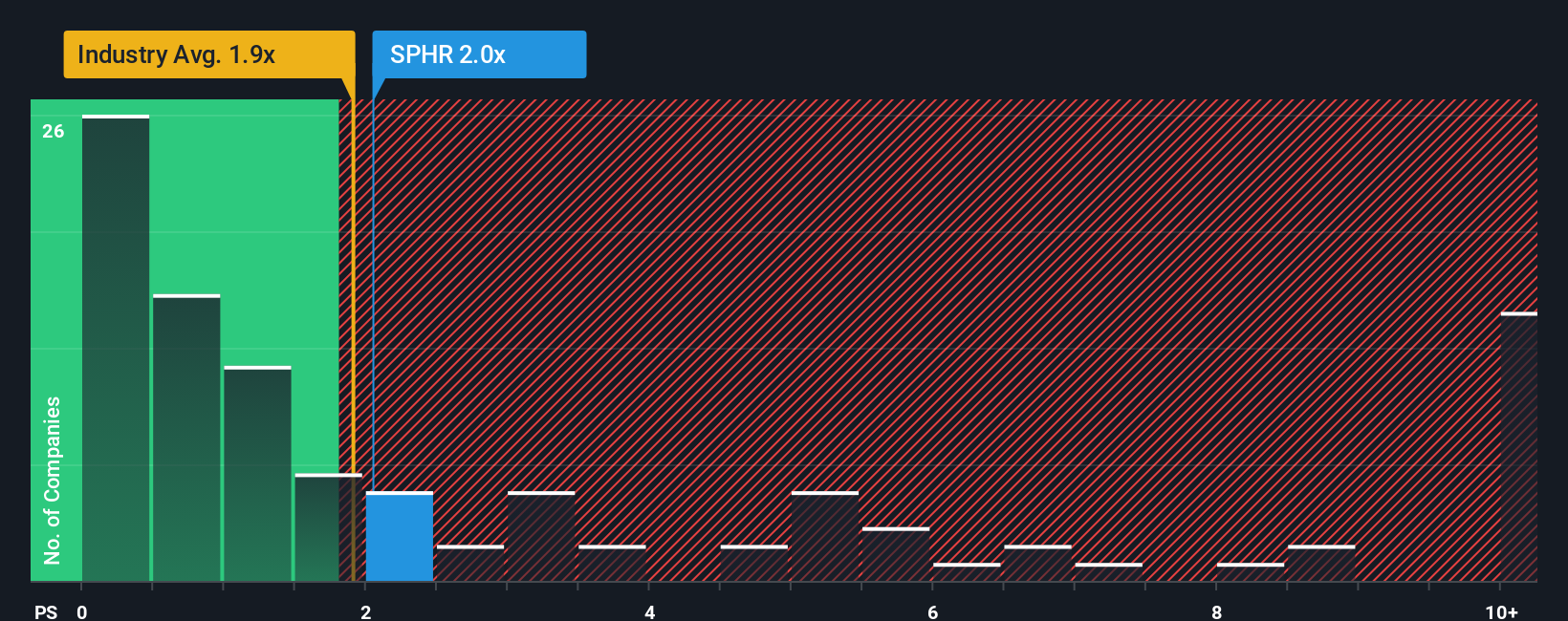

While the fair value estimate points to Sphere Entertainment being undervalued right now, a different view emerges when comparing its price-to-sales ratio. At 2.2x, it sits above the industry average of 1.8x and even higher than the fair ratio of 1.3x. This suggests that the market is pricing in ongoing optimism. This premium could signal more upside, or it might mean investors are taking on more risk if expectations are not met. Which reading is correct?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sphere Entertainment Narrative

If you have a different perspective, or like to draw your own conclusions, you can craft your own analysis and narrative with just a few clicks. Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by checking out other standout opportunities that could shape your portfolio. The smartest investors never wait for the crowd to catch on. See what’s trending before everyone else.

- Benefit from rapid advances and tech breakthroughs by checking out these 24 AI penny stocks changing the way industries operate worldwide.

- Prioritize long-term growth and resilience by spotting these 874 undervalued stocks based on cash flows primed for a turnaround in the coming market cycles.

- Boost your income stream by seeing which companies are offering strong regular payouts with these 17 dividend stocks with yields > 3% screened for impressive dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Imperfect balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion