- United States

- /

- Entertainment

- /

- NYSE:SPHR

How Sphere Immersive Sound at Radio City May Shape Sphere Entertainment’s (SPHR) Recurring Revenue Prospects

Reviewed by Sasha Jovanovic

- MSG Entertainment Corp. recently announced the launch of its advanced Sphere Immersive Sound system at Radio City Music Hall, debuting during the 2025 Christmas Spectacular and becoming available for all performances starting January 2026.

- This installation brings headphone-quality, spatial audio technology to one of the world’s most iconic venues and signals an expansion of Sphere Immersive Sound’s commercial and technological reach beyond its initial locations.

- We'll explore how introducing Sphere Immersive Sound at Radio City Music Hall could reshape Sphere Entertainment's growth narrative and recurring revenue outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sphere Entertainment Investment Narrative Recap

To be a Sphere Entertainment shareholder, you need confidence that its proprietary technologies like Sphere Immersive Sound will drive adoption in top-tier venues and open doors for recurring, high-margin revenue streams. While this Radio City Music Hall installation reflects Sphere’s ability to scale its innovations and may support new licensing revenue, the primary short-term catalyst remains overall event demand and utilization rates, and the biggest risk, demand volatility in destination markets, remains largely unchanged following this announcement.

Among recent announcements, the June 2025 adoption of cutting-edge audio enhancements for The Wizard of Oz at Sphere illustrates the company’s ongoing investment in multi-sensory event experiences, aligning closely with its efforts at Radio City. Both announcements reinforce Sphere’s commitment to delivering differentiated content and monetizing proprietary technologies through immersive live productions, a core catalyst for longer-term recurring revenue potential.

But on the other hand, investors should be aware of the risk that...

Read the full narrative on Sphere Entertainment (it's free!)

Sphere Entertainment's outlook anticipates $1.3 billion in revenue and $118.7 million in earnings by 2028. This forecast implies a 6.5% annual revenue growth rate and a $392.8 million improvement in earnings from the current level of -$274.1 million.

Uncover how Sphere Entertainment's forecasts yield a $60.60 fair value, in line with its current price.

Exploring Other Perspectives

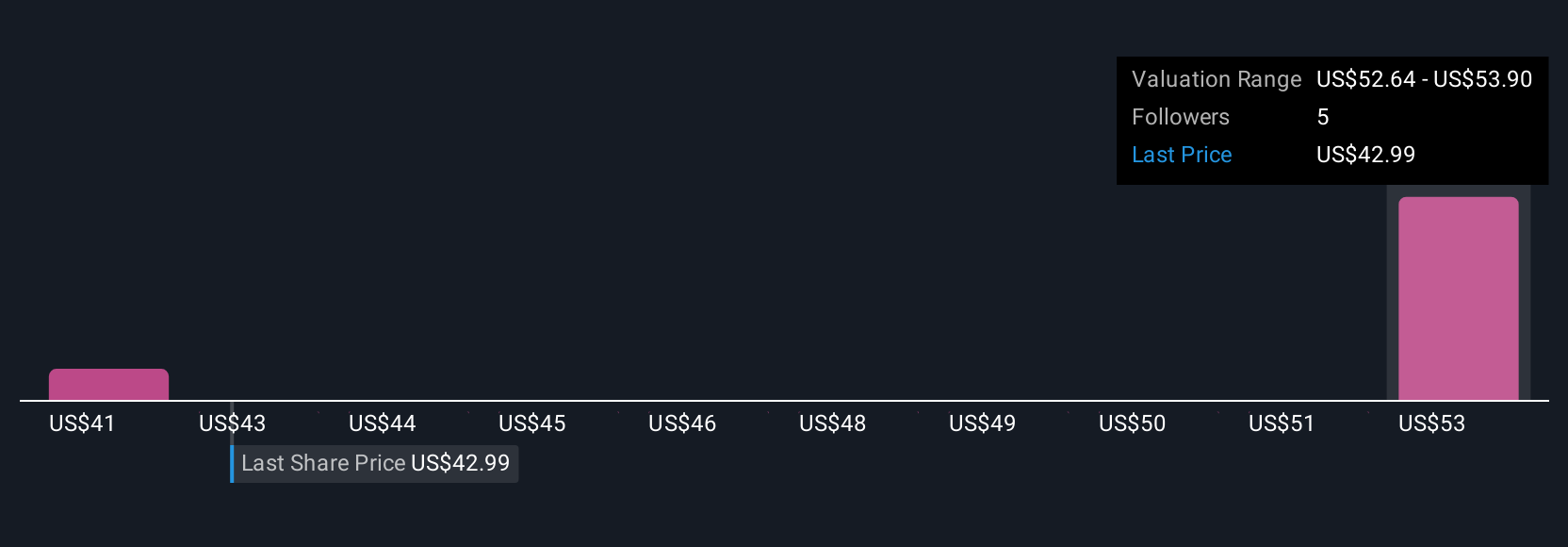

Three fair value estimates from the Simply Wall St Community span US$35.00 to US$60.60 per share, highlighting varied outlooks among retail investors. As Sphere expands its tech into iconic venues, shifting demand for live experiences could have a meaningful impact on performance, explore other viewpoints before forming your own assessment.

Explore 3 other fair value estimates on Sphere Entertainment - why the stock might be worth as much as $60.60!

Build Your Own Sphere Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Sphere Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sphere Entertainment's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives