- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (NYSE:SNAP) Unveils New Lightweight Immersive Specs At Augmented World Expo 2025

Reviewed by Simply Wall St

Snap (NYSE:SNAP) unveiled its new lightweight immersive Specs at the Augmented World Expo 2025, showcasing advanced capabilities like shared games and AI-enhanced functionalities, alongside significant partnership announcements such as its collaboration with Niantic. During the same period, the S&P 500 and Nasdaq reached new highs, with the market climbing 3% over the last week. Snap's price move of 10% aligns with this broader market rally, supported by positive sentiment from its innovative product developments and strong developer engagement, which likely added weight to the company's recent performance.

You should learn about the 1 possible red flag we've spotted with Snap.

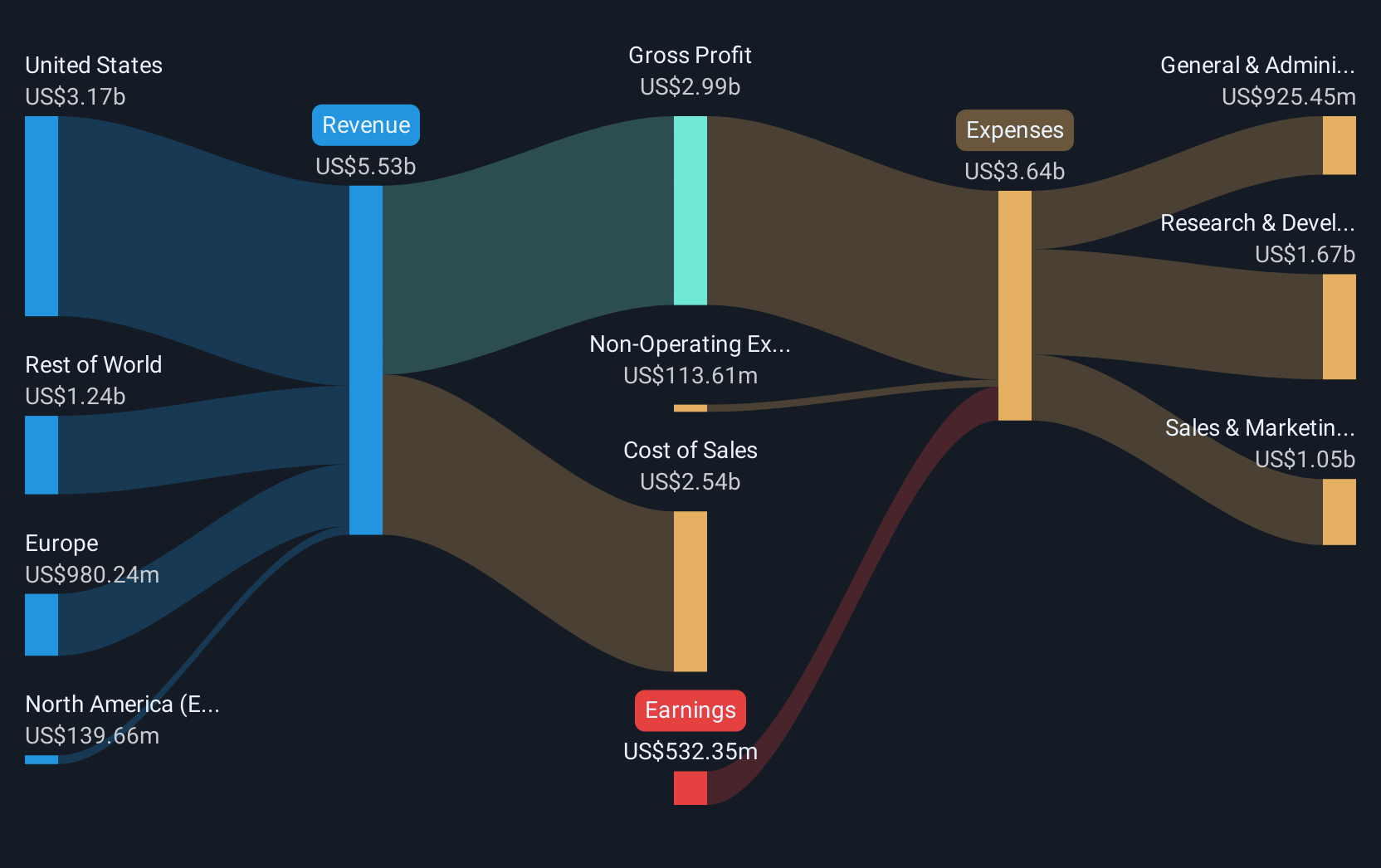

Over a three-year period, Snap Inc.'s shares experienced a substantial decline of 33.79%. Despite a recent 10% increase driven by innovative product launches and positive market conditions, the company underperformed compared to the US market’s 13.7% rise over the past year. The Interactive Media and Services industry also reported a better annual return of 14.4%, highlighting Snap's challenges in keeping pace with its peers.

The introduction of Snap’s new lightweight immersive Specs and strategic partnerships may bolster future revenue and earnings, reflecting optimism in forecasts that project profit growth. Analysts suggest a price target of US$9.62, with Snap trading at a slight discount, which some may view as an opportunity for potential gains should the company achieve projected profitability and revenue goals. This underlines the importance of Snap’s ongoing innovations and strategic collaborations in shaping its financial trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives