- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (NYSE:SNAP) Partners With RWS Global For Enhanced Fan Engagement At Sporting Events

Reviewed by Simply Wall St

Snap (NYSE:SNAP) recently announced a promising partnership with RWS Global to enhance fan engagement during high-profile sporting events worldwide. This collaboration, along with Snap's unveiling of advanced AR Specs expected in 2026, shows the company's commitment to technological innovation and expanding user interaction. Over the past month, Snap's stock saw a 13% increase, aligning with the broader market trends characterized by minimal fluctuations amidst concerns about U.S. trade policies. The innovative announcements made by Snap have likely supported its share price, contributing positively to its overall market performance despite broader economic uncertainties.

Every company has risks, and we've spotted 2 risks for Snap you should know about.

The recent partnership between Snap and RWS Global, along with the introduction of advanced AR Specs, underscores Snap’s commitment to innovation and user engagement. This development can potentially enhance Snap's revenue streams by attracting more users and advertisers, particularly around high-profile sporting events. However, despite short-term optimism reflected by the recent 13% share price rise, Snap's total shareholder return over the past three years has been a 33.62% decline. This suggests that while recent initiatives are promising, Snap faces challenges in generating sustained shareholder value over a longer period.

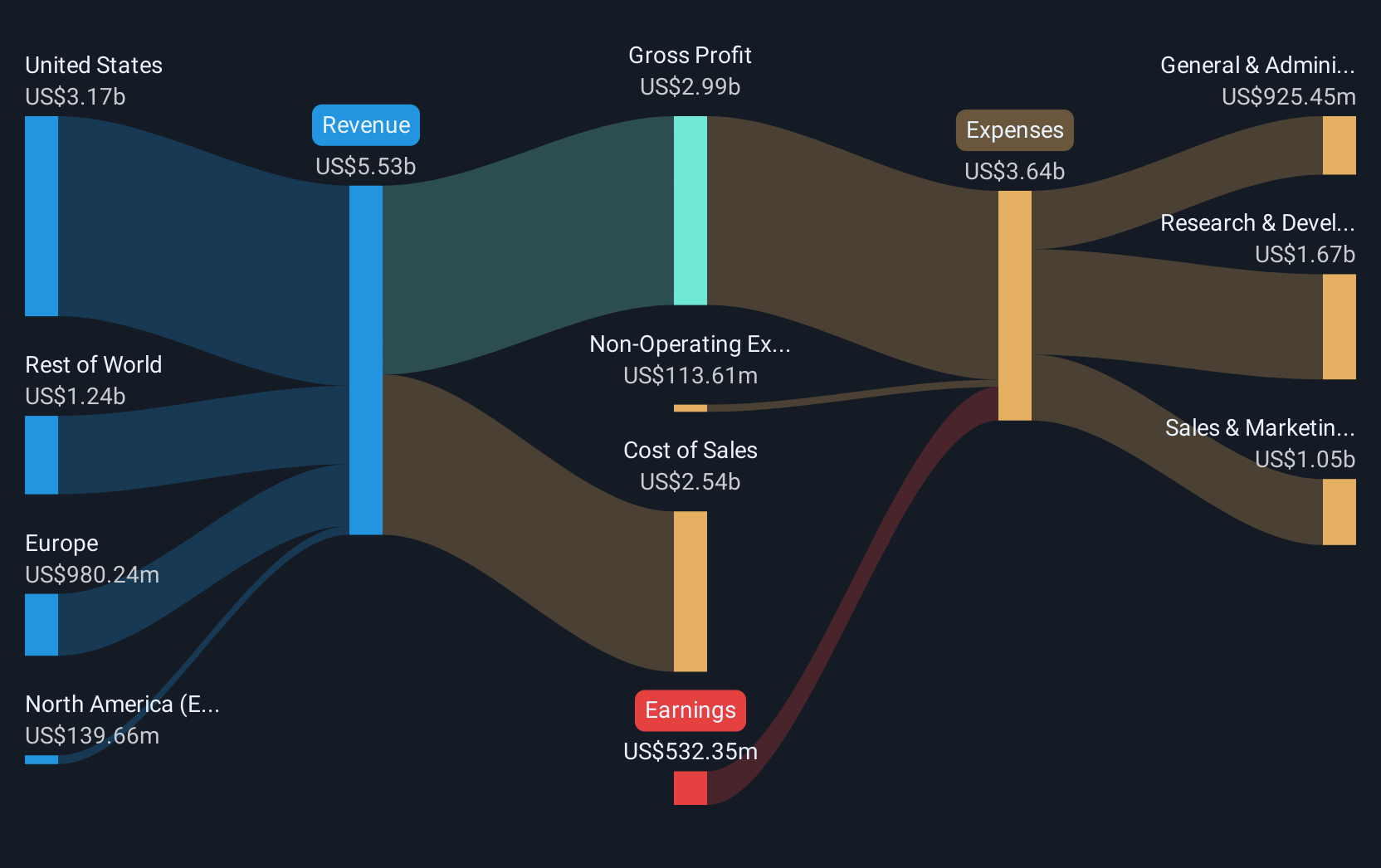

In comparison to the US Interactive Media and Services industry, Snap's performance over the past year has been less favorable, with the company underperforming the industry’s 7.6% return. Revenue growth is projected at 9.39% annually, yet Snap is not expected to achieve profitability within the next three years. The anticipated revenue growth, fueled by international user expansion and augmented reality advancements, may boost earnings over time, but analysts remain cautious as Snap is still trading below the consensus price target of US$9.7. The close gap between the current share price of US$9.27 and the price target suggests that analysts view Snap's valuation as fairly aligned with its growth prospects.

Learn about Snap's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives