- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Does the Recent Rebound Signal a Mispricing Opportunity in Snap Stock?

Reviewed by Bailey Pemberton

- Wondering if Snap at around $7.92 is a beaten down trap or a quietly mispriced opportunity? Let us unpack what the market might be getting wrong about this stock.

- Over the last week the share price has nudged up about 3.4%, but that comes after a rough stretch with the stock down roughly 8.9% over 30 days and 29.5% year to date, and still about 84.7% below where it was five years ago.

- Those moves are happening against a backdrop of ongoing product pushes in augmented reality and improvements to its ad platform, as Snap tries to sharpen its edge in a very competitive social media landscape. At the same time, investors are weighing regulatory noise around data privacy and changing digital ad spending patterns, both of which influence how much upside they are willing to price in.

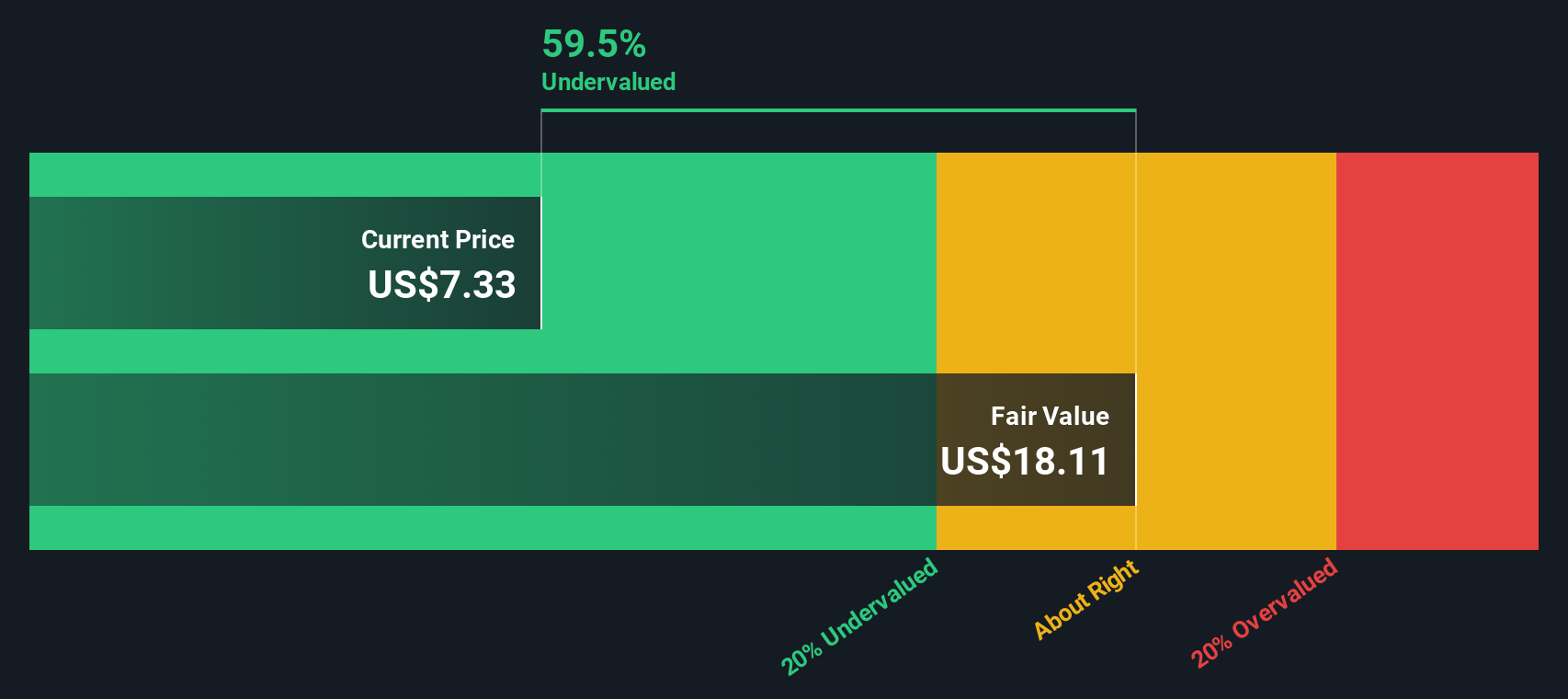

- On our checklist of six valuation tests, Snap passes four, giving it a valuation score of 4/6. This suggests there may be some disconnect between price and fundamentals. Next we will walk through the main valuation approaches behind that score, and then finish with a more nuanced way to think about what Snap might really be worth.

Find out why Snap's -34.0% return over the last year is lagging behind its peers.

Approach 1: Snap Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future, then discounting those cash flows back into todays dollars. For Snap, the model uses a 2 stage Free Cash Flow to Equity approach based on $390.4 million of last twelve month free cash flow and analyst backed projections that see free cash flow rising to about $1.95 billion by 2035, with Simply Wall St extrapolating beyond the first five analyst forecast years.

These projected cash flows, all in $, are discounted back to today to arrive at an intrinsic value of about $13.18 per share. Compared with the current share price around $7.92, the DCF implies Snap is roughly 39.9% undervalued, suggesting the market may be underestimating the companys long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snap is undervalued by 39.9%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: Snap Price vs Sales

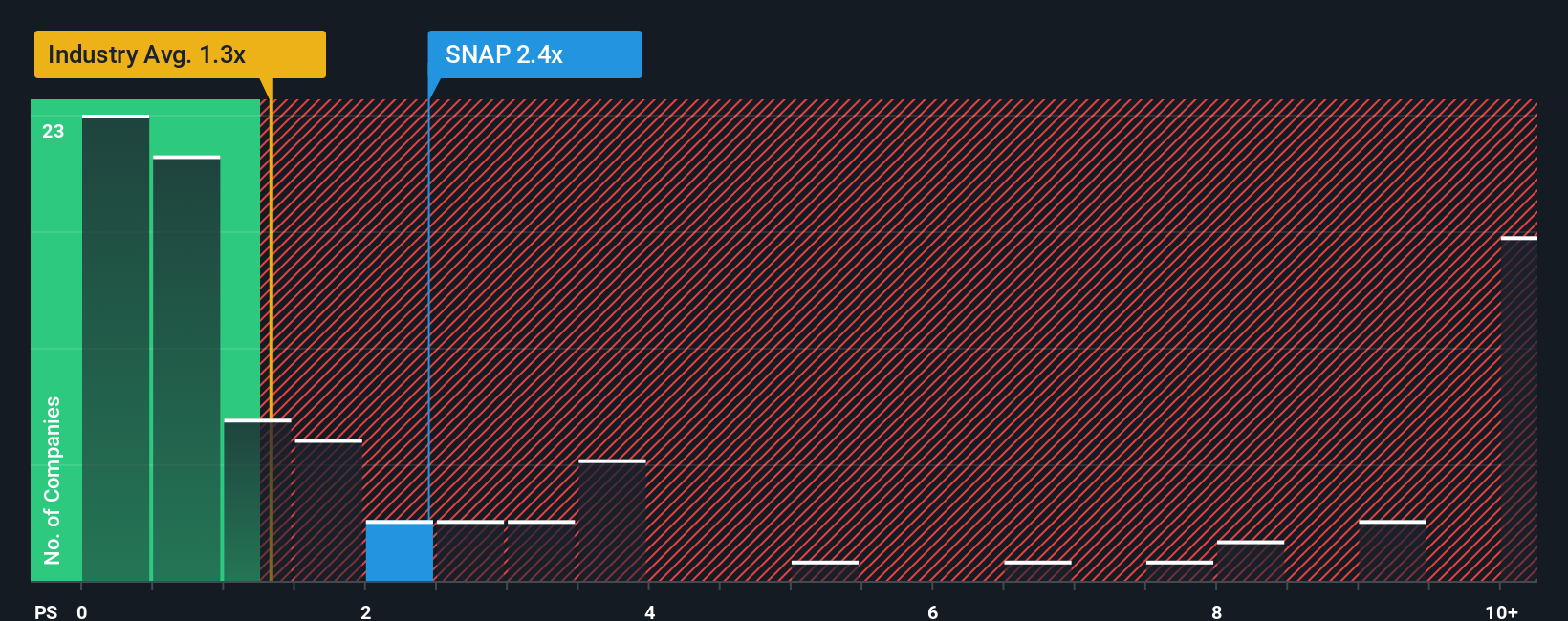

For a business like Snap, which is still normalizing profitability, the price to sales ratio is a practical way to gauge valuation because it focuses on how the market values each dollar of revenue, rather than earnings that can swing with investment cycles and restructuring.

In general, higher growth and lower perceived risk justify a richer valuation multiple, while slower or more uncertain growth tends to compress what investors are willing to pay. Snap currently trades at about 2.36x sales, which is above the broader Interactive Media and Services industry average of roughly 1.07x, but below the peer group average of about 2.91x.

Simply Wall St’s Fair Ratio for Snap is 2.55x, a proprietary estimate of what the multiple should be once you factor in its revenue growth potential, profit margin profile, size and risk characteristics, alongside its industry. This Fair Ratio is more tailored than a simple comparison to peers or the sector, which can be skewed by outliers or companies at very different stages. With Snap’s actual 2.36x sitting modestly below the 2.55x Fair Ratio, the shares appear slightly undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snap Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about a company to the numbers behind its future revenue, earnings, margins and fair value. A Narrative links what you believe about Snap’s business, like how quickly AR and higher margin revenue streams will grow or how much competition will bite, to a concrete financial forecast and then to a Fair Value you can compare with today’s price to inform your decision to buy, hold or sell. Narratives on Simply Wall St, available to millions of investors via the Community page, are dynamic, so when new information such as fresh earnings, regulatory updates or major product news hits, the forecast and Fair Value can update in line with the latest data. For example, one Snap Narrative might assume rapid AR adoption and margin expansion, leading to a Fair Value closer to the most bullish target of $16. In contrast, a more cautious Narrative, focused on competitive and regulatory risks, might lean toward a Fair Value near $7, and both perspectives are visible side by side so you can see where you agree or disagree.

Do you think there's more to the story for Snap? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026