Offloading a significant stake is rarely an accomodating task for stocks in a downtrend. Such was the situation for Sea Limited (NYSE: SE), which has dipped an astonishing 50% from its peak over the course of the last two months.

The fact that its largest shareholder keeps selling as the broad market pulls back doesn't give a lot of optimism for the current valuation.

See our latest analysis for Sea.

The largest SEA shareholder, Tencent Holdings, just sold 14.5 million shares, worth US$3b - trimming the stake from 21.3% to 18.7%.

Tencent sold these shares at an average price of US$208, which was a 6.8% discount from the closing price. Since then, the price dropped even further, dipping as low as US$180 – a fresh 12-month low. Those who follow chart technicals might notice the infamous "Death Cross," as the 50-day moving average crossed the 200-day moving average from above.

Meanwhile, Bank of America upgraded the stock to a Buy (from Neutral). It is a surprising turn of events since they downgraded it in November. Their new target price for the stock is US$287. Barclays remains in the bull camp with an optimistic price target of US$427, while Zacks Investment Research cut it from Hold to Sell.

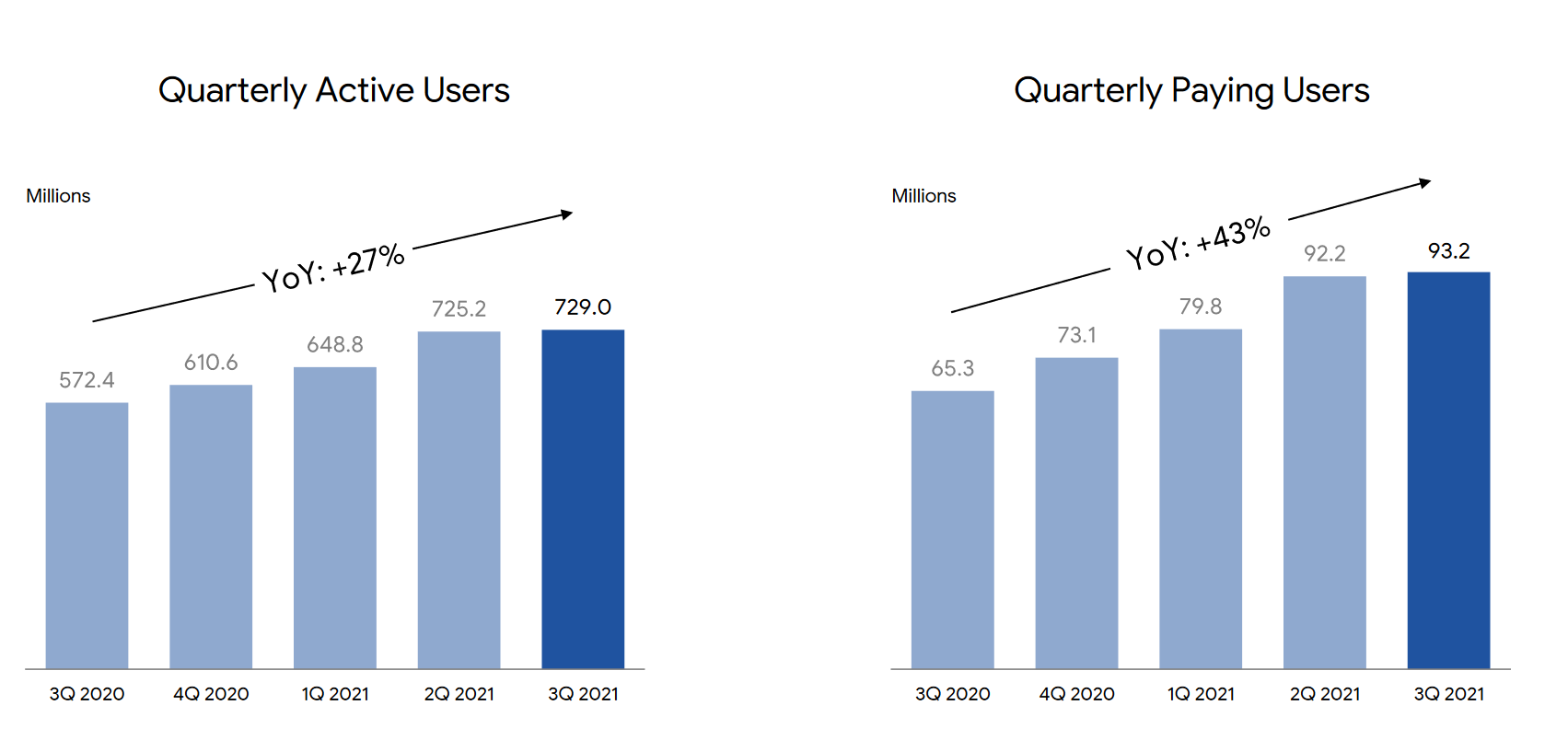

There might be multiple reasons for sustained weakness, but browsing through the latest investors' presentation points to the decelerating growth in the digital entertainment segment while expenses have been increasing.

Ownership of Sea Limited

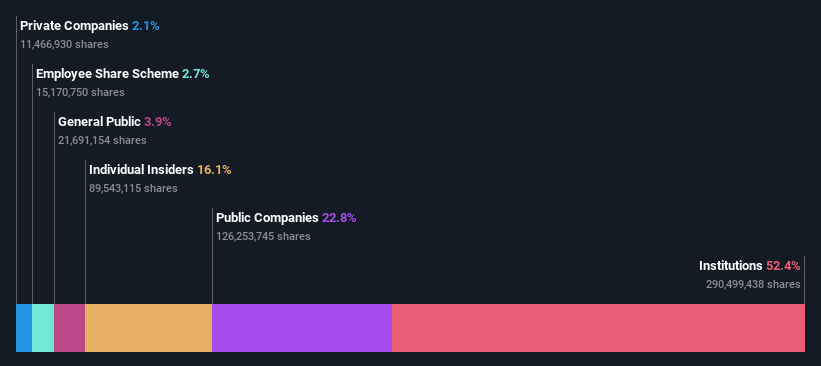

Sea has a market capitalization of US$111b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Our analysis of the company's ownership below shows that institutions are noticeable on the share registry.

We can zoom in on the different ownership groups to learn more about Sea.

What Does The Institutional Ownership Tell Us About Sea?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Sea already has institutions on the share registry. Indeed, they own a good stake in the company. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong.

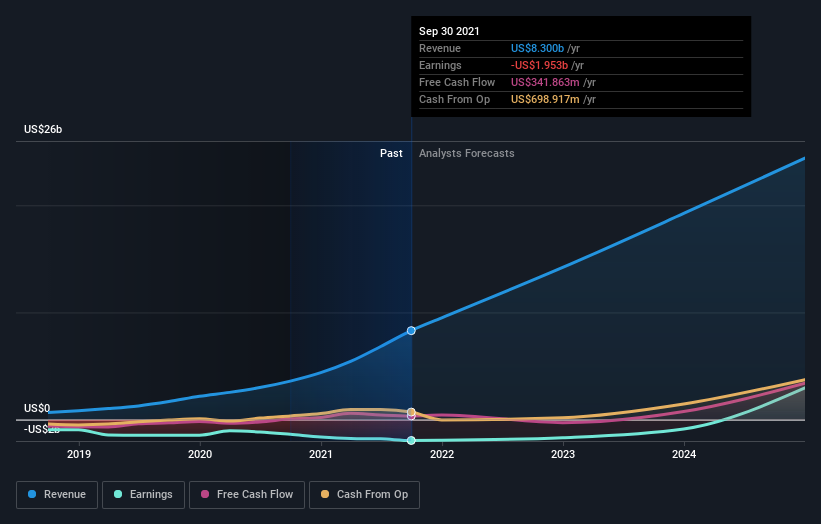

It's, therefore, worth looking at Sea's earnings history below. Of course, the future is what matters.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions. We note that hedge funds don't have a meaningful investment in Sea. The company's largest shareholder is Tencent Holdings Limited, with ownership of 18.7%. Xiaodong Li is the second-largest shareholder owning 8.3% of common stock, and T. Rowe Price Group, Inc. holds about 6.1% of the company stock. Xiaodong Li, the second-largest shareholder, also happens to have the title of Chief Executive Officer.

We also observed that the top 6 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

Insider Ownership

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management runs the business, but the CEO will answer to the board, even if they are a member of it. Insider ownership is generally a good thing. However, it makes it more difficult for other shareholders to hold the board accountable for decisions on some occasions.

Our most recent data indicates that insiders own a reasonable proportion of Sea Limited. It is interesting to see that insiders have a meaningful US$18b stake in this US$111b business. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, including retail investors -- owns a 3.9% stake and is a relatively minor group of shareholders in Sea. We'd generally expect to see a higher level of ownership by the general public than this. It's not too concerning, but it is worth noting that retail investors might struggle to influence board decisions.

Public Company Ownership

It appears to us that public companies own 22% of Sea. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

While institutions might be opposed in issuing ratings and price targets, the one whose vote matters (Tencent) sold a significant number of shares at a lower end of the price range. It is unknown whether this was a regulatory-influenced decision, but the company announced there wouldn't be any more sales for the next 6 months.

It's always worth thinking about the different groups who own shares in a company. But to understand Sea better, we need to consider many other factors. For instance, we've identified 2 warning signs for Sea that you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

If you're looking to trade Sea, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives