- United States

- /

- Entertainment

- /

- NYSE:SE

Sea (NYSE:SE) Registers 13% Price Rise Over Last Quarter After US$444 Million Net Income Increase

Reviewed by Simply Wall St

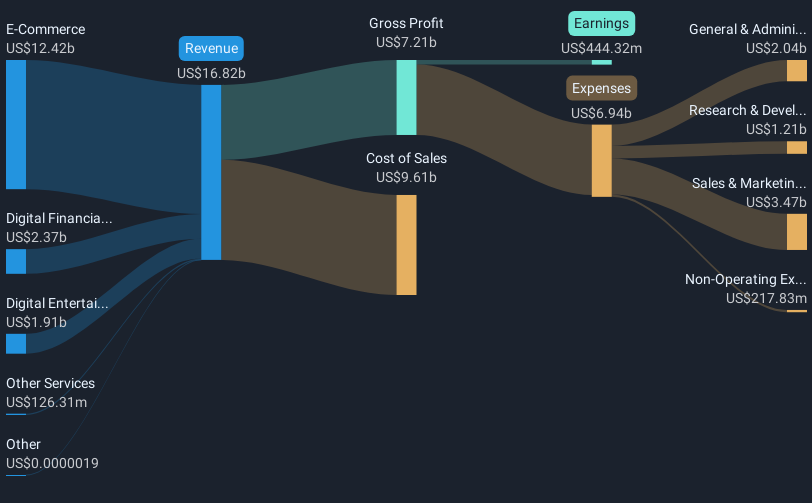

Sea (NYSE:SE) recently reported a revenue increase to $16,820 million and a substantial rise in net income to $444 million for the year ending December 2024, which likely fueled the company's stock price rise of 13% over the last quarter. Despite broader market challenges, including a drop in major indices like Dow and Nasdaq driven by tariff-related sell-offs, Sea's strong earnings and growth in basic and diluted EPS signaled resilience. The company's robust performance in contrast to the general market decline suggests that these earnings announcements were a critical driver of its share price appreciation.

Buy, Hold or Sell Sea? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Sea Limited's total shareholder returns reached 166.36%, reflecting a substantial gain. This period of growth saw significant developments, such as Shopee's strategic expansion into Brazil, enhancing its service quality and logistics efficiency, contributing to increased GMV and improved profitability. The adoption of AI in e-commerce operations further optimized conversion rates and cost efficiencies, positively impacting net margins. In digital financial services, SeaMoney's expansion of loan products across underpenetrated markets boosted revenue, bolstering earnings.

The revival of Free Fire in new regions significantly increased digital entertainment revenue, improving earnings overall. Despite these successes, challenges such as market saturation in digital entertainment and potential credit risk in SeaMoney's services persist. Over the past year, Sea outperformed both the US market, which yielded a modest 3.3% return, and the US Entertainment industry, which returned 26.5%, underscoring its resilience amid broader market fluctuations.

Dive into the specifics of Sea here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives