- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

US High Growth Tech: 3 Stocks to Watch

Reviewed by Simply Wall St

As the U.S. market experiences a resurgence in tech stocks, with key indices like the S&P 500 and Nasdaq posting gains amid renewed investor confidence, attention turns to high-growth opportunities within the tech sector. In this environment, identifying promising stocks involves looking for companies that demonstrate robust innovation and adaptability to capitalize on emerging trends such as AI and cloud computing.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.08% | 84.58% | ★★★★★☆ |

| Atlassian | 14.83% | 54.18% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Viridian Therapeutics | 56.24% | 54.30% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. is a company that offers enterprise cloud applications both in the United States and internationally, with a market capitalization of $57.50 billion.

Operations: Workday generates revenue primarily from its cloud applications, amounting to $9.23 billion.

Workday's recent financial performance and strategic initiatives underscore its adaptability in the high-growth tech sector, despite some challenges. With a revenue increase to $2.432 billion in Q3 2025 from $2.160 billion the previous year, and net income rising to $252 million from $193 million, Workday demonstrates robust financial health. The company's commitment to innovation is evident in its R&D spending and partnerships aimed at enhancing product offerings like Workday GO for midsize companies and the EU Sovereign Cloud for compliance with European data laws. Furthermore, Workday's significant share repurchases totaling $594.51 million reflect confidence in its business trajectory amidst a forecasted 32.2% annual earnings growth over the next three years, outpacing the US market average of 16.2%. These strategic moves could position Workday favorably within tech’s competitive landscape while addressing both enterprise-level needs and regulatory challenges effectively.

- Click here to discover the nuances of Workday with our detailed analytical health report.

Understand Workday's track record by examining our Past report.

Calix (CALX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Calix, Inc. offers cloud and software platforms, systems, and services globally with a market capitalization of approximately $3.62 billion.

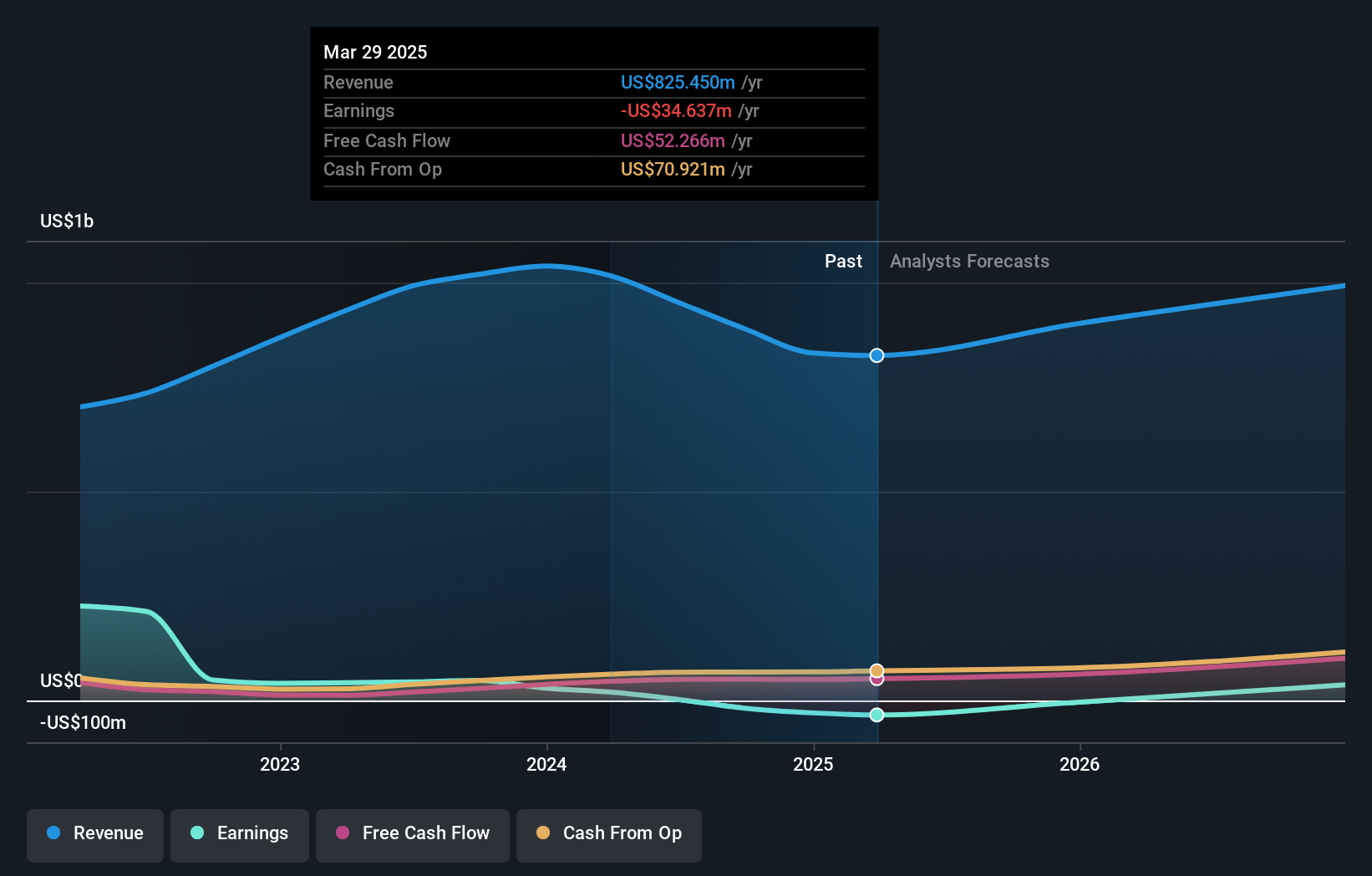

Operations: The company generates revenue primarily from developing, marketing, and selling communications access systems and software, amounting to $933.68 million.

Calix's strategic focus on AI-driven broadband solutions and customer success initiatives positions it as a forward-thinking player in the tech industry. With a revenue growth of 13.3% annually, outpacing the US market average of 10.7%, and an impressive earnings forecast to grow by 91.94% per year, Calix demonstrates robust potential for profitability. The recent appointment of John Durocher as COO, known for his transformative leadership at Salesforce, underscores Calix's commitment to operational excellence and innovation in customer experiences. This leadership change coincides with significant developments such as CoastConnect leveraging the Calix Platform to enhance broadband services with AI capabilities, signaling strong future growth prospects in an increasingly competitive sector.

- Delve into the full analysis health report here for a deeper understanding of Calix.

Evaluate Calix's historical performance by accessing our past performance report.

Reddit (RDDT)

Simply Wall St Growth Rating: ★★★★★☆

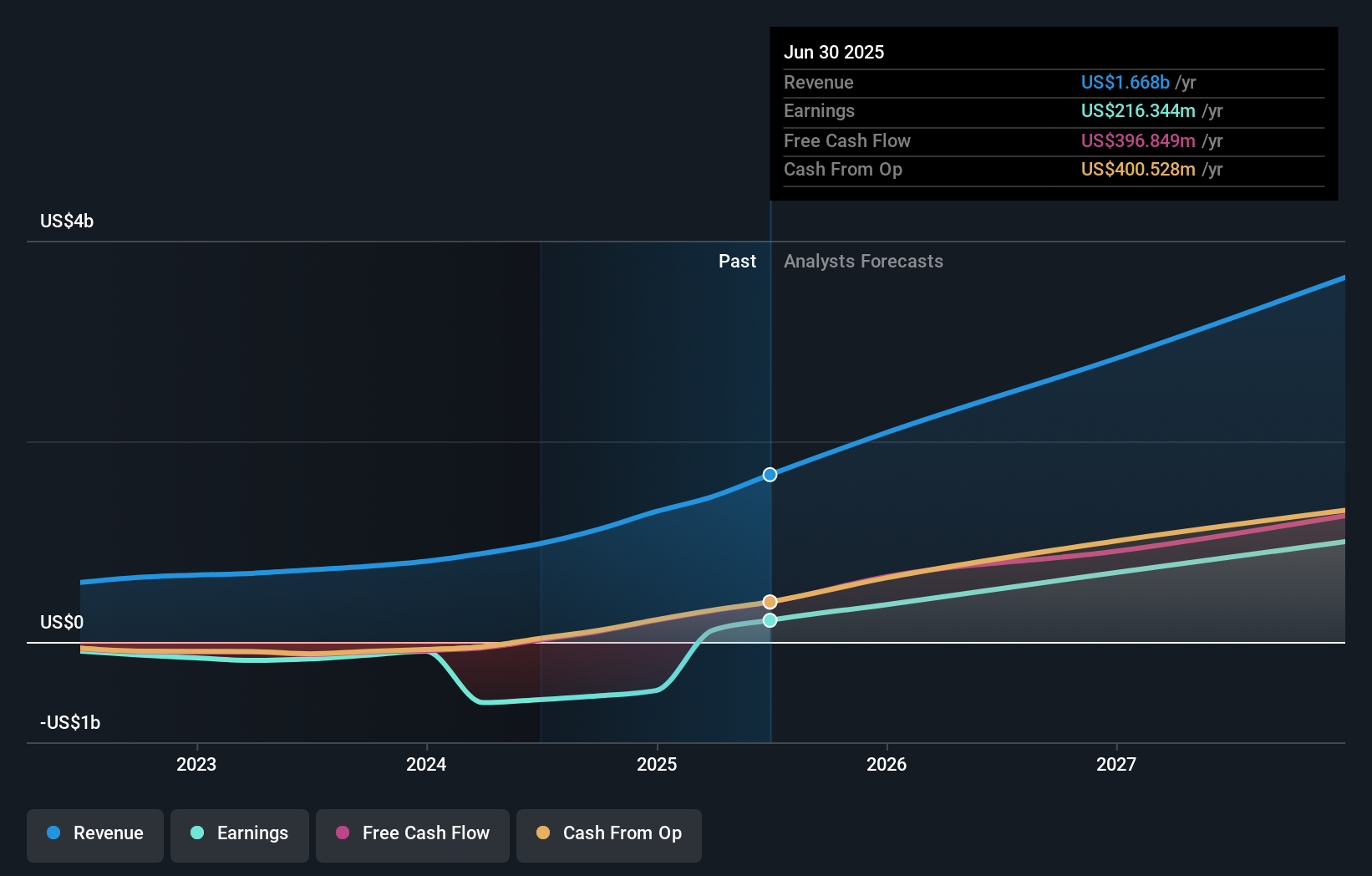

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally with a market capitalization of $44.19 billion.

Operations: The company generates revenue primarily through its Internet Information Providers segment, amounting to $1.90 billion.

Reddit's recent strategic partnership with Bombora, aimed at enhancing B2B targeting on its platform, underscores its innovative approach to monetizing its vast user base. This collaboration could significantly boost Reddit's appeal to advertisers seeking precise audience engagement, evidenced by a substantial increase in quarterly sales to $584.91 million from $348.35 million the previous year. Moreover, Reddit has turned a corner financially this year, with net income reaching $162.66 million in the third quarter compared to just $29.85 million a year ago, and projecting Q4 revenues between $655 million and $665 million. These figures reflect not only a recovery but also an acceleration in growth due in part to effective leveraging of advanced data analytics for targeted advertising solutions.

- Click to explore a detailed breakdown of our findings in Reddit's health report.

Gain insights into Reddit's historical performance by reviewing our past performance report.

Summing It All Up

- Delve into our full catalog of 76 US High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion