- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT): Exploring Whether Recent Share Price Strength Still Leaves Upside in the Valuation

Reviewed by Simply Wall St

Reddit (RDDT) has quietly turned into one of the year’s stronger media-tech trades, with the stock up about 34% year to date and nearly 49% over the past year as revenue and earnings trend higher.

See our latest analysis for Reddit.

That momentum reflects a shift in how investors are pricing Reddit’s growth story, with a solid year to date share price return helping drive a 48.7% one year total shareholder return as the stock consolidates around $222.76.

If Reddit’s run has you thinking more broadly about the space, it might be worth scouting other high growth tech names. You can use our high growth tech and AI stocks as a starting universe.

But with shares now hovering near analysts’ targets and a rich premium to traditional media platforms, is Reddit still trading below its true long term potential, or is the market already baking in years of rapid growth?

Most Popular Narrative: 7.5% Undervalued

With Reddit closing at $222.76 against a narrative fair value near $240, the valuation case leans on aggressive growth and margin expansion assumptions.

The value of Reddit's data for AI/LLM training is gaining wider recognition, as demonstrated by their data licensing deals and status as a top-cited source for LLMs; Reddit's growing corpus and unique conversation base position the company to expand high-margin data licensing revenues in the years ahead.

Curious how a fast scaling ad engine, rising margins, and a premium future earnings multiple combine into that fair value estimate? The full narrative breaks it down.

Result: Fair Value of $240.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained ad reliance and moderation challenges could quickly pressure margins and user growth, testing how durable Reddit’s current narrative really is.

Find out about the key risks to this Reddit narrative.

Another Angle: Multiples Tell a Hotter Story

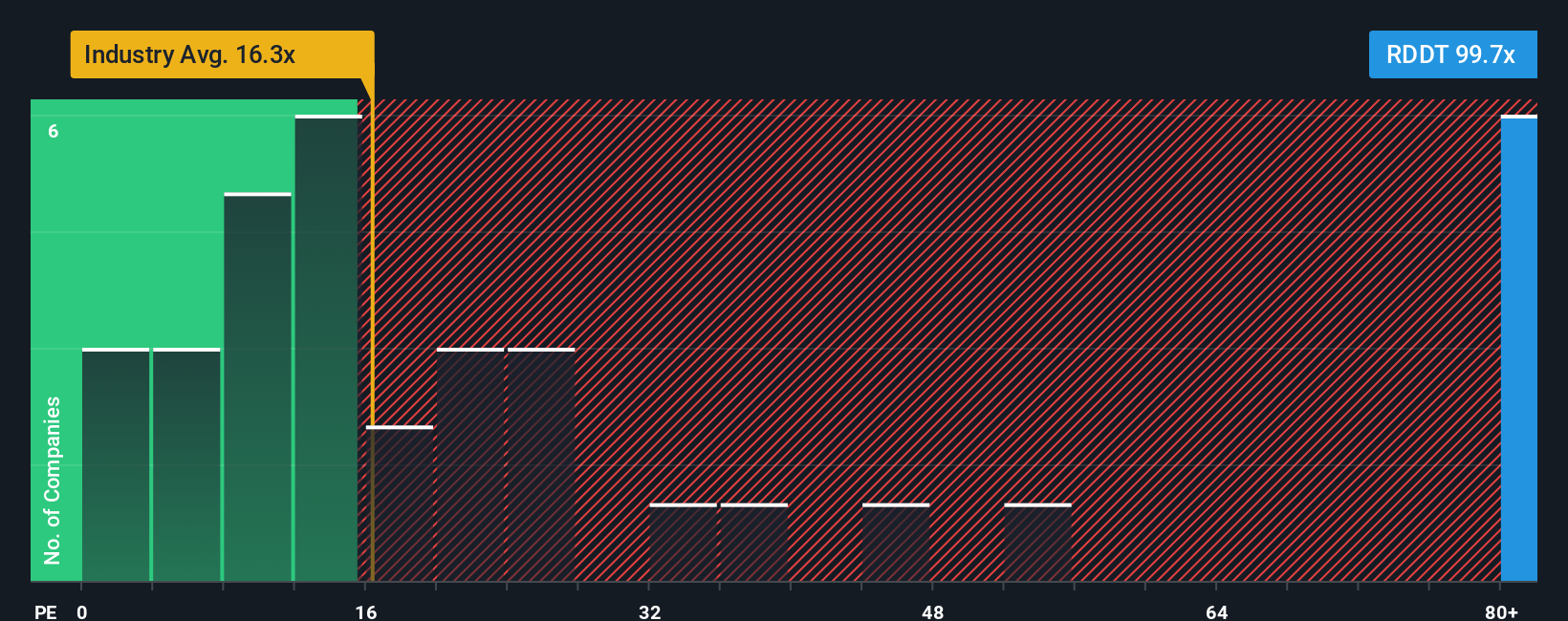

Reddit might look modestly undervalued on narrative fair value, but its 120.9x price to earnings towers over the 16x industry average, 38.9x peer average, and a 37.8x fair ratio. That gap signals real downside risk if sentiment cools, even with strong growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you are not fully aligned with this view, or prefer to dive into the numbers yourself, you can build a custom Reddit storyline in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

If you want to stay ahead of the next wave of winners, put Simply Wall St’s powerful screener to work before these opportunities move without you.

- Capture potential multi-baggers early by scanning these 3567 penny stocks with strong financials that already show financial strength, not just speculative hype.

- Position yourself at the heart of the AI boom by focusing on these 25 AI penny stocks that combine innovation with genuine business momentum.

- Lock in quality at a discount by targeting these 935 undervalued stocks based on cash flows where current prices still trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026