- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

High Growth Tech Stocks To Watch This September 2024

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs, with growth stocks notably outpacing value shares, the technology sector has shown remarkable resilience and potential. With economic indicators such as core inflation slightly higher than expected and Treasury yields reaching year-to-date lows, investors are keenly watching high-growth tech stocks that can capitalize on these dynamic market conditions. In this context, a good stock typically demonstrates strong fundamentals, innovative capabilities, and the ability to adapt to evolving market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 36.07% | 67.23% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Gilead Sciences (NasdaqGS:GILD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gilead Sciences, Inc. is a biopharmaceutical company that discovers, develops, and commercializes medicines addressing unmet medical needs globally, with a market cap of approximately $103.40 billion.

Operations: Gilead Sciences focuses on the discovery, development, and commercialization of innovative medicines, generating approximately $27.81 billion in revenue from these activities. The company operates primarily in the United States and Europe but also has a significant international presence.

Gilead Sciences has been actively enhancing its portfolio through strategic alliances and targeted acquisitions, as demonstrated by its recent collaboration with Marengo Therapeutics to explore novel cancer treatments. This move underscores Gilead's commitment to expanding in high-stakes markets like oncology, where innovation directly translates to competitive advantage. Despite a modest annual revenue growth projection of 2.2%, the company is positioned for a significant earnings increase, with forecasts suggesting a 36% rise per year. Gilead's focus on R&D is evident from its substantial investment in this area, which not only fuels future growth but also solidifies its standing in biotechnology amidst intense market competition.

- Navigate through the intricacies of Gilead Sciences with our comprehensive health report here.

Review our historical performance report to gain insights into Gilead Sciences''s past performance.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coherent Corp. develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems for industrial, communications, electronics, and instrumentation markets worldwide with a market cap of $11.95 billion.

Operations: Coherent Corp. generates revenue primarily through three segments: Lasers ($1.40 billion), Materials ($1.47 billion), and Networking ($2.34 billion). The company's focus spans industrial, communications, electronics, and instrumentation markets globally.

Coherent's recent unveiling of the L-band 800 Gbps coherent pluggable transceiver marks a significant stride in optical communication, doubling fiber capacity crucial for hyperscale data centers and telecom carriers. This innovation not only supports an open ecosystem with its standardized form factor but also promises substantial cost reductions, enhancing Coherent’s competitive edge in dense wavelength division multiplexing applications. Despite currently being unprofitable, Coherent is poised for rapid growth with expected revenue increases at 11.7% per year and earnings forecast to surge by 85.3% annually, signaling robust future prospects as it transitions from R&D phase to market leadership.

- Click here and access our complete health analysis report to understand the dynamics of Coherent.

Gain insights into Coherent's historical performance by reviewing our past performance report.

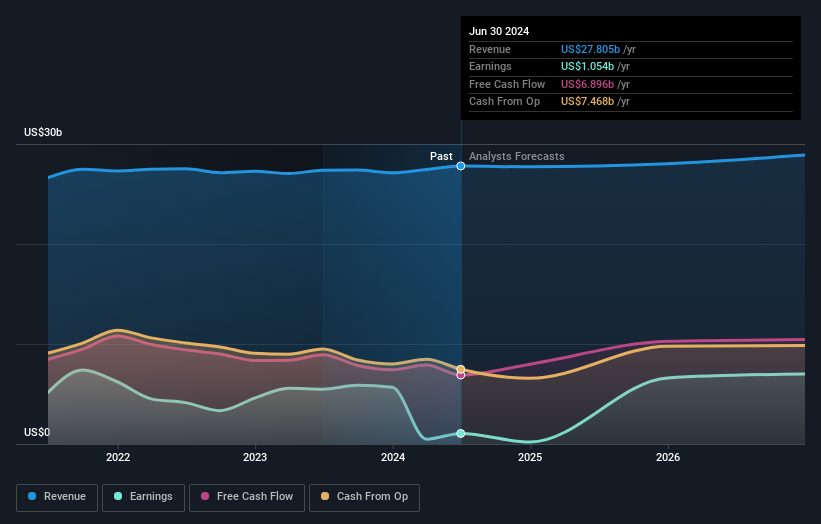

Reddit (NYSE:RDDT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Reddit, Inc. operates a website that organizes digital communities and has a market cap of $10.27 billion.

Operations: Reddit, Inc. generates revenue primarily through its Internet Information Providers segment, which brought in $981.41 million. The company focuses on organizing digital communities via its website.

Despite its current unprofitability, Reddit is navigating a promising trajectory with robust revenue growth projections of 18.6% annually, outpacing the US market's average of 8.7%. This growth is underpinned by significant R&D investments, which are essential for sustaining innovation and competitiveness in the dynamic tech landscape. Recent strategic moves include exploring mergers and acquisitions and potential share repurchases, signaling a proactive approach to capital deployment aimed at bolstering its market position. Furthermore, with earnings expected to surge by 103.7% per year, Reddit's aggressive growth strategy could well position it for future profitability and industry leadership.

- Unlock comprehensive insights into our analysis of Reddit stock in this health report.

Understand Reddit's track record by examining our Past report.

Taking Advantage

- Dive into all 1282 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Flawless balance sheet with high growth potential.