- United States

- /

- Software

- /

- NYSE:SEMR

Exploring US High Growth Tech Stocks with Potential

Reviewed by Simply Wall St

As the S&P 500 faces its fifth consecutive day of declines and investors keenly await Federal Reserve Chair Jerome Powell's speech, the market sentiment remains cautious, particularly impacting technology stocks. In this environment, identifying high-growth tech stocks with strong fundamentals and innovative potential can be crucial for navigating the evolving economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.25% | 31.57% | ★★★★★★ |

| Workday | 11.35% | 29.87% | ★★★★★☆ |

| OS Therapies | 57.14% | 70.11% | ★★★★★☆ |

| Mereo BioPharma Group | 51.44% | 64.61% | ★★★★★★ |

| Circle Internet Group | 27.36% | 78.79% | ★★★★★☆ |

| RenovoRx | 65.63% | 68.83% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Circle Internet Group (CRCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications with a market cap of $31.30 billion.

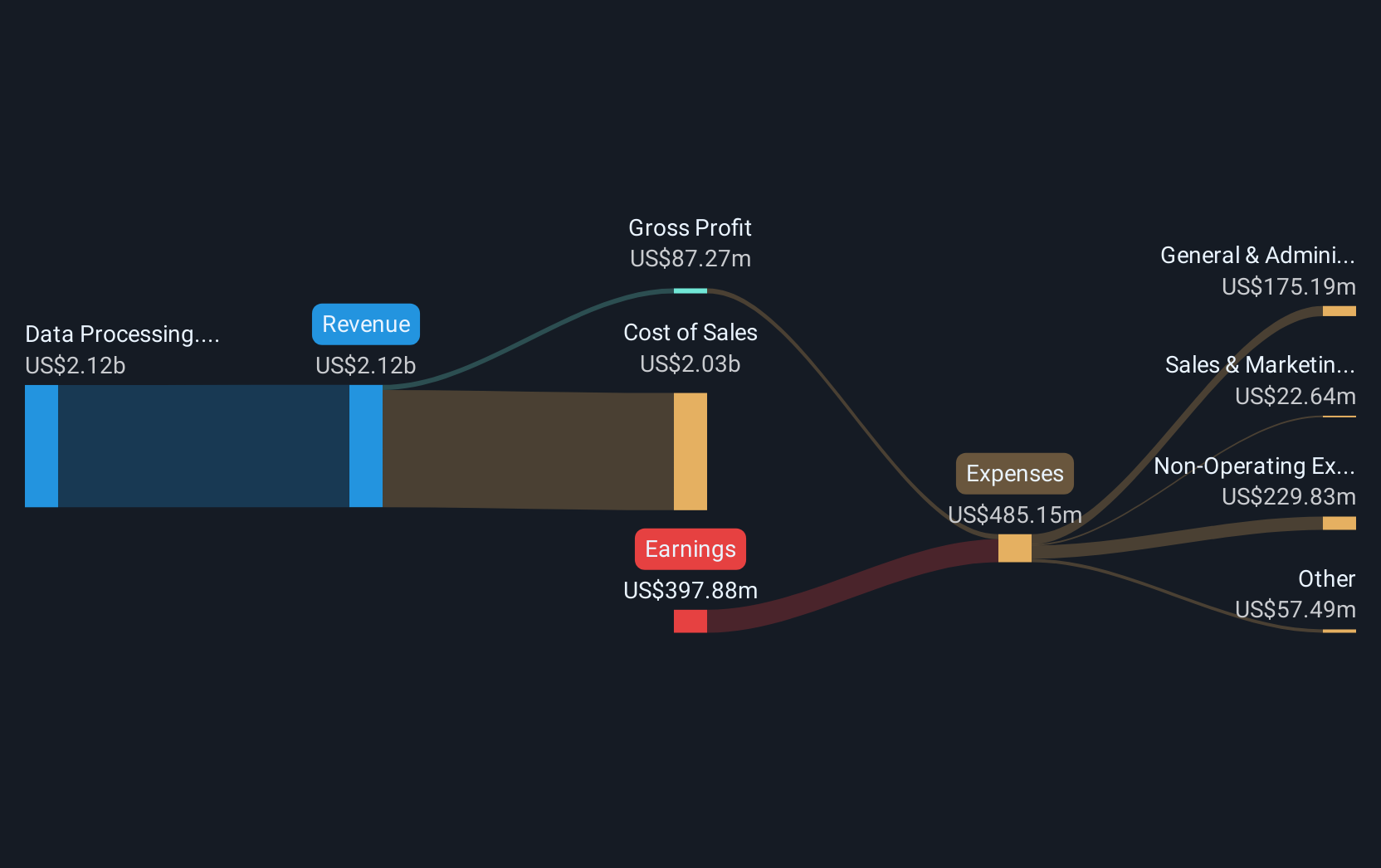

Operations: Circle Internet Group generates revenue primarily from data processing, amounting to $2.12 billion.

Circle Internet Group has recently showcased robust financial maneuvers and strategic alliances that position it as a notable entity in the tech landscape. With an annualized revenue growth of 27.4% and earnings forecast to surge by 78.8%, the company's aggressive expansion is evident. Notably, their R&D expenditure aligns with their innovation trajectory, supporting developments in blockchain and stablecoin integrations across global payment channels. The recent $1.3 billion equity offering and strategic partnerships with entities like Corpay enhance their operational capabilities, ensuring they remain at the forefront of integrating digital assets with traditional finance systems, which could significantly influence future profitability and market presence.

Reddit (RDDT)

Simply Wall St Growth Rating: ★★★★★☆

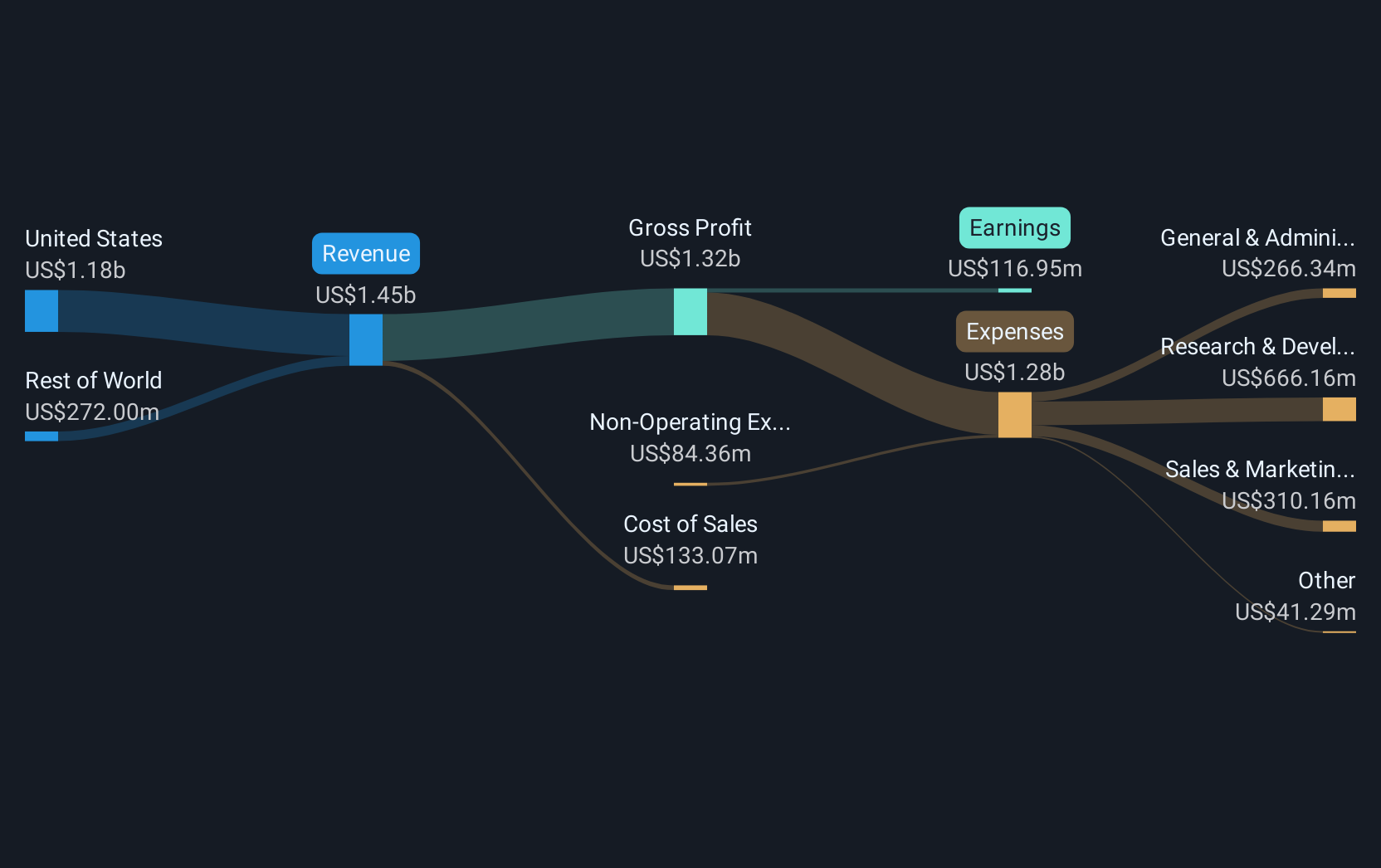

Overview: Reddit, Inc. operates a digital community both in the United States and internationally with a market capitalization of $42.71 billion.

Operations: Reddit primarily generates revenue through its Internet Information Providers segment, with a reported $1.67 billion in revenue. The company's operations focus on facilitating digital community interactions across various regions.

Facing legal challenges and algorithm shifts from Google Search, Reddit has seen significant fluctuations in its stock price and user traffic dynamics. Despite these hurdles, the company reported a remarkable recovery with a 55% year-over-year revenue growth projection for Q3 2025, signaling resilience and adaptability in its business model. This performance is underscored by a turnaround to profitability in the first half of 2025, with net income reaching $115.46 million compared to a net loss previously. These developments highlight Reddit's potential to navigate through tech disruptions while leveraging its vast user base for sustained revenue generation.

- Unlock comprehensive insights into our analysis of Reddit stock in this health report.

Understand Reddit's track record by examining our Past report.

Semrush Holdings (SEMR)

Simply Wall St Growth Rating: ★★★★☆☆

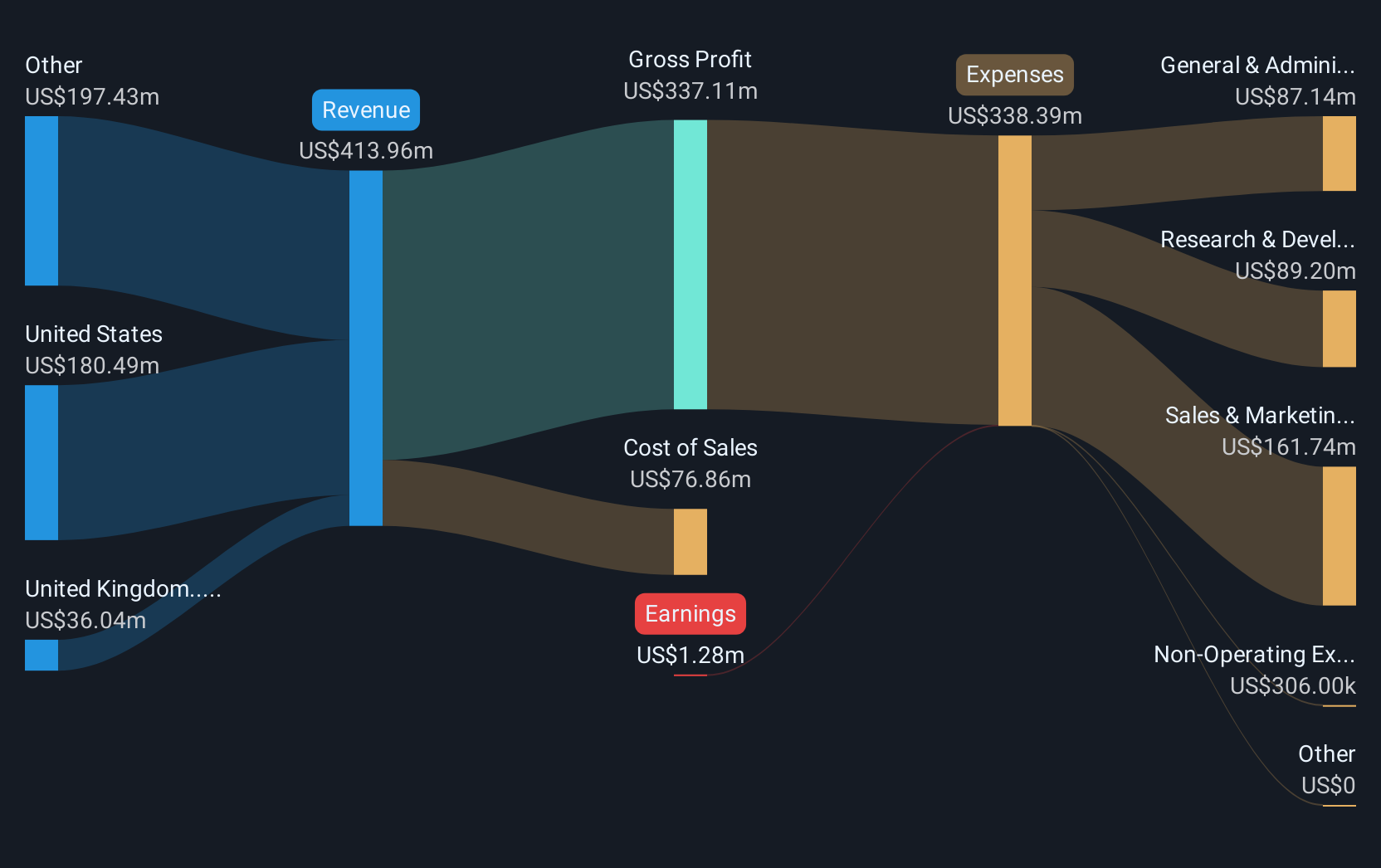

Overview: Semrush Holdings, Inc. provides an online visibility management software-as-a-service platform operating in the United States, the United Kingdom, and internationally with a market capitalization of approximately $1.15 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $413.96 million. Operating as a software-as-a-service platform, it focuses on online visibility management across various international markets.

Semrush Holdings, amidst a challenging market, is navigating its path toward profitability with projected earnings growth of 104.3% annually. Despite a recent dip to a net loss of $6.57 million in Q2 2025 from a net profit last year, the company's commitment to innovation is evident in its R&D investments, aligning with an industry trend towards enhanced digital marketing tools. The firm also announced a significant share repurchase program valued at $150 million, underscoring confidence in its long-term strategy and financial health. This move complements their revenue forecast which expects an 18% increase by year-end, signaling robust demand for their SEO and marketing analytics services despite rising costs in paid search segments.

- Delve into the full analysis health report here for a deeper understanding of Semrush Holdings.

Evaluate Semrush Holdings' historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 67 US High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion