- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (NYSE:RBLX) Surges 11% Over Last Week Amid Market Optimism

Reviewed by Simply Wall St

Roblox (NYSE:RBLX) experienced a 10.8% price increase over the last week, driven by a combination of market optimism and speculation surrounding gaming and technology stocks. During this period, the overall market rose by 2.9%, defying the broader tech sector's downward trend led by declines in giants like Tesla and Nvidia. While market sentiment fluctuated in anticipation of potential economic policies, Roblox benefited from investor interest as a substantial player in the interactive entertainment space. Despite other sectors’ declines, these factors appeared to shield Roblox from the selloff impacting other market segments, contributing to its remarkable price movement.

We've spotted 2 possible red flags for Roblox you should be aware of.

Over the past year, Roblox's total shareholder return was an impressive 66.29%. This performance far outpaced the broader U.S. market's return of 10.5% and the entertainment industry's 37.8% gain. Several key developments likely contributed to this robust return. Roblox's expansion into AI-driven functionalities and entry into new markets like India and Japan have been instrumental, potentially increasing revenue streams and daily active user growth. Additionally, the introduction of video ads targeting the Gen Z demographic marked a significant step toward enhancing its advertising revenue.

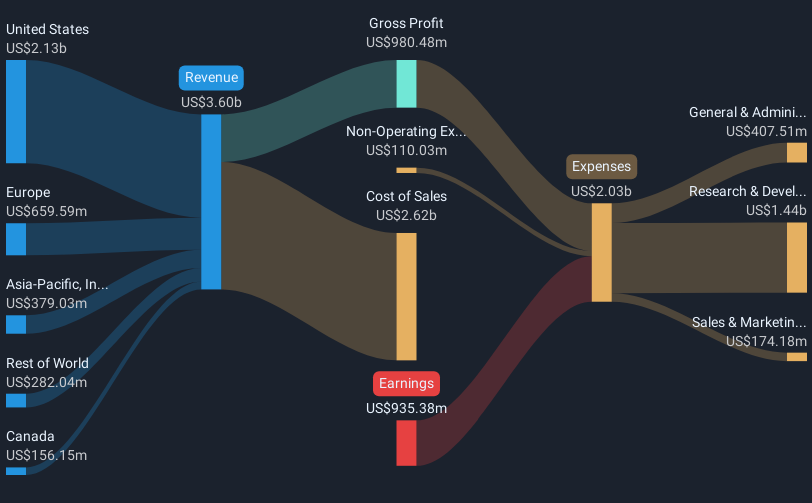

Despite a net loss in 2024, which improved compared to the previous year, Roblox showed resilience by boosting its full-year sales to $3.60 billion from $2.80 billion in 2023. However, the company remains unprofitable and faced some legal challenges, including lawsuits in June and December 2024. The resignation of CFO Michael Guthrie in October added to the year’s changes. Nevertheless, the combination of strategic market expansion and product innovation appears to have driven the overall positive return for shareholders.

Review our historical performance report to gain insights into Roblox's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives