- United States

- /

- Entertainment

- /

- NYSE:RBLX

Amidst increasing losses, Investors bid up Roblox (NYSE:RBLX) 9.1% this past week

Roblox Corporation (NYSE:RBLX) shareholders will doubtless be very grateful to see the share price up 58% in the last quarter. The stock is actually down over the last year. But on the bright side, its return of 12%, is better than the market, which is down 0.13355170430634.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Roblox

Roblox wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Roblox saw its revenue grow by 16%. That's definitely a respectable growth rate. While the share price drop of 12% over twelve months certainly won't delight holders, it's not bad in a weak market. We'd venture the revenue growth helped inspire some faith from holders. So growth investors might like to put this one on the watchlist to see if revenue keeps trending in the right direction.

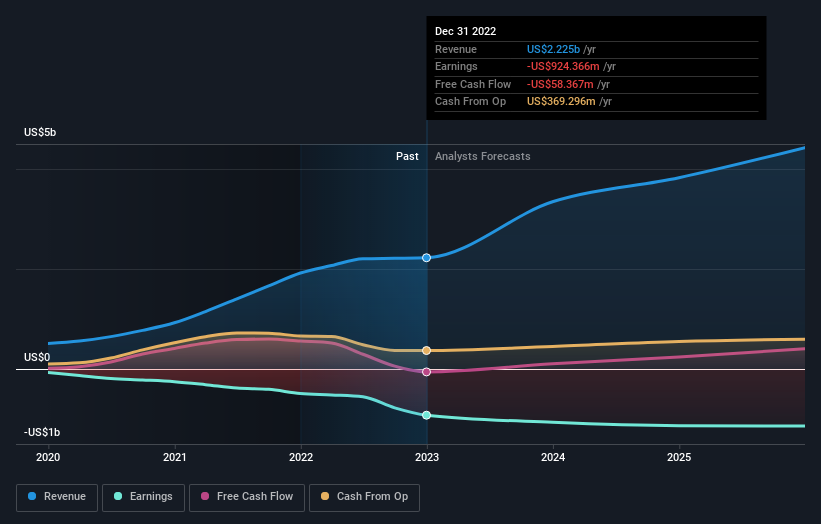

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Roblox is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Roblox stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While they no doubt would have preferred make a profit, at least Roblox shareholders didn't do too badly in the last year. Their loss of 12%, actually beat the broader market, which lost around 13%. On the plus side, the share price has bounced a full 58% in the last three months. The recent uptick could be an early suggestion that the prior falls were too extreme; but we'll need to see how the business progresses. It's always interesting to track share price performance over the longer term. But to understand Roblox better, we need to consider many other factors. For instance, we've identified 5 warning signs for Roblox (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Roblox, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives