- United States

- /

- Interactive Media and Services

- /

- NYSE:PSQH

PSQ Holdings, Inc. (NYSE:PSQH) Shares Slammed 42% But Getting In Cheap Might Be Difficult Regardless

PSQ Holdings, Inc. (NYSE:PSQH) shares have retraced a considerable 42% in the last month, reversing a fair amount of their solid recent performance. Longer-term shareholders would now have taken a real hit with the stock declining 9.4% in the last year.

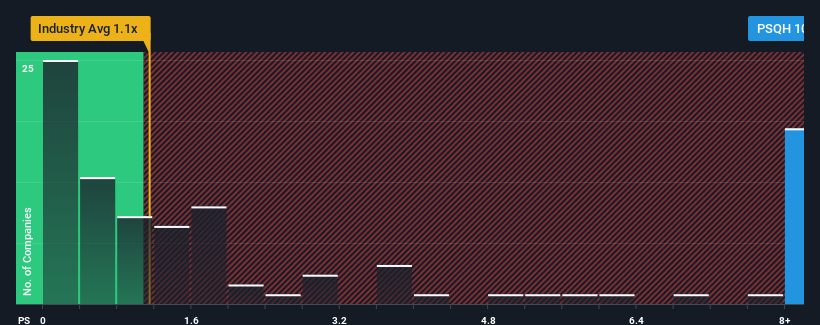

Even after such a large drop in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider PSQ Holdings as a stock not worth researching with its 10.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for PSQ Holdings

How PSQ Holdings Has Been Performing

Recent times have been advantageous for PSQ Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PSQ Holdings.How Is PSQ Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like PSQ Holdings' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 78% over the next year. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this information, we can see why PSQ Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does PSQ Holdings' P/S Mean For Investors?

PSQ Holdings' shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that PSQ Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Interactive Media and Services industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for PSQ Holdings (of which 2 don't sit too well with us!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PSQH

PSQ Holdings

Operates an online marketplace through advertising and eCommerce in the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives