- United States

- /

- Entertainment

- /

- NYSE:MANU

Manchester United (NYSE:MANU): Is the Club’s Current Valuation Justified After Latest Share Price Momentum?

Reviewed by Kshitija Bhandaru

Manchester United (MANU) shares have been on the radar lately, trading near $17 after a slight uptick this week. Over the past month, the stock has climbed 4%, which signals a bit of positive momentum for investors watching the club’s financial performance.

See our latest analysis for Manchester United.

This week’s surge in Manchester United’s share price has grabbed attention, coming on the heels of several ownership rumors and ongoing discussions about the club’s long-term strategy. Over the past year, the stock’s momentum has shifted, with the 1-year total shareholder return of just over 5% reflecting modest gains compared to the strong 31% total return seen over three years. Overall, momentum has picked up lately; however, the longer-term story remains mixed and closely tied to speculation around potential deals and club performance.

If recent moves in sports and media stocks have you thinking broader, now is a great opportunity to discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and recent profit growth outpacing revenue, the big question emerges: is Manchester United undervalued with more upside ahead, or has the market already priced in future gains?

Price-to-Sales of 3.3x: Is it justified?

With Manchester United’s shares closing at $17.13, the stock is trading at a price-to-sales (P/S) ratio of 3.3x. This is considerably higher than both its peer average of 1.4x and the US Entertainment industry average of 1.7x. This signals that the market is demanding a significant premium for Manchester United compared to the wider sector and its direct competitors.

The P/S ratio is commonly used to value sports and media companies when profits are volatile or negative, focusing on the price investors are willing to pay for each dollar of revenue. For Manchester United, relying on sales rather than profit-based multiples is especially relevant given its history of fluctuating earnings and recent periods of unprofitability.

However, compared to industry standards, the 3.3x P/S is high. Sector peers command materially lower multiples, making Manchester United look expensive on a revenue basis. The estimated fair P/S ratio for the company stands at 2.1x, highlighting that the current valuation could be stretched if future growth does not materialize as expected. Markets could readjust if results disappoint or sector sentiment shifts.

Explore the SWS fair ratio for Manchester United

Result: Price-to-Sales of 3.3x (OVERVALUED)

However, continued net losses and revenue growth that lags industry averages remain key risks. These factors could quickly shift sentiment and impact Manchester United’s valuation.

Find out about the key risks to this Manchester United narrative.

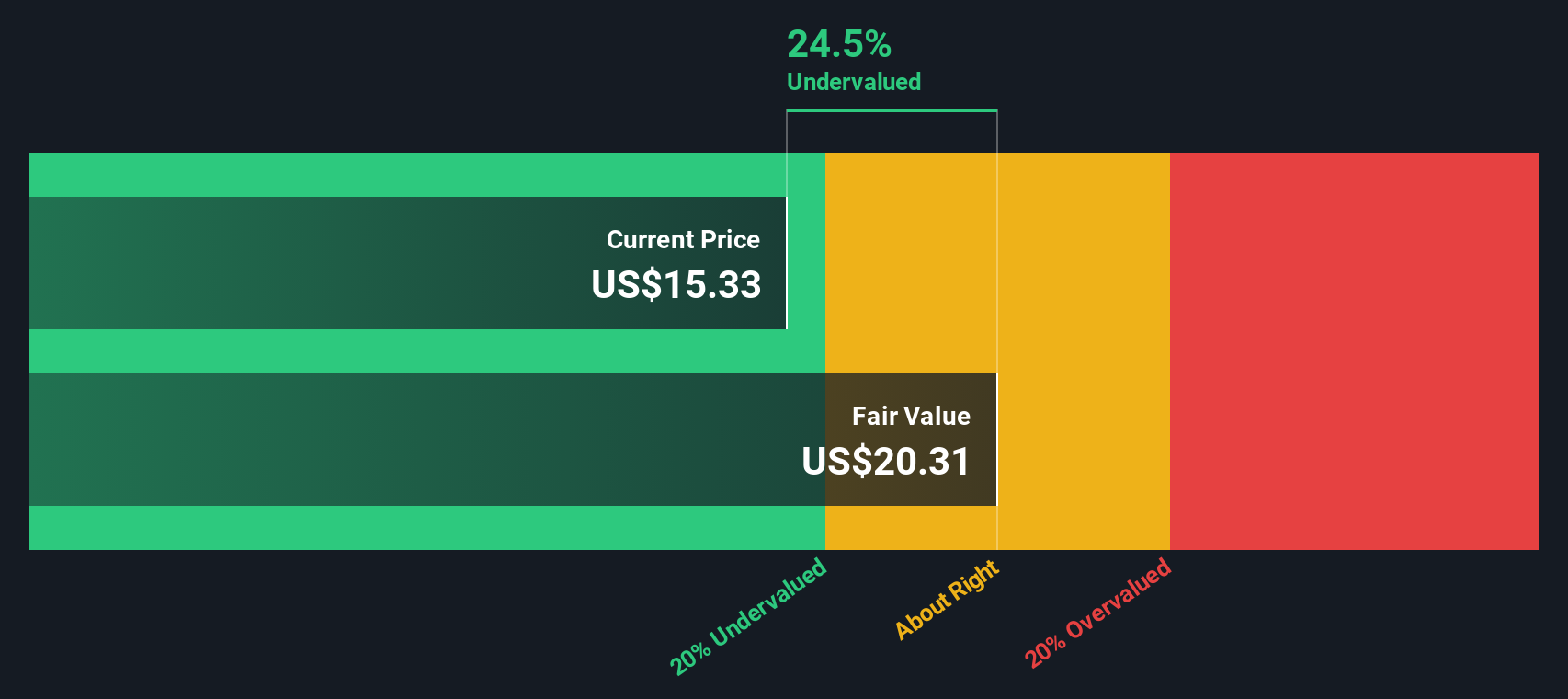

Another View: Our DCF Model Suggests Upside

Taking a different approach, the SWS DCF model estimates Manchester United's fair value at $20.18, which is about 15% above the current price. This method focuses on projected cash flows instead of sales and suggests the stock may have more room to run. However, questions remain about the reliability of this outlook, especially given persistent earnings volatility.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Manchester United for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Manchester United Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can build your own view in just minutes, and Do it your way.

A great starting point for your Manchester United research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open, and Simply Wall Street’s powerful Screener puts a world of opportunity at your fingertips. Don’t let unique investment opportunities pass you by. These ideas could be your next winning move.

- Capitalize on potential high-flyers and uncover hidden market gems by checking out these 3573 penny stocks with strong financials, which are making waves with strong financials and growth.

- Tap into the unstoppable momentum of artificial intelligence and spot real opportunities by exploring these 25 AI penny stocks that are pushing the boundaries in their industries.

- Lock in attractive yields for your portfolio by starting with these 18 dividend stocks with yields > 3%, offering consistent dividend returns above 3 percent and backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MANU

Manchester United

Operates a professional sports team in the United Kingdom.

Moderate growth potential and overvalued.

Market Insights

Community Narratives