- United States

- /

- Entertainment

- /

- NYSE:LYV

Is It Too Late to Consider Live Nation After DOJ Antitrust Lawsuit and 2024 Price Surge?

Reviewed by Simply Wall St

If you have your eye on Live Nation Entertainment stock, you are not alone. With concerts and live experiences roaring back, investors have seen the company’s share price climb an impressive 25% so far this year and over 67% over the past twelve months. That kind of run naturally raises the question: does LYV have more room to run, or is the market already pricing in all that potential?

Digging a bit deeper, LYV’s journey has been anything but boring. In just the past three months, the stock rose nearly 12%, compared to an over 8% uptick in the last month. The recent momentum seems to reflect a mix of surging demand for live events and ongoing optimism about the broader entertainment industry. After the challenges of previous years, sentiment has genuinely shifted, with investors recalibrating their risk and growth expectations upward.

But when it comes to valuation, things get a bit more interesting. On a scale where each checkmark means the company looks undervalued on key metrics, Live Nation currently scores a 0 out of 6. That means not a single standard valuation method sees the stock as undervalued at these levels, at least on paper.

With that score in mind, let’s break down what those valuation checks really tell us about LYV. And, perhaps more importantly, let’s explore whether there is a smarter way to think about the company’s intrinsic worth, something even seasoned investors may overlook.

Live Nation Entertainment delivered 67.8% returns over the last year. See how this stacks up to the rest of the Entertainment industry.Approach 1: Live Nation Entertainment Cash Flows

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting future cash flows and then discounting those back to the present. For Live Nation Entertainment, this approach means looking beyond just current profits and instead focusing on the cash the business is expected to generate over time.

Right now, Live Nation produces Free Cash Flow (FCF) of about $1.24 billion annually. Looking ahead, analysts are forecasting steady FCF growth, reaching roughly $3.29 billion in a decade. This trajectory is built from a combination of expert estimates and modest, ongoing growth rates year after year.

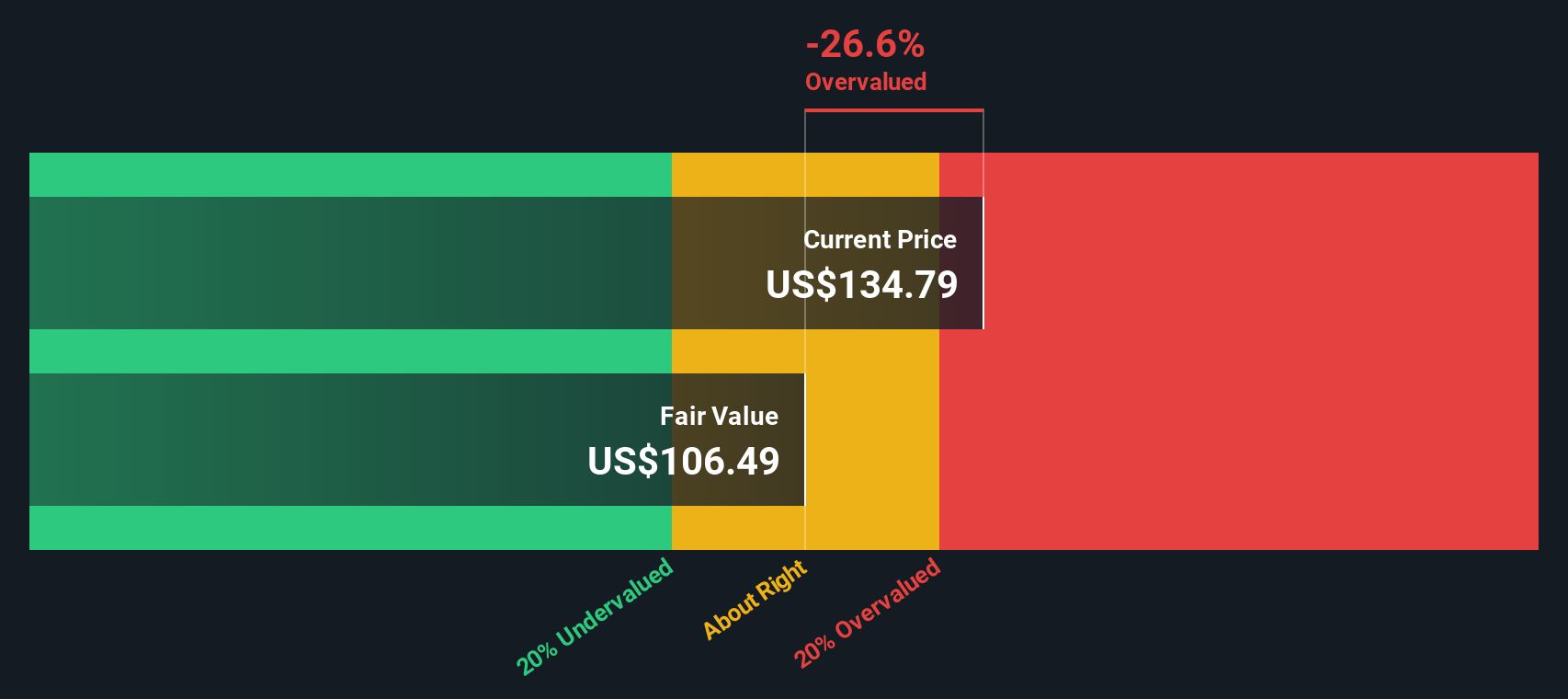

Applying these projections, Live Nation’s estimated intrinsic value lands at $151.01 per share. Compared to its current market price, the stock is approximately 7.2% overvalued based on this DCF calculation. In other words, the market has priced in much of the expected growth, and there is not a clear margin of safety at these levels.

Result: ABOUT RIGHT

Approach 2: Live Nation Entertainment Price vs Earnings

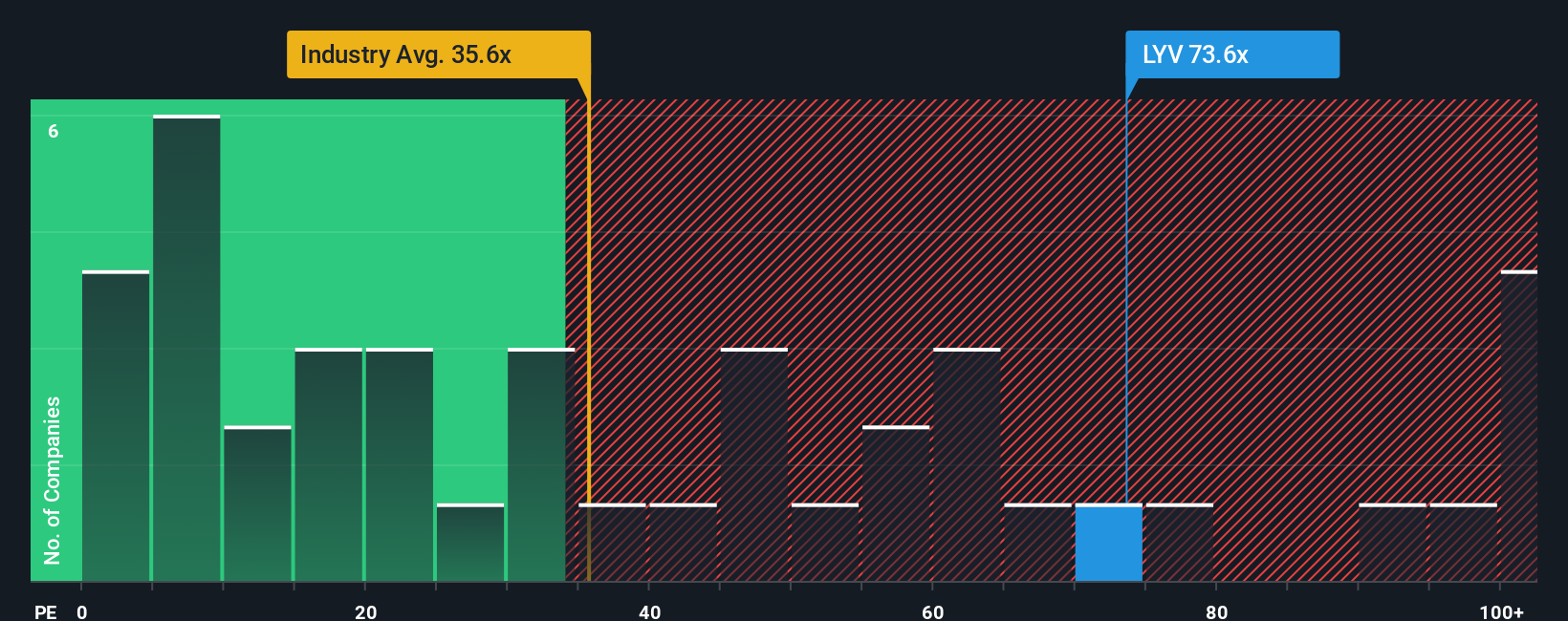

The price-to-earnings (PE) ratio is a common valuation tool for profitable companies like Live Nation Entertainment because it connects a company’s stock price directly to its underlying earnings power. Higher growth expectations or lower perceived risk can justify a higher PE ratio, while cyclical uncertainty or sluggish growth generally leads to lower multiples.

Live Nation currently trades at a substantial 68.5x PE. This is notable compared to the entertainment industry’s average of 35.2x and the peer group’s average of 51.1x. These benchmarks offer important context for how the market values similar companies based on earnings, profitability, and expected growth.

Simply Wall St’s proprietary Fair Ratio for Live Nation is 20.8x, which factors in the company’s own growth prospects, margins, size, and unique risk profile. With Live Nation’s actual valuation well above this fair number, the stock appears to be richly priced according to this metric.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Live Nation Entertainment Narrative

A Narrative is your story about a company that connects the facts, such as future revenue, earnings, and margins, with your personal outlook. This approach helps you turn the numbers into an informed estimate of what the business is really worth.

Instead of relying only on static metrics or expert opinions, Narratives bring together the company’s business story, a custom financial forecast, and a calculated fair value. This empowers you to make investment calls that actually fit your perspective.

Within the Simply Wall St platform and community, Narratives are easy to build, share, and follow. This helps millions of investors see exactly how changes in news or earnings can immediately adjust the outlook and fair value, so your buy or sell decisions stay updated in real time.

For Live Nation Entertainment, one investor’s Narrative could emphasize global expansion and rising digital engagement, pointing to a higher fair value. Another might focus on regulatory risks or competition, resulting in a much lower estimate. This makes it easy to compare your own view to others and spot if the current price fits your story.

Do you think there's more to the story for Live Nation Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026