- United States

- /

- Entertainment

- /

- NYSE:LION

Exploring Lionsgate (LION) Valuation: Is the Studio’s Recent Momentum Pointing to Hidden Value?

Reviewed by Simply Wall St

Lionsgate Studios (LION) shares have moved quietly in recent trading, with investors weighing the latest trends in the media and entertainment sector. The stock's returns over the past month and 3 months suggest a modest upswing.

See our latest analysis for Lionsgate Studios.

Lionsgate Studios has shown a burst of momentum recently, with a 30-day share price return of 14.2% and a 90-day gain of 16.5%, even as the year-to-date share price is still down. Taking a longer view, the studio’s 1-year total shareholder return stands at 13.8%. This suggests that while near-term sentiment remains cautious, longer-term investors have seen meaningful gains as market confidence slowly rebuilds.

If you’re curious to see how other media and entertainment stocks are moving lately, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

Yet with recent gains and analyst price targets still above current levels, the question remains: Is Lionsgate Studios stock trading at a discount to its true value, or is the market already factoring in any future growth potential?

Most Popular Narrative: 14.8% Undervalued

Lionsgate Studios’ widely-followed valuation narrative points to a fair value well above the last close of $7.34, indicating significant upside that many investors might be overlooking.

Lionsgate is leveraging its franchise-building strategy to expand popular IPs (Hunger Games, John Wick, Saw, Twilight) across film, TV, animation, games, virtual experiences, and live shows. The company is tapping into the growing demand for multi-platform, cross-medium content and creating new recurring revenue streams, which is expected to drive top-line revenue growth and provide greater earnings visibility.

Want to know what bold financial forecasts justify this premium? The narrative hinges on a future profit rebound, ambitious margin transformation, and a projected earnings multiple that sparks debate. Are you curious which figures underpin this eye-catching upside?

Result: Fair Value of $8.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Lionsgate’s heavy reliance on unpredictable box office hits and rising competition from larger entertainment giants could undermine these optimistic projections.

Find out about the key risks to this Lionsgate Studios narrative.

Another View: Testing the Numbers with Multiples

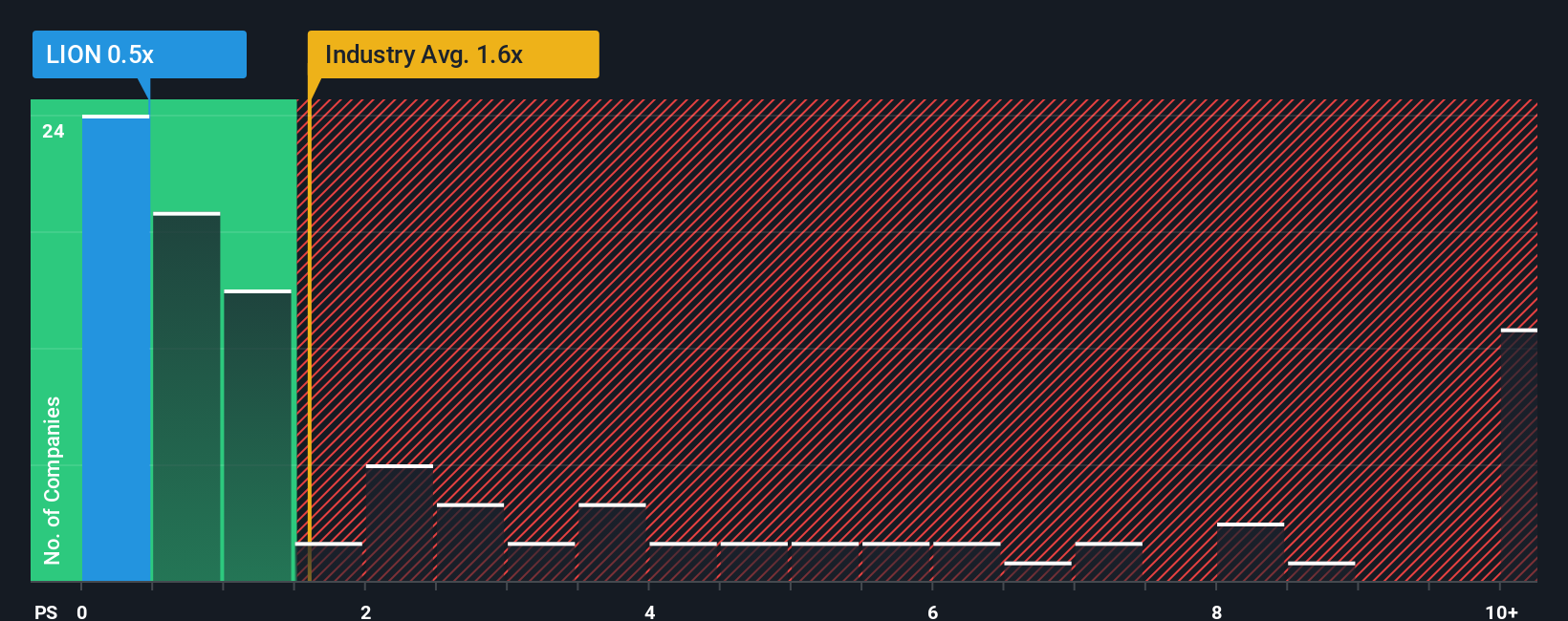

While analyst forecasts point to upside, Lionsgate Studios is trading at a price-to-sales ratio of just 0.6x. This figure stands out as notably lower than both its peer average of 2.9x and the broader US Entertainment industry at 1.4x, and it even sits just below the fair ratio of 0.7x. Such a gap can signal untapped value, but it also raises the question of whether investor caution is justified or if opportunity is being overlooked. Are the market’s low expectations setting up a value surprise, or do they reflect real risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lionsgate Studios for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lionsgate Studios Narrative

If you want to take a different perspective or dive deeper into the numbers, you can quickly shape your own view using the tools provided. Do it your way.

A great starting point for your Lionsgate Studios research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for the perfect moment. Get ahead by searching for unique stocks and trends that others might be missing with the Simply Wall Street Screener.

- Tap into future tech and check out cutting-edge companies blazing a trail in artificial intelligence with these 25 AI penny stocks.

- Unlock value by reviewing these 928 undervalued stocks based on cash flows that are currently trading well below their potential based on strong cash flows.

- Boost your portfolio’s income stream with these 14 dividend stocks with yields > 3% offering reliable yields above 3% and a history of payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LION

Lionsgate Studios

Engages in diversified motion picture and television production and distribution businesses in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026