- United States

- /

- Entertainment

- /

- NYSE:LGF.A

There's No Escaping Lions Gate Entertainment Corp.'s (NYSE:LGF.A) Muted Revenues

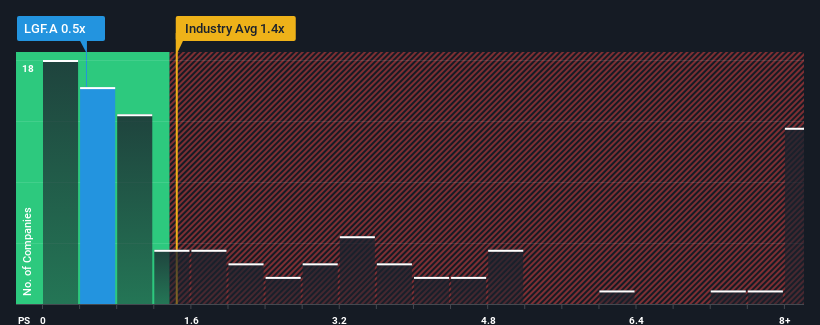

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Lions Gate Entertainment Corp. (NYSE:LGF.A) is a stock worth checking out, seeing as almost half of all the Entertainment companies in the United States have P/S ratios greater than 1.4x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Lions Gate Entertainment

How Lions Gate Entertainment Has Been Performing

Recent times haven't been great for Lions Gate Entertainment as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lions Gate Entertainment will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Lions Gate Entertainment?

The only time you'd be truly comfortable seeing a P/S as low as Lions Gate Entertainment's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 17% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 6.9% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

With this in consideration, its clear as to why Lions Gate Entertainment's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Lions Gate Entertainment's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Lions Gate Entertainment's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Lions Gate Entertainment you should be aware of.

If these risks are making you reconsider your opinion on Lions Gate Entertainment, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LGF.A

Lions Gate Entertainment

Engages in the film, television, subscription, and location-based entertainment businesses in the United States, Canada, and internationally.

Good value low.