- United States

- /

- Interactive Media and Services

- /

- NYSE:KIND

Optimistic Investors Push Nextdoor Holdings, Inc. (NYSE:KIND) Shares Up 26% But Growth Is Lacking

Nextdoor Holdings, Inc. (NYSE:KIND) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.6% isn't as impressive.

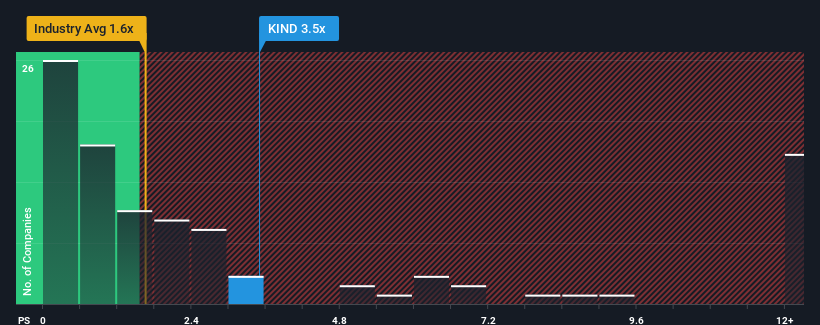

Following the firm bounce in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Nextdoor Holdings as a stock probably not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Nextdoor Holdings

How Has Nextdoor Holdings Performed Recently?

While the industry has experienced revenue growth lately, Nextdoor Holdings' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nextdoor Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Nextdoor Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 75% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 5.8% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 12% per year growth forecast for the broader industry.

With this information, we find it concerning that Nextdoor Holdings is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Nextdoor Holdings' P/S Mean For Investors?

Nextdoor Holdings' P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Nextdoor Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Nextdoor Holdings you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nextdoor Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KIND

Nextdoor Holdings

Operates a neighborhood network that connects neighbors, businesses, and public services in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives