- United States

- /

- Interactive Media and Services

- /

- NYSE:KIND

3 Penny Stocks With Market Caps Over $70M Worth Watching

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, while in the past 12 months it has risen by 14%, with earnings expected to grow by 15% per annum over the next few years. For investors willing to explore beyond established names, penny stocks—often representing smaller or newer companies—can offer intriguing opportunities. Although "penny stocks" might seem like an outdated term, their potential for growth and affordability remains significant, especially when these companies boast strong financials and balance sheet resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.70 | $524.41M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.46 | $249.3M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9714 | $159.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.37 | $234.25M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.29M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.13 | $414.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.83 | $6.01M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.68 | $99.74M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.96 | $43.75M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Zura Bio (ZURA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zura Bio Limited is a clinical-stage biotechnology company focused on developing medicines for immune and inflammatory disorders in the United States, with a market cap of $79.82 million.

Operations: No revenue segments have been reported.

Market Cap: $79.82M

Zura Bio, a clinical-stage biotechnology company with a market cap of US$79.82 million, is currently pre-revenue, highlighting its early development stage. The recent appointment of Eric Hyllengren as CFO brings extensive financial leadership experience from the biotech sector, potentially strengthening Zura's strategic finance and operational execution. Despite having no debt and sufficient cash runway for over three years, the company's shares are highly volatile and it faces challenges such as being dropped from several growth benchmarks while being added to value indices. Its ongoing Phase 2 trial for tibulizumab reflects active efforts in drug development amidst these transitions.

- Click here to discover the nuances of Zura Bio with our detailed analytical financial health report.

- Examine Zura Bio's earnings growth report to understand how analysts expect it to perform.

Nextdoor Holdings (KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of approximately $696.31 million.

Operations: The company generates revenue of $248.31 million from its Internet Information Providers segment.

Market Cap: $696.31M

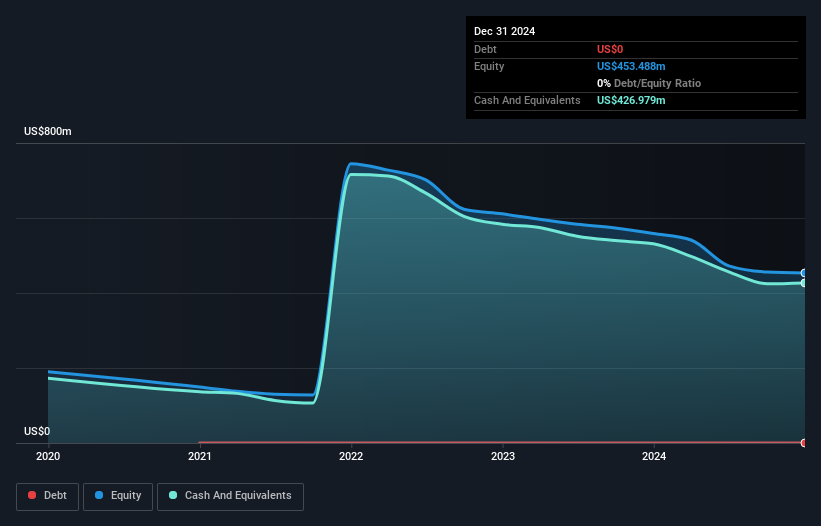

Nextdoor Holdings, Inc., with a market cap of US$696.31 million, trades significantly below its estimated fair value and remains debt-free. Despite being unprofitable with a negative return on equity and no forecasted profitability in the next three years, the company maintains sufficient cash runway for over three years without significant shareholder dilution recently. Recent developments include a major redesign of its platform to enhance user engagement through features like Alerts, News, and Faves. Additionally, Nextdoor has expanded advertising into Canada and completed a substantial share buyback program aimed at enhancing shareholder value.

- Unlock comprehensive insights into our analysis of Nextdoor Holdings stock in this financial health report.

- Understand Nextdoor Holdings' earnings outlook by examining our growth report.

Elite Pharmaceuticals (ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release and generic pharmaceuticals, with a market cap of approximately $567.50 million.

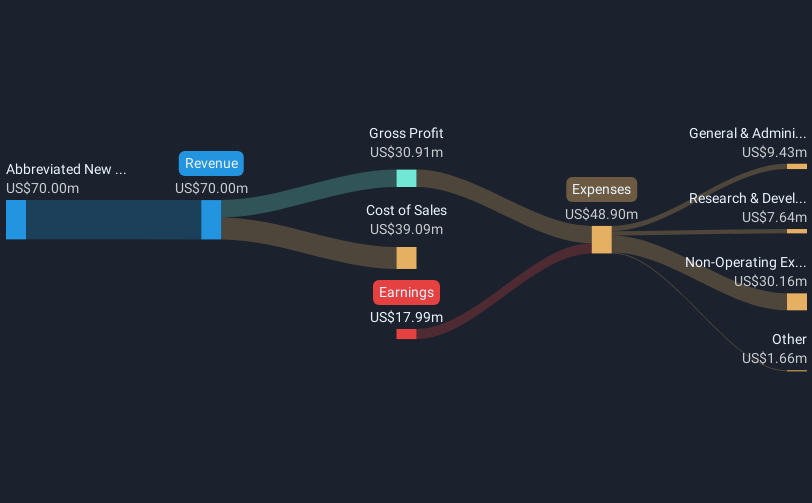

Operations: The company's revenue is primarily derived from its Abbreviated New Drug Applications (ANDA) segment, which generated $84.04 million.

Market Cap: $567.5M

Elite Pharmaceuticals, Inc., with a market cap of US$567.50 million, has shown revenue growth to US$84.04 million for the year ended March 31, 2025, despite reporting a net loss of US$4.31 million compared to the previous year's net income. The company maintains financial stability with short-term assets exceeding both short and long-term liabilities and has reduced its debt-to-equity ratio significantly over five years. Although unprofitable, Elite's operating cash flow covers its debt well and it hasn't seen meaningful shareholder dilution recently. However, significant insider selling in recent months could be a concern for potential investors.

- Dive into the specifics of Elite Pharmaceuticals here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Elite Pharmaceuticals' track record.

Where To Now?

- Explore the 417 names from our US Penny Stocks screener here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextdoor Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KIND

Nextdoor Holdings

Operates a neighborhood network that connects neighbors, businesses, and public agencies in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives