- United States

- /

- Media

- /

- NYSE:IPG

How Bayer’s Global Creative Agency Deal Has Changed Interpublic Group’s (IPG) Investment Story

Reviewed by Sasha Jovanovic

- In September 2025, Bayer’s Consumer Health division announced it had selected Interpublic Group as its exclusive global creative, production, and media agency partner for iconic self-care brands including Aspirin and Claritin.

- This partnership signals Bayer’s commitment to integrated marketing powered by GenAI for both global consistency and tailored local consumer engagement.

- We'll review how IPG’s appointment as Bayer’s lead global partner could strengthen its client portfolio and reinforce its AI-driven investment case.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Interpublic Group of Companies Investment Narrative Recap

If you’re considering Interpublic Group, the big picture is about believing in the company’s ability to win and retain major global clients, drive digital transformation through AI, and balance cost management amid ongoing shifts in media consumption. The recent Bayer global agency win adds immediate credibility to IPG’s client portfolio and supports optimism for offsetting recent account losses, but growing in-housing trends and continued organic revenue declines remain significant risks to watch.

Among IPG’s recent announcements, securing ISO certifications for information security and cloud management stands out in the context of the Bayer news. As brands like Bayer look for comprehensive, data-driven solutions with strict privacy controls, these certifications could give IPG a competitive edge with large multinational clients needing trustworthy, technologically advanced partners.

However, with competition from in-housing and automated ad tech platforms accelerating, investors should not overlook the fact that…

Read the full narrative on Interpublic Group of Companies (it's free!)

Interpublic Group of Companies' narrative projects $9.7 billion revenue and $1.0 billion earnings by 2028. This requires 3.2% yearly revenue growth and a $558.3 million earnings increase from $441.7 million today.

Uncover how Interpublic Group of Companies' forecasts yield a $33.14 fair value, a 24% upside to its current price.

Exploring Other Perspectives

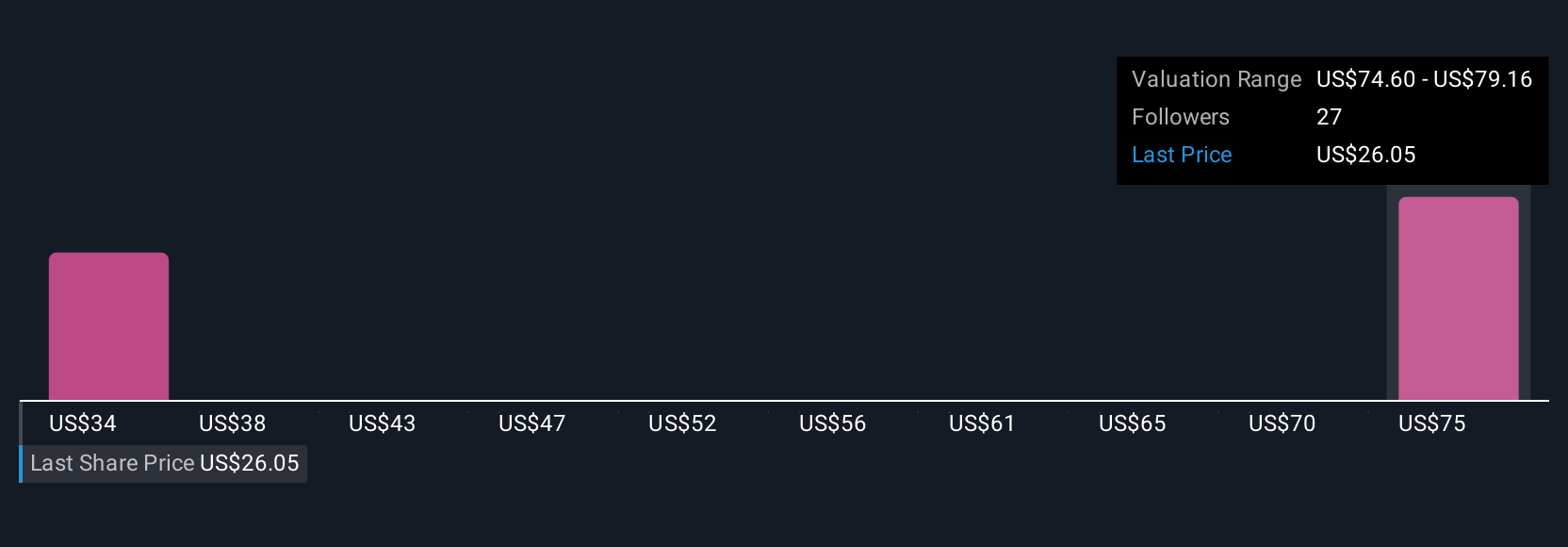

Simply Wall St Community members published two fair value estimates for IPG ranging from US$33.14 to US$79.35 per share. While some see strong offset potential from major client wins, persistent revenue declines shape a wide spectrum of expectations you can compare for yourself.

Explore 2 other fair value estimates on Interpublic Group of Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Interpublic Group of Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interpublic Group of Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Interpublic Group of Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interpublic Group of Companies' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IPG

Interpublic Group of Companies

Provides advertising and marketing services worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives