- United States

- /

- Biotech

- /

- NasdaqCM:AKBA

High Growth Tech Stocks to Watch in October 2024

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the past week, although it has risen by 37% over the last 12 months, with earnings forecasted to grow by 15% annually. In this context, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 21.08% | 28.73% | ★★★★★★ |

| Sarepta Therapeutics | 23.83% | 44.09% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Travere Therapeutics | 29.24% | 70.32% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Akebia Therapeutics (NasdaqCM:AKBA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Akebia Therapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing therapeutics for kidney disease patients, with a market cap of approximately $288.09 million.

Operations: The company generates revenue primarily from developing and commercializing novel therapeutics for kidney disease, amounting to $174.50 million.

Akebia Therapeutics, despite being unprofitable, is navigating a promising trajectory with expected revenue growth of 24.4% annually, surpassing the US market average of 8.8%. This growth is complemented by an aggressive R&D strategy, where expenses are tightly aligned with innovation in treatments for chronic kidney disease (CKD). Recently approved by the FDA, Vafseo® marks a significant milestone and is set to be commercially available in January 2025. The company's recent contract with U.S. Renal Care underscores its strategic positioning within the nephrology sector, potentially enhancing its market presence upon Vafseo’s launch. Moreover, Akebia's commitment to advancing CKD treatment was evident at ASN Kidney Week 2024, where it presented promising data on vadadustat’s safety and efficacy. These developments suggest a robust framework for future growth and industry contribution despite current financial losses and high share price volatility.

- Unlock comprehensive insights into our analysis of Akebia Therapeutics stock in this health report.

Explore historical data to track Akebia Therapeutics' performance over time in our Past section.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in the People’s Republic of China, with a market cap of $8.40 billion.

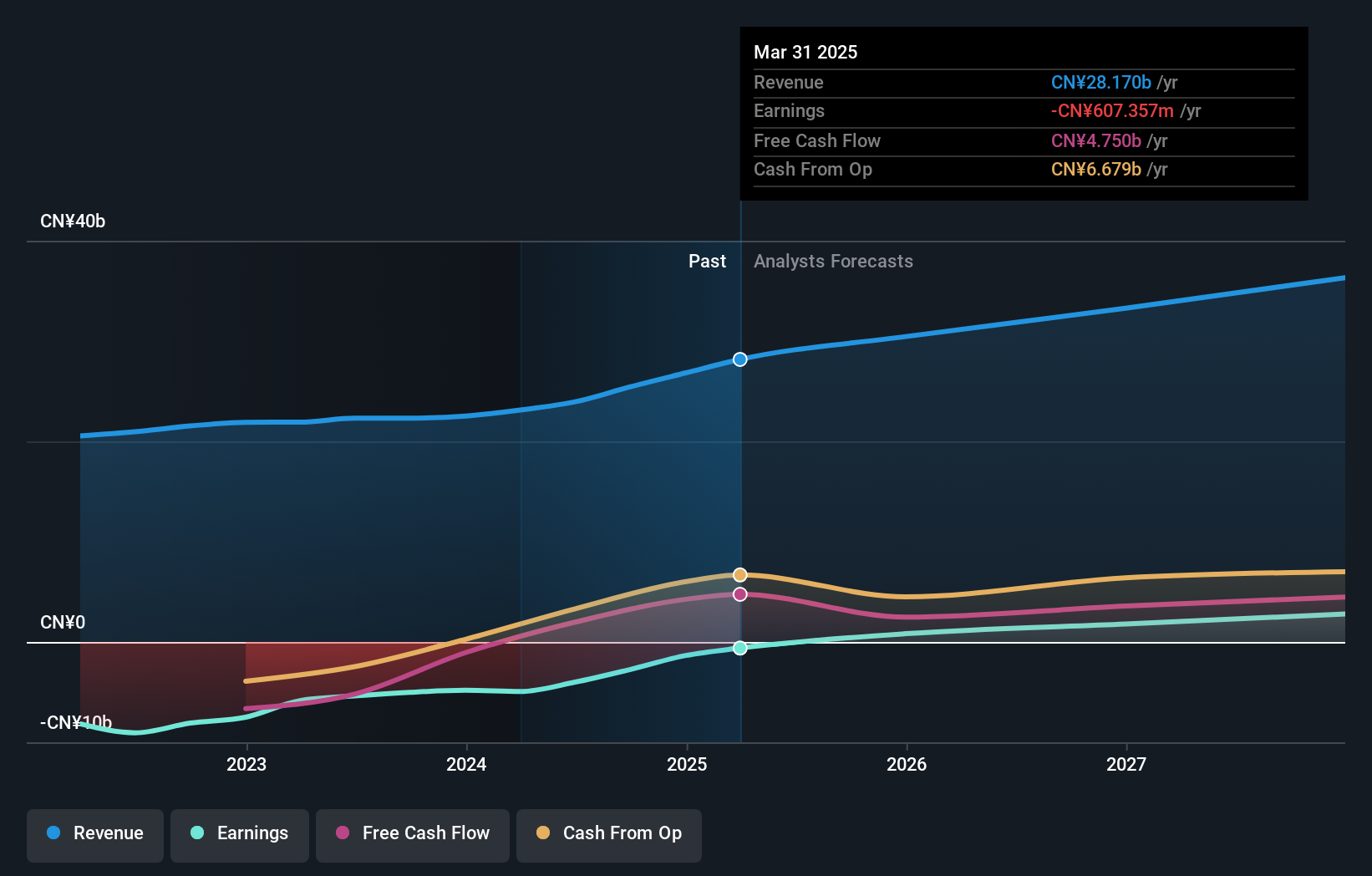

Operations: The company generates revenue primarily from internet information services, amounting to CN¥23.95 billion.

Bilibili, navigating through its unprofitable phase, is poised for a promising turnaround with an expected revenue growth of 11.6% annually, outpacing the US market's 8.9%. This growth trajectory is bolstered by significant R&D investments aimed at enhancing its platform and user engagement, crucial as the company transitions towards profitability with earnings forecasted to surge by 80.3% per year. Recent strategic moves include a $2.745 billion Shelf Registration to potentially fuel these expansions, underscoring Bilibili’s commitment to scaling operations and innovating within the tech space despite current financial challenges.

Ibotta (NYSE:IBTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ibotta, Inc. is a technology company that provides the Ibotta Performance Network (IPN), enabling consumer packaged goods brands to offer digital promotions directly to consumers, with a market cap of $2.16 billion.

Operations: Ibotta generates revenue primarily through its Internet Software segment, which reported $355.21 million. The company focuses on facilitating digital promotions for consumer packaged goods brands via the Ibotta Performance Network (IPN).

Ibotta, recently added to the S&P Global BMI Index, is showing promising signs in the tech landscape with a projected revenue increase of 16.5% per year, outpacing the US market's average of 8.8%. This growth is fueled by strategic partnerships like its recent alliance with Instacart, positioning it as a preferred coupon provider and enhancing its market reach. The company has also committed to significant capital return through a $100 million share repurchase program announced in August 2024. Despite facing challenges such as a volatile share price and substantial insider selling over the past three months, Ibotta's focus on expanding its digital offerings and maintaining robust R&D investment—which stands at an impressive rate compared to revenues—underscores its potential to leverage technology for sustained growth.

- Click here and access our complete health analysis report to understand the dynamics of Ibotta.

Examine Ibotta's past performance report to understand how it has performed in the past.

Make It Happen

- Dive into all 250 of the US High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AKBA

Akebia Therapeutics

A biopharmaceutical company, focuses on the development and commercialization of therapeutics for patients with kidney diseases.

High growth potential and fair value.