- United States

- /

- Media

- /

- NYSE:CTV

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

The United States market has shown impressive performance recently, with a 2.0% increase over the last week and a remarkable 32% rise over the past year, while earnings are expected to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks that align with these robust market trends can be crucial for investors seeking potential opportunities in November 2024.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.91% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Grid Dynamics Holdings (NasdaqCM:GDYN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grid Dynamics Holdings, Inc. offers technology consulting, platform and product engineering, and analytics services across North America, Europe, and internationally with a market capitalization of $1.58 billion.

Operations: The company generates revenue primarily through its computer services segment, amounting to $328.36 million. It operates across North America, Europe, and internationally, focusing on technology consulting and engineering services.

Grid Dynamics Holdings is capitalizing on the shift towards flexible digital commerce solutions, as evidenced by their recent launch of the Composable Commerce Starter Kit on Azure. This strategic move caters to both B2C and B2B sectors aiming to transition from outdated monolithic systems to modern MACH architectures, underscoring Grid Dynamics' role in facilitating next-generation commerce experiences. Financially, the company has shown resilience with a significant increase in quarterly sales from $77.42 million to $87.44 million and a leap in net income from $0.676 million to $4.28 million year-over-year. These figures reflect not only recovery but also an adaptation to market demands for more agile and integrated commerce solutions, positioning Grid Dynamics well amid evolving industry dynamics. Moreover, with an expected revenue growth rate of 17.4% per year outpacing the US market average of 8.9%, coupled with forecasted earnings growth at an impressive rate of 81.3% annually, Grid Dynamics is demonstrating robust financial health and potential for sustained growth within the tech sector's competitive landscape.

- Get an in-depth perspective on Grid Dynamics Holdings' performance by reading our health report here.

Understand Grid Dynamics Holdings' track record by examining our Past report.

Innovid (NYSE:CTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovid Corp. operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $453.11 million.

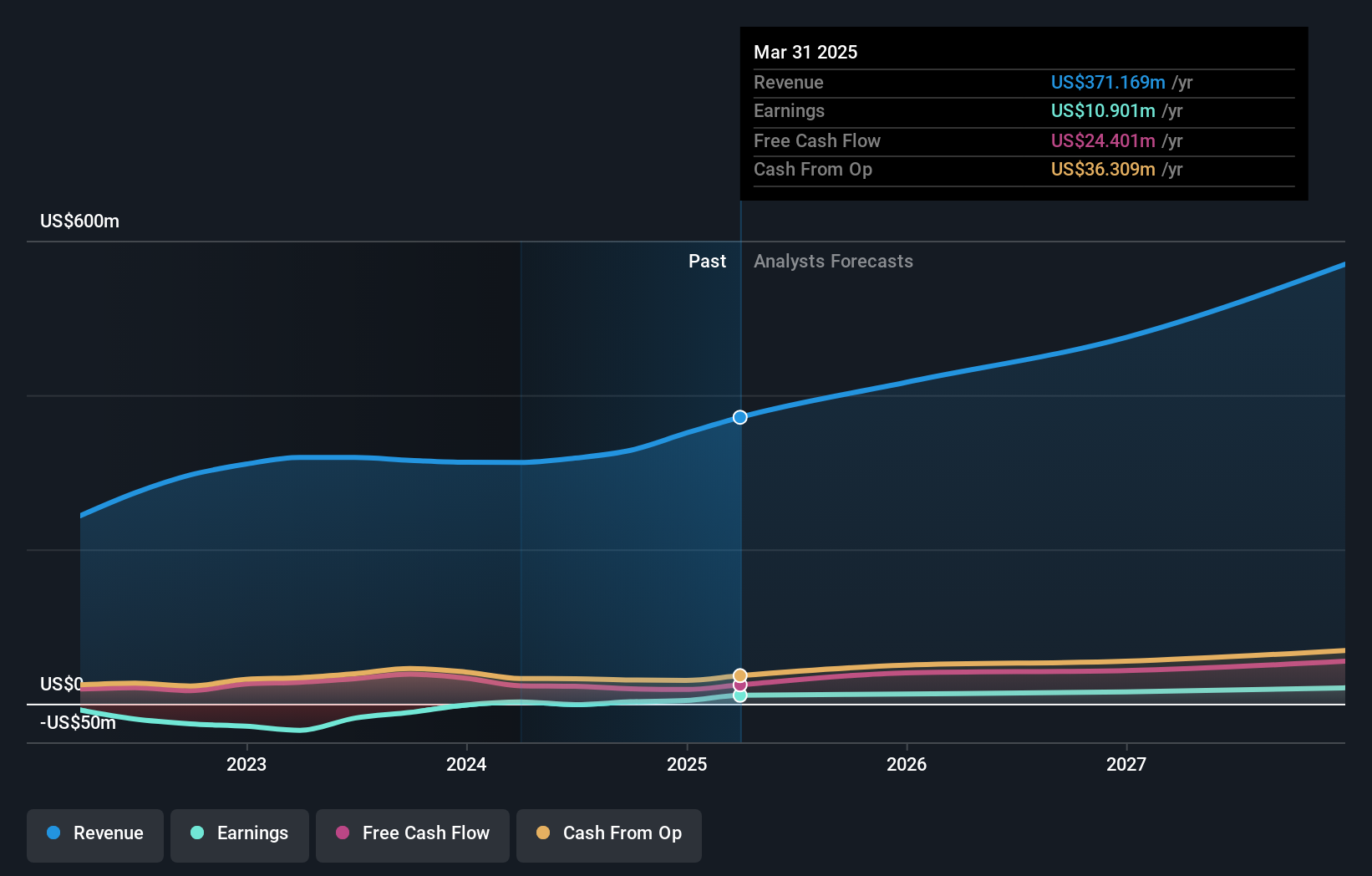

Operations: The company generates revenue primarily from advertising and creative services, amounting to $151.56 million.

Innovid, amid its recent acquisition by Flashtalking for $510 million, showcases strategic growth and potential in the ad tech sector. This move is expected to enhance Innovid's market position by leveraging Flashtalking's resources, with projected revenue growth of 9% annually. Notably, the company has turned a net loss into a net income of $4.67 million this quarter, reflecting a significant improvement in operational efficiency. Additionally, Innovid's commitment to innovation is evident as R&D expenses have been strategically allocated to foster advancements in digital advertising technologies. This focus on R&D not only underscores Innovid’s dedication to maintaining technological leadership but also aligns with industry trends towards more sophisticated and integrated advertising solutions.

- Unlock comprehensive insights into our analysis of Innovid stock in this health report.

Gain insights into Innovid's past trends and performance with our Past report.

Ibotta (NYSE:IBTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ibotta, Inc. is a technology company that provides the Ibotta Performance Network (IPN), enabling consumer packaged goods brands to offer digital promotions to consumers, with a market cap of $2.16 billion.

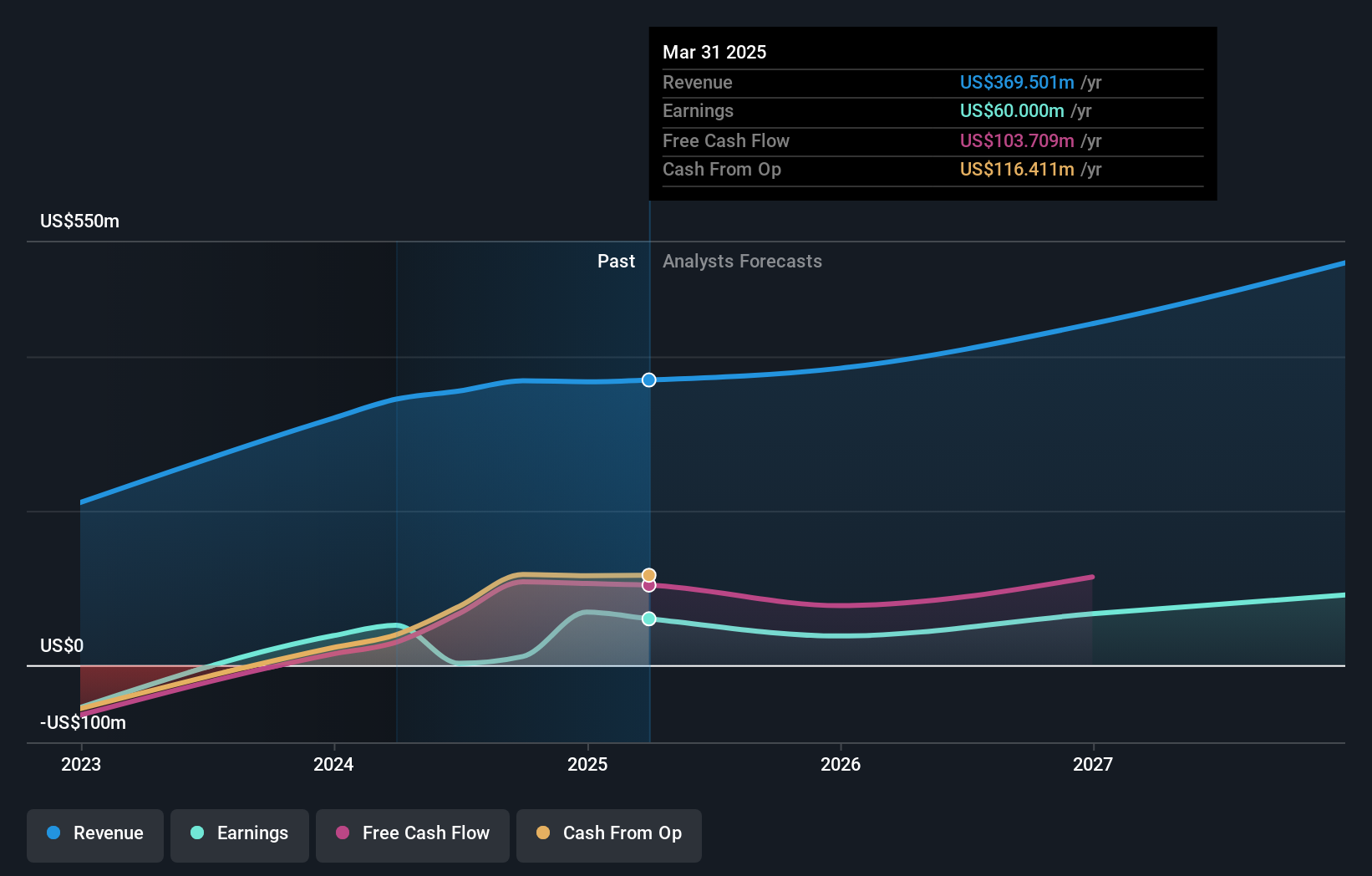

Operations: Ibotta generates revenue primarily through its Internet Software segment, amounting to $368.55 million. The company facilitates digital promotions for consumer packaged goods brands via its Ibotta Performance Network (IPN).

Ibotta, navigating through a challenging landscape, reported a significant revenue increase to $98.62 million in Q3 2024, up from $85.29 million the previous year, demonstrating resilience and adaptability in its market strategies. Despite a net loss this year due to a one-off $10.1 million expense, the company's commitment to growth is evident with an aggressive R&D investment strategy aimed at enhancing technological capabilities and product offerings. This focus on innovation is crucial as Ibotta's earnings are expected to surge by 64.9% annually over the next three years, outpacing the US market projection of 15.2%. Moreover, with revenue growth forecasted at 15.7% per year—nearly double the national average of 8.9%—Ibotta is positioning itself as a formidable contender in its sector despite current profitability challenges.

- Dive into the specifics of Ibotta here with our thorough health report.

Explore historical data to track Ibotta's performance over time in our Past section.

Where To Now?

- Get an in-depth perspective on all 250 US High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTV

Innovid

Operates an independent software platform that provides ad serving, measurement, and creative services.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives