- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

Grindr (GRND): Assessing Valuation Following Strong Q3 Results and Upbeat 2025 Growth Outlook

Reviewed by Simply Wall St

Grindr (GRND) drew investor focus following its third quarter results, which showed a jump in both sales and net income. The company also provided a renewed revenue growth outlook for the full year 2025.

See our latest analysis for Grindr.

Grindr’s upbeat third quarter and renewed growth guidance come after a year of both sharp rallies and notable pullbacks, with recent leadership changes also affecting the company. Despite the improved financials, the stock’s year-to-date share price return of -22% reflects how momentum has faded. However, the 3-year total shareholder return stands at a resilient 14%.

If recent results have you thinking about what else is picking up pace in the market, this could be your moment to discover fast growing stocks with high insider ownership

With shares still down this year despite robust earnings growth and a renewed outlook, investors must ask whether Grindr’s current price represents an overlooked bargain or if the market is already factoring in its future ambitions.

Most Popular Narrative: 37% Undervalued

Grindr’s widely followed narrative assigns a fair value far higher than the current share price, positioning the stock as a major undervalued opportunity in the eyes of analyst consensus. This bold outlook stands in sharp contrast to the latest closing price and sets the foundation for ambitious revenue projections and margin gains.

Expansion into emerging markets, increasing acceptance, and localized strategies are expected to drive user growth and unlock new revenue opportunities. Focus on premium features, AI infrastructure, and diversified advertising should lift margins, support recurring revenues, and ensure long-term earnings growth.

There is an intriguing growth formula buried within this narrative. Find out which financial levers are expected to deliver record-setting gains and drive up future profit multiples. The surprise? It is not just about user growth. See what else is fueling the case for a higher price.

Result: Fair Value of $22.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including rising operating expenses and potential difficulties expanding beyond Grindr's core user base. Both of these factors could challenge the bullish case.

Find out about the key risks to this Grindr narrative.

Another View: High Sales Multiple Signals Caution

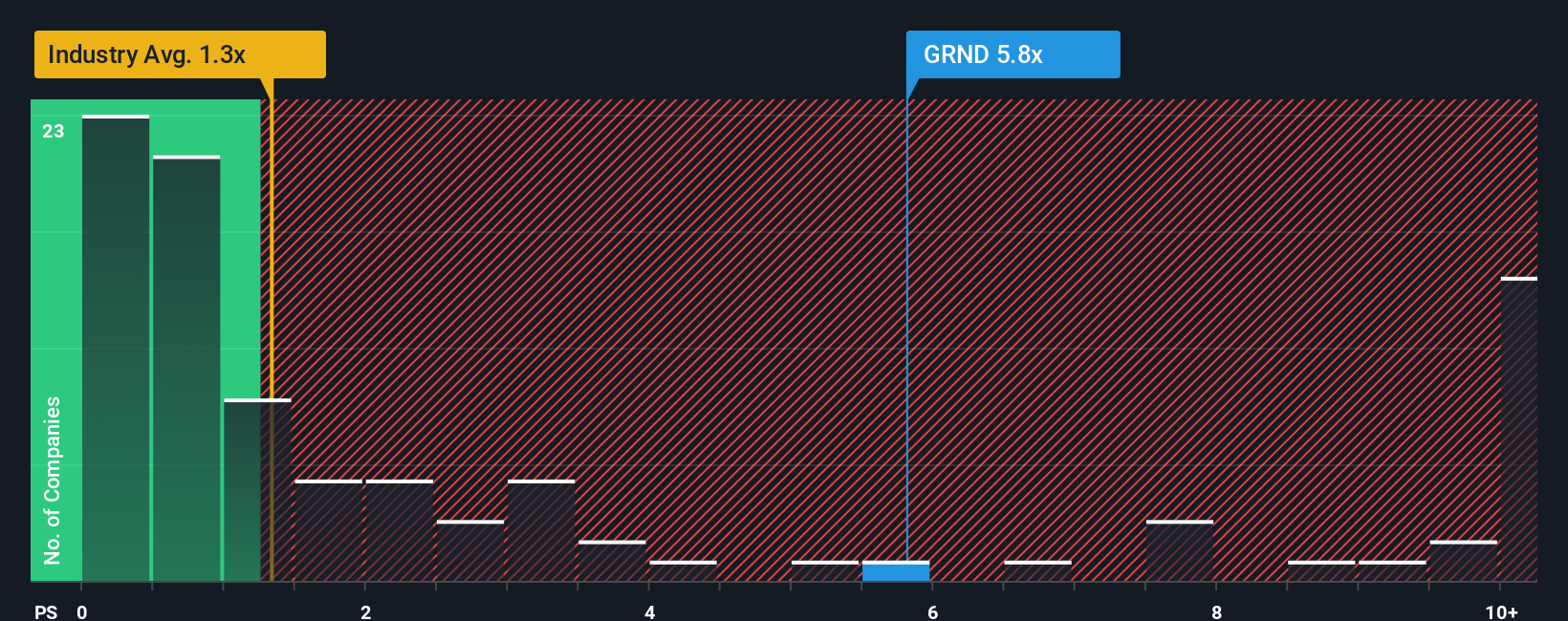

Looking at Grindr's valuation from a price-to-sales perspective, things become more complicated. The current ratio of 6.2x is not only far above the US industry average of 1.1x but also double the stock’s fair ratio of 3.1x. Compared to its peers at 6.3x, Grindr appears more reasonable. However, this gap to the industry and fair value indicates that investors could be paying a premium that the market may not reward unless growth accelerates soon. Will this premium hold up, or could it lead to disappointment if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grindr Narrative

If the consensus view does not reflect your own thinking or you would rather follow your own research path, you can build a personalized narrative for Grindr in just a few minutes with Do it your way.

A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not let your next big win slip away. There are creative ways to grow your wealth beyond Grindr. Use these handpicked stock ideas to level up your portfolio and take control of your financial journey.

- Spot undervalued gems ready for comeback gains when you check out these 894 undervalued stocks based on cash flows and see which companies the market is overlooking.

- Capture double-digit yields as you tap into these 18 dividend stocks with yields > 3% featuring companies paying reliable dividends above 3%.

- Ride the AI revolution to potentially explosive growth. Uncover which companies are powering tomorrow's breakthroughs with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)