- United States

- /

- Entertainment

- /

- NYSE:EB

Eventbrite (NYSE:EB investor five-year losses grow to 82% as the stock sheds US$39m this past week

Eventbrite, Inc. (NYSE:EB) shareholders should be happy to see the share price up 18% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 82%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Eventbrite

Eventbrite isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Eventbrite grew its revenue at 9.7% per year. That's a pretty good rate for a long time period. So the stock price fall of 13% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

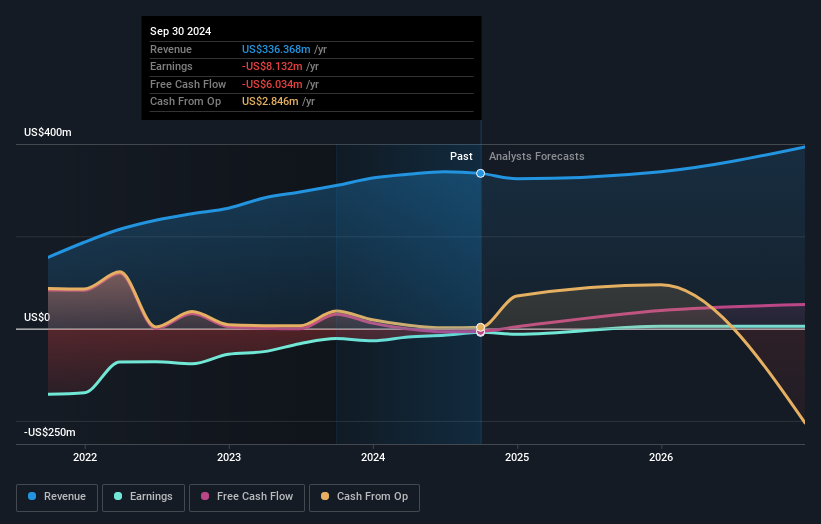

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Eventbrite stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Eventbrite had a tough year, with a total loss of 56%, against a market gain of about 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Eventbrite .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eventbrite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EB

Eventbrite

Operates a two-sided marketplace that provides self-service ticketing and marketing tools for event creators in the United States and internationally.

Undervalued with adequate balance sheet.