- United States

- /

- Media

- /

- NYSE:DV

Will DoubleVerify’s (DV) Leadership Transition Shape Its Commercial Ambitions or Reveal Succession Challenges?

Reviewed by Sasha Jovanovic

- DoubleVerify Holdings recently announced upcoming changes to its senior commercial management, including the planned retirement of current Global Chief Commercial Officer Julie Eddleman by December 31, 2025, with leadership transitions and a new appointment of Joris Stevens as SVP, Global Account Management.

- This evolution marks a significant shift in the company's commercial leadership structure, reinforcing internal succession while introducing experienced talent back into the organization.

- We'll examine how the planned leadership succession and expanded commercial team could influence DoubleVerify's long-term growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

DoubleVerify Holdings Investment Narrative Recap

To be a shareholder in DoubleVerify Holdings, investors generally need confidence in the company's ability to expand its presence and scale product innovation across the rapidly evolving digital advertising market, particularly as brand safety, transparency, and measurement become more important to global advertisers. The recently announced leadership succession is structured and phased, with experienced executives stepping into key roles. This transition, while important, is not expected to materially impact the company's most important short-term catalyst: continued product innovation and deeper integrations with major platforms. The key risk remains DV's dependence on large digital platforms and the potential impact of any policy changes or access restrictions on recurring revenue and data transparency.

Of the recent announcements, DoubleVerify’s July expansion of brand suitability measurement across 30 Meta content categories stands out. This partnership directly addresses one of DV’s most important growth catalysts by furthering its integration with major ad platforms, improving advertiser transparency, and potentially enhancing revenue resilience. As DV broadens its verification suite, these integrations are likely to remain a closely watched driver for both near- and long-term performance.

On the other hand, investors should be aware that tighter data access controls or abrupt platform policy changes...

Read the full narrative on DoubleVerify Holdings (it's free!)

DoubleVerify Holdings' narrative projects $1.0 billion in revenue and $114.0 million in earnings by 2028. This requires an 11.9% yearly revenue growth and an earnings increase of $61.3 million from the current earnings of $52.7 million.

Uncover how DoubleVerify Holdings' forecasts yield a $19.39 fair value, a 63% upside to its current price.

Exploring Other Perspectives

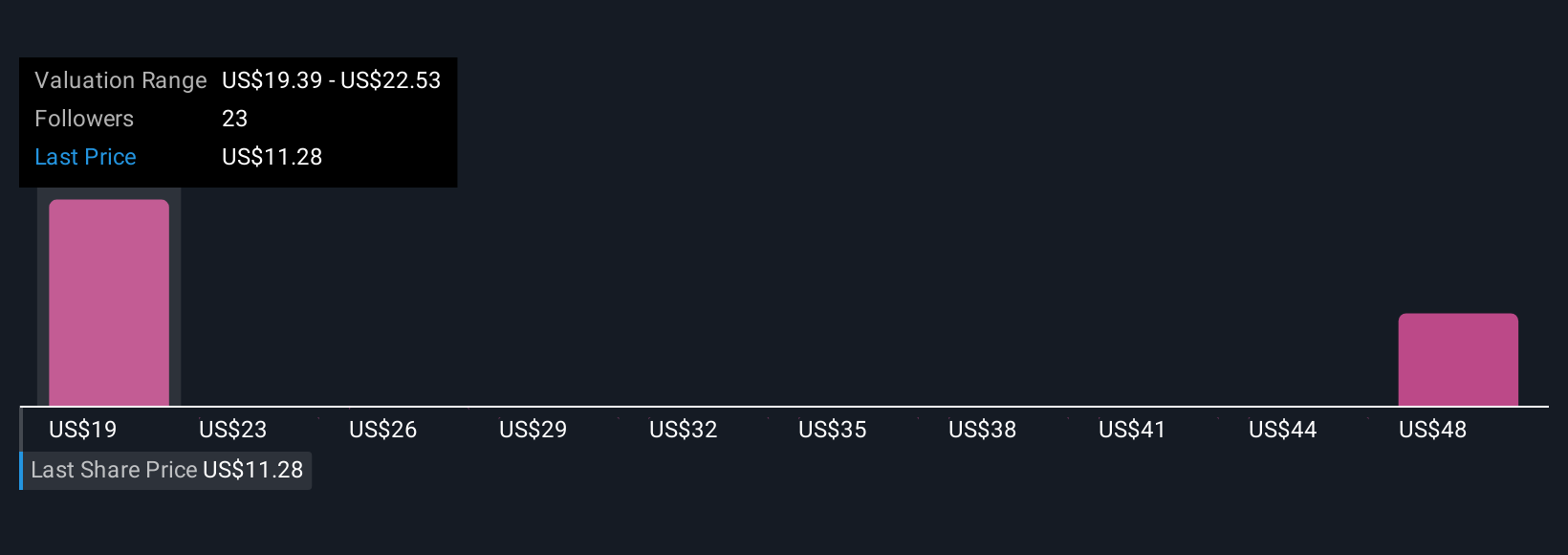

Simply Wall St Community users published four fair value estimates for DoubleVerify ranging from US$19.39 to US$51.14 per share. These diverse perspectives reflect sharply contrasting views, while broader concerns about DV's reliance on the policies of major ad platforms can heavily influence future expectations.

Explore 4 other fair value estimates on DoubleVerify Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own DoubleVerify Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DoubleVerify Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DoubleVerify Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives