- United States

- /

- Media

- /

- NYSE:DV

DoubleVerify (DV): Evaluating Valuation After New TikTok Attention-Measurement Partnership

Reviewed by Simply Wall St

DoubleVerify Holdings (DV) is in focus after expanding its DV Authentic Attention product to TikTok, creating the first badged attention measurement partnership on the platform with direct impression level signals for advertisers.

See our latest analysis for DoubleVerify Holdings.

Despite this TikTok partnership and a recent senior hire from TikTok to lead EMEA, DoubleVerify’s 1 year total shareholder return of -45.37 percent and year to date share price return of -42.99 percent show sentiment has cooled, but also reset expectations.

If this kind of ad tech move has your attention, it might be worth scanning high growth tech and AI stocks for other platforms where growth, innovation and market sentiment are starting to line up.

Yet with revenue still growing and shares trading at a steep discount to analyst targets and estimated intrinsic value, is DV a mispriced ad tech compounder in reset mode, or is the market rightly discounting future growth?

Most Popular Narrative: 21.1% Undervalued

With DoubleVerify last closing at 10.98 dollars against a narrative fair value near 13.92 dollars, the valuation case leans on resilient growth and margins.

The fair value estimate remains unchanged at approximately 13.92 dollars per share, indicating no revision to the core valuation outlook.

Revenue growth remained effectively flat at around 10.36 percent, suggesting no material adjustment to long term growth expectations.

Curious why a beaten down ad tech name is still modeled for steady growth and rising profitability, yet only a mid range earnings multiple later on seals the upside story? Result: Fair Value of $13.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising platform dependency and tighter privacy rules could restrict data access, disrupt recurring revenue, and undermine the long term upside embedded in today’s models.

Find out about the key risks to this DoubleVerify Holdings narrative.

Another Lens on Valuation

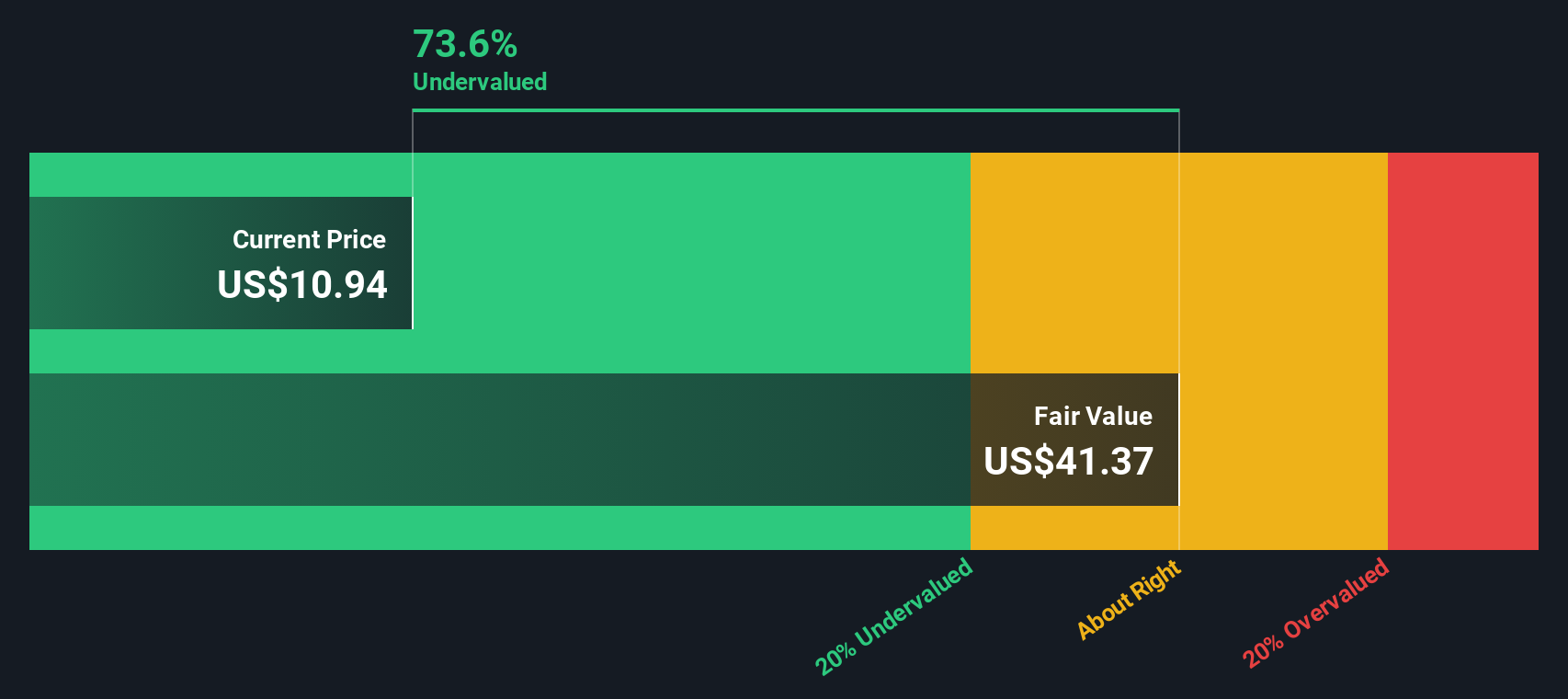

Our SWS DCF model paints a far more optimistic picture, suggesting DV is worth about 41.37 dollars per share, roughly 73 percent above the current price. If cash flows really compound that strongly, is the market misreading execution risk or just refusing to pay up yet?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DoubleVerify Holdings Narrative

If you want to stress test these assumptions yourself and build a view that fits your own research and timeframe, you can create a tailored narrative in just a few minutes: Do it your way.

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment move?

Use the Simply Wall Street Screener now to uncover focused stock ideas, sharpen your watchlist, and avoid missing opportunities that others will only notice later.

- Identify potential multi baggers early by scanning these 3605 penny stocks with strong financials that combine small market caps with improving fundamentals and growing market attention.

- Explore the frontier of automation by targeting these 25 AI penny stocks that generate revenue from applied artificial intelligence across multiple sectors.

- Find value focused candidates by reviewing these 903 undervalued stocks based on cash flows where cash flows and pricing gaps indicate a potential margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion