- United States

- /

- Entertainment

- /

- NYSE:DIS

What Does Disney’s CEO Succession Mean for the Stock in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Walt Disney stock right now? You are definitely not alone. Disney is a company that seems to always be in the headlines, whether it is for blockbuster hits, big leadership decisions, or moves in the ever-changing streaming and entertainment landscape. However, when it comes to making a smart investment decision, there is a lot more to the story than the latest news cycle.

Let us take a look at recent stock performance: over the past year, Disney’s shares have rebounded by 16.5%. A 0.8% gain year-to-date may not signal outperformance, but it is a sign of stability, especially considering some of the boardroom drama. Over the last three years, the total return sits at 14.7%. If you have held the stock for five years, you are still looking at a 10.3% loss, which shows that big headlines do not always lead to quick gains. Most recently, the stock dipped by 3.4% in the last month and was nearly flat for the past week. Some of this back-and-forth may be due to speculation over who could eventually replace Bob Iger as CEO or decisions like keeping Disney’s intellectual property out of AI tools; both factors are keeping investors wondering what moves come next.

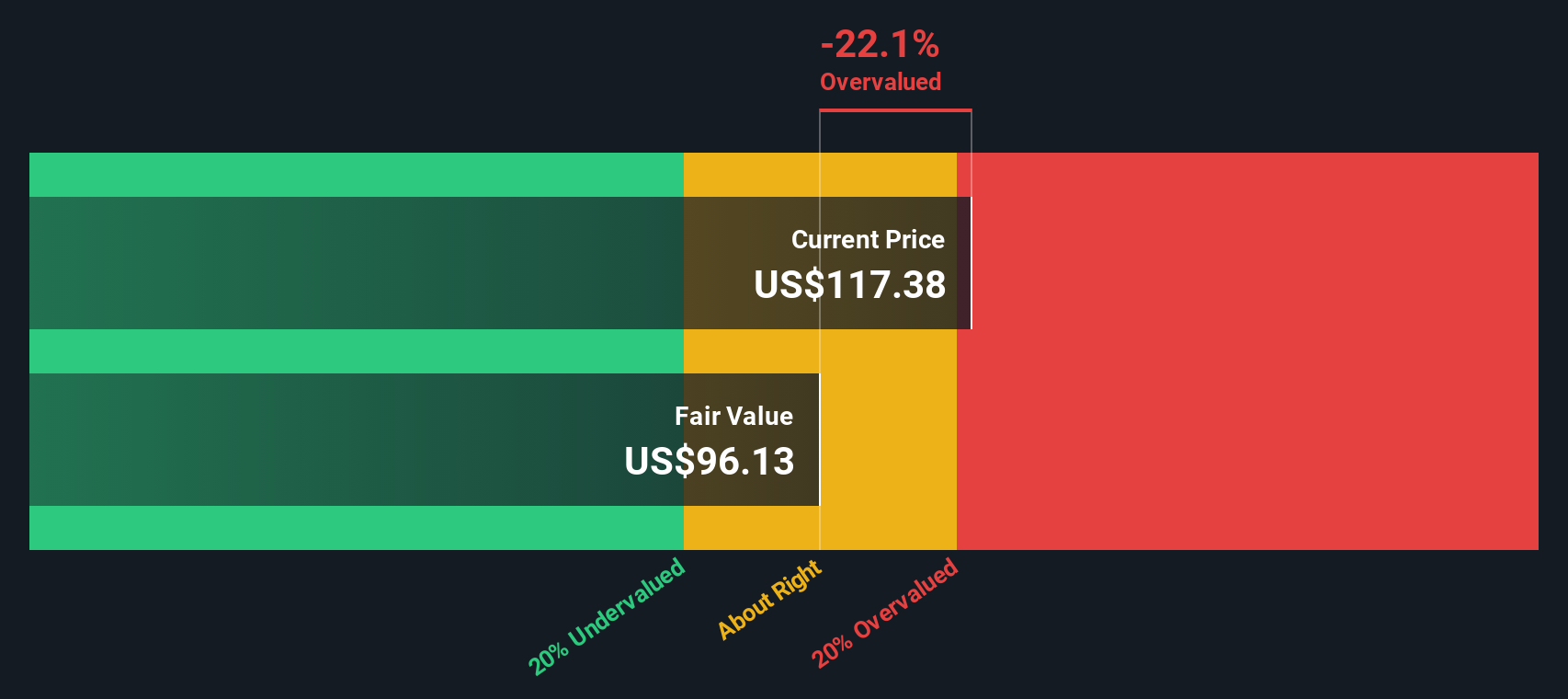

Here is where it gets interesting: by our standard valuation model, Disney scores a 3 out of 6 for undervaluation. This means the stock is not cheap, but not expensive either. Three major value factors are in Disney’s favor, with three suggesting room for improvement or risk.

So, what exactly goes into this valuation score, and how should you read it? Let’s break down the valuation methods we use, and stay tuned because at the end, I will share an even better angle for judging Disney’s real value.

Why Walt Disney is lagging behind its peers

Approach 1: Walt Disney Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today's dollars. This approach aims to help investors understand whether the current share price reflects a fair value based on expected long-term performance.

For Walt Disney, the model uses a two-stage Free Cash Flow to Equity forecast. The company's latest twelve months Free Cash Flow sits at $13.02 Billion, and analysts provide cash flow estimates for the next five years, with projections gradually increasing. By 2030, Disney's Free Cash Flow is forecasted to reach around $13.51 Billion. Further projections into the next decade are extrapolated based on modest growth rates.

The result of this DCF calculation gives an estimated fair value of $105.63 per share. Compared to Disney's current share price, this suggests the stock is trading about 5.8% higher than its intrinsic value calculated by this method. In DCF terms, the stock is neither dramatically overpriced nor a bargain but is right around its fair value range.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walt Disney's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

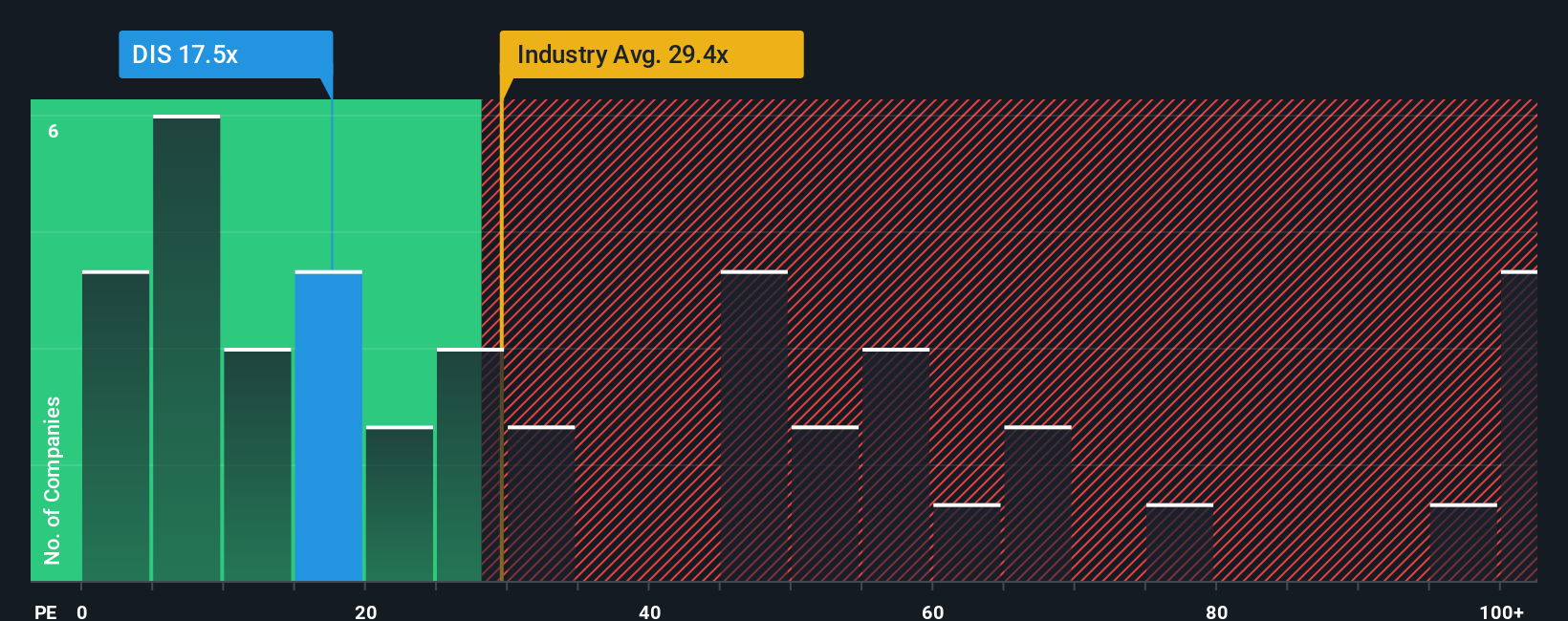

Approach 2: Walt Disney Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is one of the most widely used valuation metrics for profitable companies like Walt Disney, since it tells investors how much they are paying for a dollar of current earnings. Companies with stable profits and predictable growth are typically judged by this multiple, making it particularly suitable for evaluating Disney’s value in the current market environment.

What is a “fair” P/E? The answer largely depends on a company’s expected earnings growth and its overall risk profile. Higher future growth and lower risk usually justify a higher P/E. In contrast, slow or uncertain growth and higher risks push the fair P/E lower. Comparing Disney's current P/E of 17.4x to the entertainment industry average of 28.3x and the average P/E of its direct peers at 82.7x, Disney appears to be trading at a noticeable discount.

However, Simply Wall St's proprietary “Fair Ratio” goes a step further by adjusting for Disney’s unique earnings growth, margins, market cap, and risk factors. The Fair Ratio for Disney is calculated at 25.6x and represents the multiple a balanced investor should expect after considering all these influences. This approach is much more nuanced than simply comparing with peers or the industry, as it reflects what is truly justified for Disney rather than just what competitors are valued at.

Disney’s actual P/E of 17.4x is below its Fair Ratio of 25.6x, indicating the stock is undervalued relative to its fundamentals and risk-adjusted growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walt Disney Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story you create about a company, connecting your perspective on Disney’s future, such as assumptions about revenue growth, margins, and risks, with measurable forecasts that translate into a fair value estimate.

This approach helps you link Disney’s real business story to a financial forecast, making it much easier to see how your beliefs map onto the numbers. Narratives are a simple, accessible tool available right now on Simply Wall St's Community page, where millions of investors share and refine their views.

With Narratives, you can quickly see whether the current share price is above or below your Fair Value estimate, helping you decide whether to buy, hold, or sell. In addition, Narratives automatically update whenever there is new news or earnings data, so your perspective stays relevant.

For example, some investors see Disney’s global cruise and digital integration strategy enabling growth and assign a fair value as high as $152.00 per share, while others are less optimistic about streaming and assign just $79.00. Narratives let you pick the story and price that makes the most sense to you.

Do you think there's more to the story for Walt Disney? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives