- United States

- /

- Entertainment

- /

- NYSE:DIS

Walt Disney (NYSE:DIS) 10% Dip; Tata Play-Bharti Airtel Merger Talks Highlighted

Reviewed by Simply Wall St

Walt Disney (NYSE:DIS) shares declined by 10% last week amid several unfolding events. The recent partnership with Bath & Body Works to launch the Disney Princess Fragrance Collection may have offered some market intrigue, but it was overshadowed by ongoing discussions involving Disney's indirect stake through Tata Play in the merger talks with Bharti Airtel. Meanwhile, investor sentiments might have been swayed by As You Sow's proposal for Disney to disclose risks associated with high-carbon investments. While the market overall experienced a 3.7% drop, leading tech stocks saw a rebound following an encouraging Consumer Price Index report. Despite broader economic trends such as potential tariff impacts and recession concerns, Disney's stock experienced a steeper weekly decline, possibly reflecting investors' cautious stance amidst these surrounding events.

Assess the downside scenarios for Walt Disney with our risk evaluation.

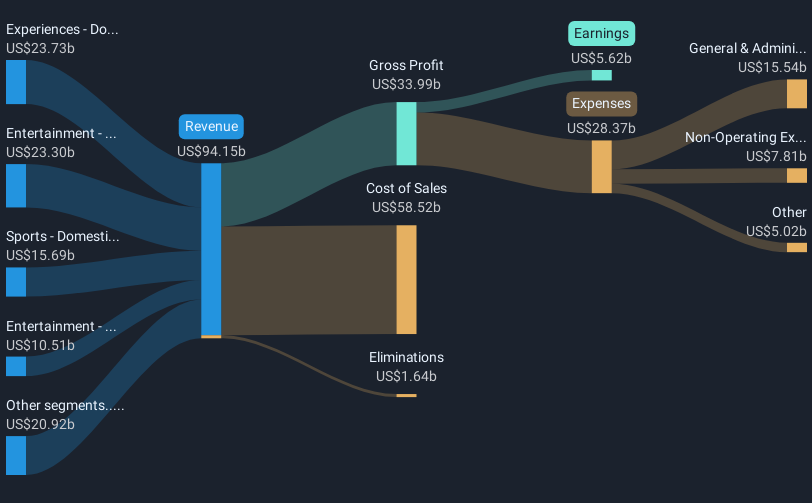

The past five years have seen Walt Disney's total shareholder return grow by 5.97%. This performance stands against various industry dynamics and market conditions. The company's participation in mergers and acquisitions played a significant role, notably its involvement in the merger between Tata Play and Bharti Airtel, reshaping its strategic investments in the Indian market. Furthermore, ongoing earnings growth, with profits soaring by 19.2% annually, bolstered its financial foundation despite challenging market conditions.

The introduction of share buybacks totaling US$3.80 billion underlines Disney's commitment to enhancing shareholder value. Concurrently, substantial executive changes, such as new leadership appointments, aimed to strengthen its operational capabilities. Despite a strong yearly profit growth that surpassed industry peers, Disney's 1-year return trailed behind both the US market and the broader entertainment industry. A dividend increase in December 2024, moving from US$0.75 to US$1.00 per share, also underscores the company's efforts to provide consistent returns to its investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Walt Disney, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives