- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS) Valuation: Is Recent Share Weakness Creating a Buying Opportunity?

Reviewed by Kshitija Bhandaru

See our latest analysis for Walt Disney.

Disney’s share price has steadily lost some ground lately, with recent weakness reinforcing a fading momentum seen over the past several months. While the stock’s year-to-date share price return sits slightly negative, the total shareholder return for the past year remains a strong 17%, suggesting longer-term investors have still come out ahead.

If you’re curious what else is delivering for investors this season, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The key question now is whether Disney’s recent dip means the stock is undervalued and offers fresh upside for investors, or if the market has already priced in everything about Disney’s future growth story.

Most Popular Narrative: 18% Undervalued

With Walt Disney shares recently closing at $109.19 and the most widely followed narrative estimating fair value at $133.22, the market may be missing key drivers that could propel the stock higher. This premium reflects deep conviction in ongoing business transformation and global growth opportunities.

The unified Disney+, Hulu, and ESPN app, paired with upgraded personalization and bundling NFL+ and WWE content, is designed to drive higher engagement, lower churn, and unlock new recurring revenue streams. This approach may improve net margins as digital adoption accelerates.

Want a behind-the-scenes look at what’s fueling this price target? There’s a bold roadmap of revenue expansion, digital innovation, and profit margin shifts at the heart of the fair value. Are you curious about the specific assumptions and forecasts powering this outlook? The full narrative reveals the high-stakes numbers and strategic bets that shape this compelling valuation case.

Result: Fair Value of $133.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent franchise fatigue or slower-than-expected subscriber growth in streaming could challenge Disney’s optimistic outlook and put pressure on long-term valuation gains.

Find out about the key risks to this Walt Disney narrative.

Another View: Discounted Cash Flow Check

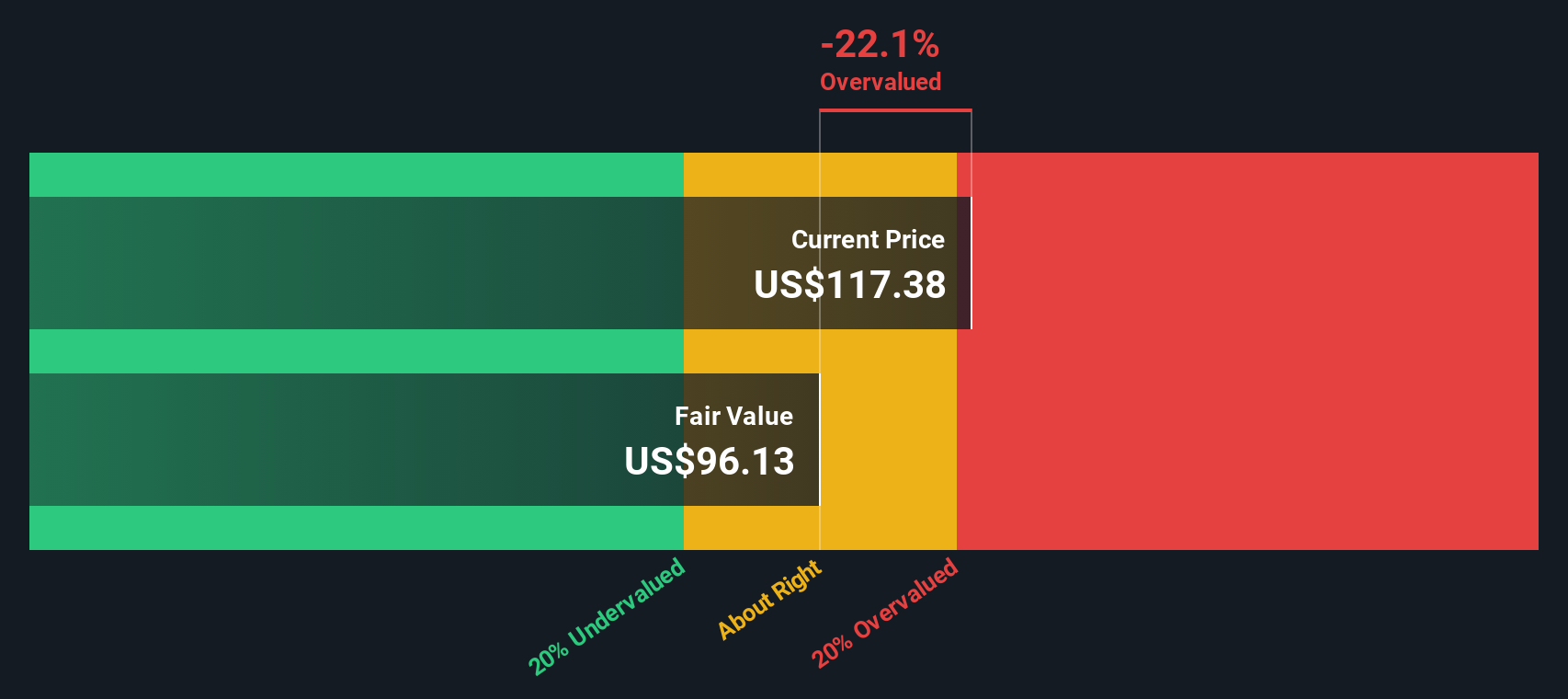

While analyst consensus sees notable upside, our SWS DCF model estimates Walt Disney’s intrinsic value at $105.70, which is beneath today’s share price. This suggests the market may be more optimistic than fundamentals alone support, increasing the pressure on Disney to deliver on growth. Can Disney outperform these more cautious expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you want to dig into Walt Disney’s numbers for yourself, you can piece together your own perspective in minutes and see where your analysis leads. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Looking for more investment ideas?

Don’t miss out on market-moving opportunities that smart investors are already watching. Put yourself ahead of the curve with actionable stock picks tailored to your goals.

- Supercharge your portfolio by targeting smart algorithms and machine learning advancements with these 24 AI penny stocks.

- Unlock hidden value and seize potential bargains that others overlook with these 898 undervalued stocks based on cash flows.

- Boost your passive income by focusing on companies consistently delivering strong yields through these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives