- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS) Valuation in Focus After Analyst Upgrade and ESPN Streaming Launch

Reviewed by Simply Wall St

Walt Disney (DIS) has just grabbed the attention of investors, not only with a fresh upgrade in its analyst rating but also due to mounting optimism around its newly launched ESPN streaming service. The boost to a buy rating is largely the result of higher earnings estimate revisions, which can be a strong signal for stock movement. The debut of a dedicated ESPN streaming platform, featuring multiple subscription options and recent content deals, shows Disney is committed to capturing direct-to-consumer momentum in the fast-changing media landscape. This combination of analyst optimism and strategic execution could present interesting developments for investors in the coming months.

Looking back, Disney’s shares have experienced some swings recently. The stock fell nearly 5% over the past month, underperforming the broader market, though it remains significantly higher over the past year with a gain of more than 30%. Earlier in the year, management’s focus on integrating traditional and digital TV, along with ongoing content partnerships, contributed to positive sentiment. Now, short-term momentum appears to be stabilizing just as long-term investors assess the impact of Disney’s ESPN streaming initiative.

The question remains: with new catalysts and a recovery in investor optimism, is Disney trading at a bargain, or has the market already accounted for the company’s future growth?

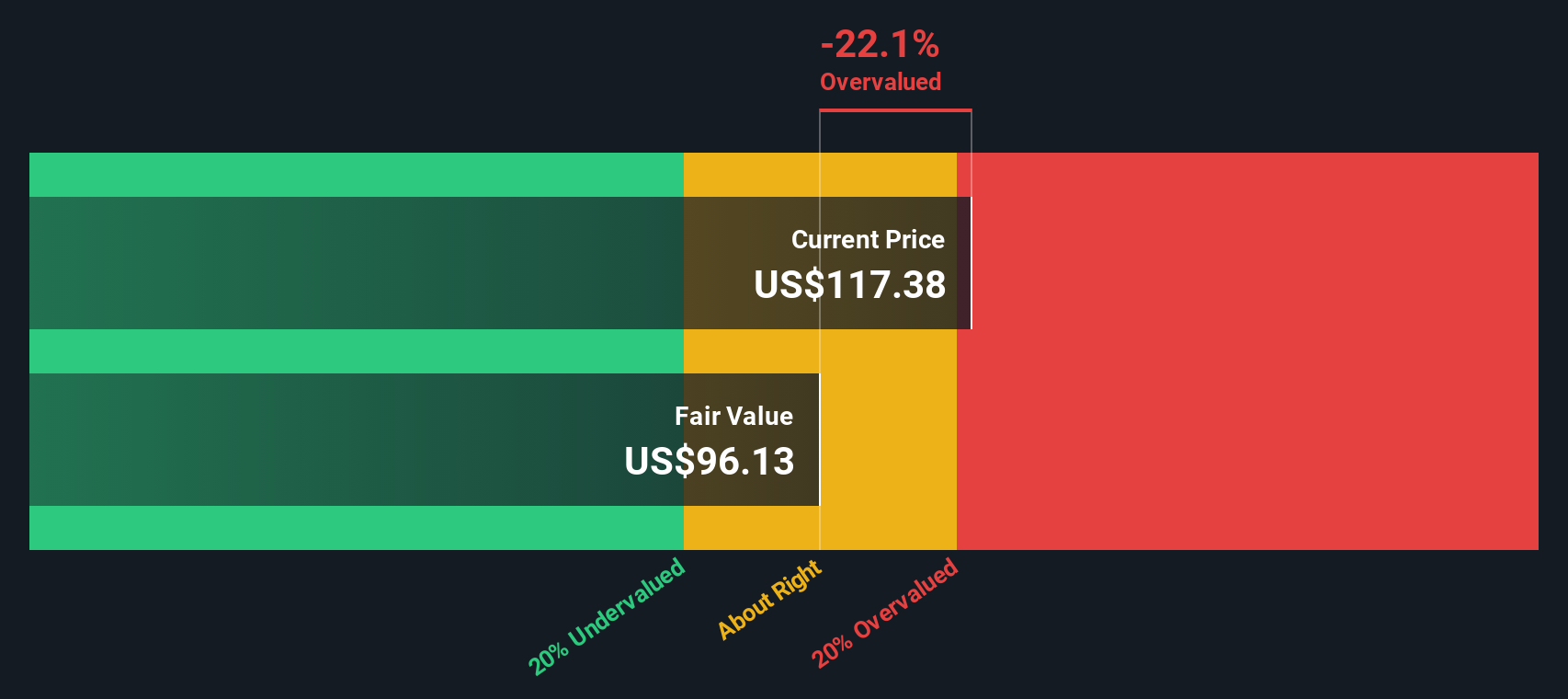

Most Popular Narrative: 23.9% Overvalued

The current fair value of Disney shares is debated, and according to the narrative by Bailey, the stock is considered overvalued based on a detailed cash flow and growth scenario.

The streaming wars are heating up, and Disney is facing formidable competition from the likes of Netflix, Amazon Prime Video, and HBO Max. To stay ahead, Disney has been investing heavily in original content, which is notably a high-cost endeavor. These increased production costs could put significant pressure on their profit margins over time.

Wondering what drives Bailey's bold call that Disney is trading above its true worth? It’s not just headline growth. The full narrative uncovers detailed projections about shrinking margins, a high discount rate, and future earnings rates that might surprise you. Disney’s parks, content wars, and new subscriber forecasts all play pivotal roles in this dramatic valuation story. Ready to see the assumptions that challenge the market’s optimism?

Result: Fair Value of $95.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, if Disney’s parks division outperforms or blockbuster franchises drive stronger streaming growth, these strengths could help address concerns about rising production and licensing costs. Find out about the key risks to this Walt Disney narrative.Another View: SWS DCF Model Tells a Different Story

While the narrative methodology paints Disney as overvalued, our DCF model approaches the company's prospects differently. This fundamental tool finds a result that stands apart from the first view. Could the market be missing something? Or is this just a matter of perspective?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Walt Disney Narrative

If you would like to dive into the numbers yourself or shape your own viewpoint, you can easily build your own narrative in just a few minutes. So why not do it your way?

A great starting point for your Walt Disney research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your investment journey to just one stock. Now is the time to uncover unique opportunities tailored to your strategy. Use the Simply Wall Street Screener to enhance your portfolio with standout companies and trends you might otherwise miss.

- Discover real income potential by exploring stable companies offering dividend stocks with yields > 3% and provide your portfolio with a solid source of yield.

- Participate in the innovation wave by identifying trailblazers in healthcare with the latest healthcare AI stocks and invest in the future of medical technology.

- Take advantage of valuable opportunities by targeting undervalued stocks based on cash flows and find quality stocks trading below their intrinsic worth before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives