- United States

- /

- Life Sciences

- /

- OTCPK:INIS

Zedge And 2 Other US Penny Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

U.S. stocks recently experienced a downturn as inflation data came in hotter than expected, leading to increased Treasury yields and concerns over the Federal Reserve's monetary policy. In such a fluctuating market, investors often look for opportunities that balance risk with potential growth, which is where penny stocks come into play. Despite their historical connotations, penny stocks—typically representing smaller or newer companies—can offer intriguing prospects for those seeking affordable entry points combined with solid financial fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.870625 | $6.51M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $131.87M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.2M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $89.48M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $46.86M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.71 | $48.23M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $25.54M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8876 | $80.72M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $388.67M | ★★★★☆☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Zedge (NYSEAM:ZDGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zedge, Inc. operates digital marketplaces and competitive games focused on user-generated content for self-expression, with a market cap of $40.45 million.

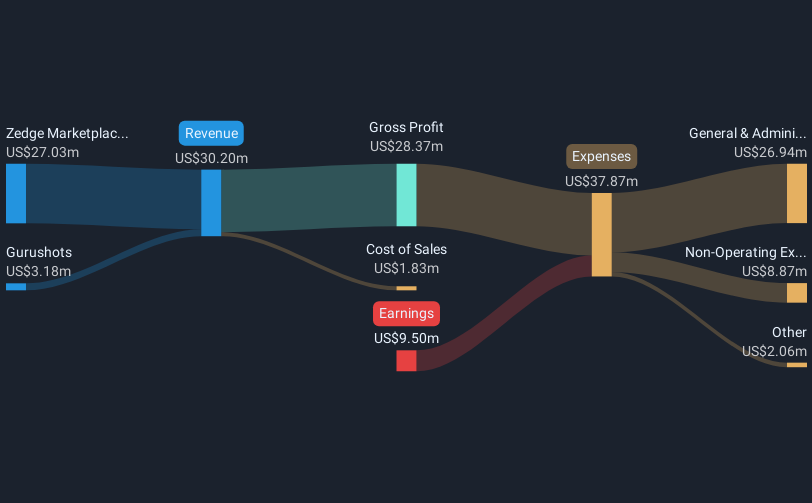

Operations: The company generates revenue through its Gurushots segment, contributing $3.18 million, and the Zedge Marketplace, which brings in $27.03 million.

Market Cap: $40.45M

Zedge, Inc., with a market cap of US$40.45 million, operates in the digital marketplaces sector and has shown resilience despite being unprofitable. Recent earnings reported sales of US$7.19 million for Q1 2024, slightly up from the previous year, although net losses increased to US$0.339 million. The company's financial position is bolstered by short-term assets of US$24.2 million exceeding both short and long-term liabilities, while remaining debt-free with a positive cash flow runway over three years. Zedge's strategic enhancements to its marketplace could potentially drive future revenue growth amidst current volatility challenges.

- Click here to discover the nuances of Zedge with our detailed analytical financial health report.

- Examine Zedge's earnings growth report to understand how analysts expect it to perform.

Innovid (NYSE:CTV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Innovid Corp. operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $466.48 million.

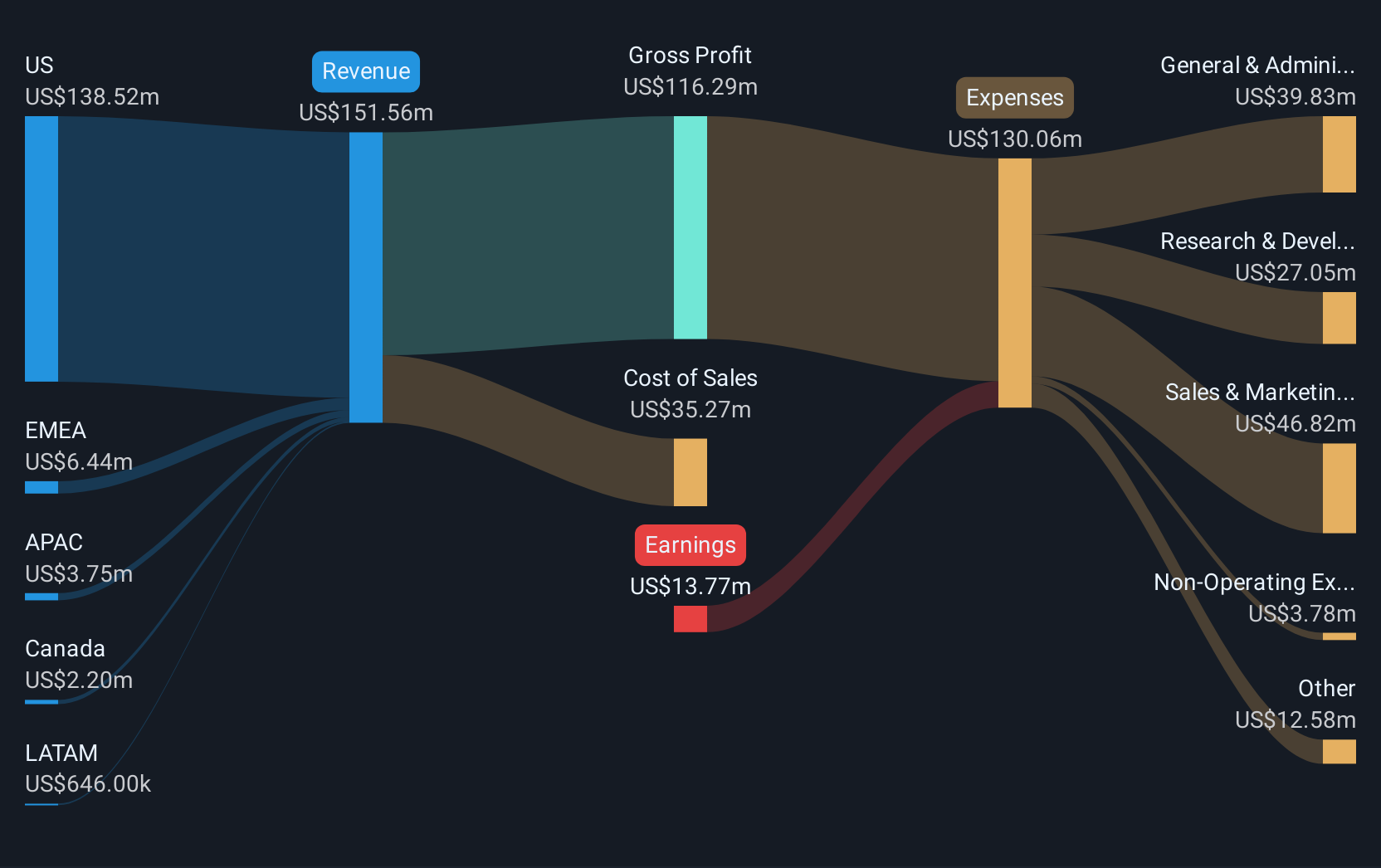

Operations: The company generates revenue of $151.56 million from its advertising and creative services segment.

Market Cap: $466.48M

Innovid Corp., with a market cap of US$466.48 million, operates in the ad tech industry and is currently unprofitable. Despite this, it maintains a strong financial position with short-term assets of US$83.4 million exceeding both its short and long-term liabilities. Innovid's recent partnership with IRIS.TV enhances its platform by integrating contextual targeting capabilities, potentially improving campaign ROI for advertisers. The company was recently acquired by Flashtalking for approximately $510 million, a move that aligns Innovid under Mediaocean's leadership while maintaining Zvika Netter as CEO of the combined organization to drive strategic growth initiatives forward.

- Jump into the full analysis health report here for a deeper understanding of Innovid.

- Explore Innovid's analyst forecasts in our growth report.

International Isotopes (OTCPK:INIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: International Isotopes Inc. manufactures and sells nuclear medicine calibration and reference standards, cobalt-60 products, sodium iodide I-131 drug products, and radiochemicals for clinical research and life sciences in the United States and internationally, with a market cap of $26.18 million.

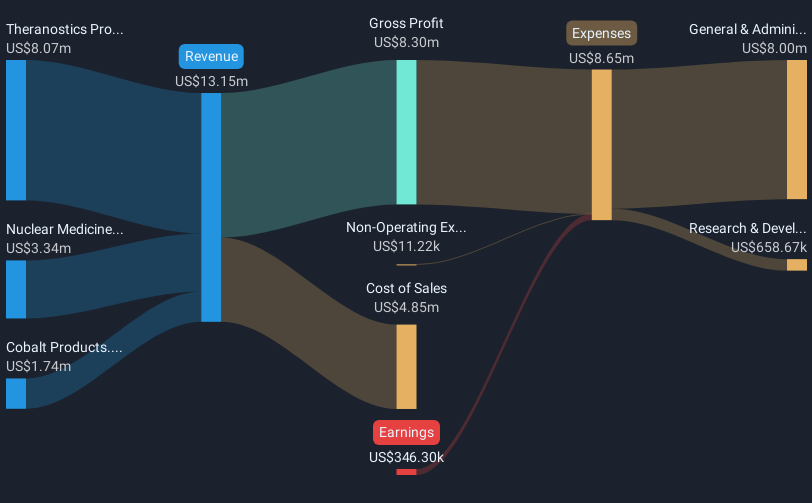

Operations: The company's revenue segments include Cobalt Products generating $1.74 million, Theranostics Products contributing $8.07 million, and Nuclear Medicine Standards (including Radiological Services) accounting for $3.34 million.

Market Cap: $26.18M

International Isotopes Inc., with a market cap of US$26.18 million, is navigating the penny stock landscape by expanding its operational footprint in Idaho Falls through strategic acquisitions and leases. This expansion aims to double its capacity, potentially benefiting all business segments, including Cobalt Products and Theranostics. While unprofitable with negative return on equity and high net debt to equity ratio (89.5%), the company has improved from negative shareholder equity five years ago and maintains a cash runway exceeding three years if current free cash flow levels are sustained. Recent earnings show reduced losses year-over-year, indicating potential financial stabilization efforts.

- Get an in-depth perspective on International Isotopes' performance by reading our balance sheet health report here.

- Assess International Isotopes' previous results with our detailed historical performance reports.

Where To Now?

- Reveal the 717 hidden gems among our US Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:INIS

International Isotopes

Manufactures and sells nuclear medicine calibration and reference standards, cobalt-60 products, sodium iodide I-131 drug product, and radiochemicals for clinical research and life sciences in the United States and internationally.

Slight with questionable track record.

Market Insights

Community Narratives