- United States

- /

- Pharma

- /

- NasdaqGM:HROW

US Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the Dow Jones Industrial Average closing at a record high and major indices posting weekly gains, investors are increasingly focused on identifying promising opportunities in this thriving environment. In such a robust market, stocks of growth companies with high insider ownership can be particularly appealing due to their potential for alignment between management and shareholder interests, offering a compelling case for those looking to capitalize on current economic trends.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.5% | 31.5% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| BBB Foods (NYSE:TBBB) | 22.9% | 50.7% |

Let's dive into some prime choices out of the screener.

Harrow (NasdaqGM:HROW)

Simply Wall St Growth Rating: ★★★★★☆

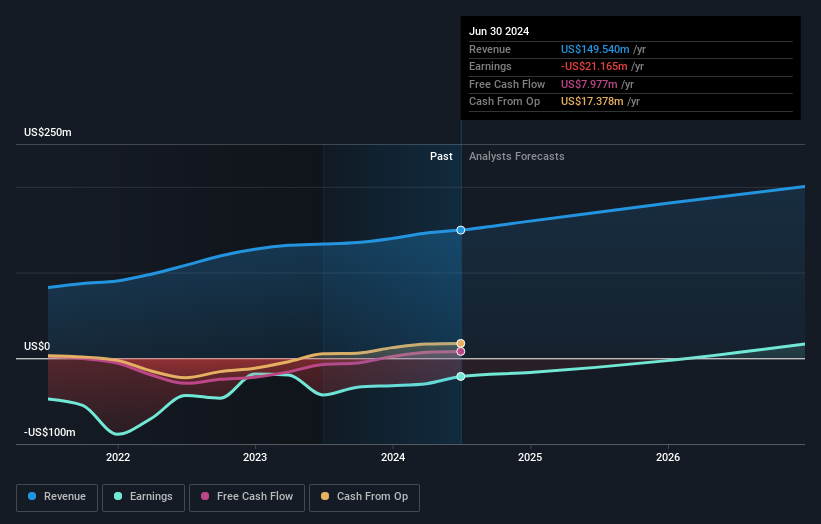

Overview: Harrow, Inc. is an eyecare pharmaceutical company focused on discovering, developing, and commercializing ophthalmic pharmaceutical products, with a market cap of $1.53 billion.

Operations: The company's revenue segments include $133.22 million from the discovery, development, and commercialization of innovative ophthalmic therapies and a segment adjustment of $35.92 million.

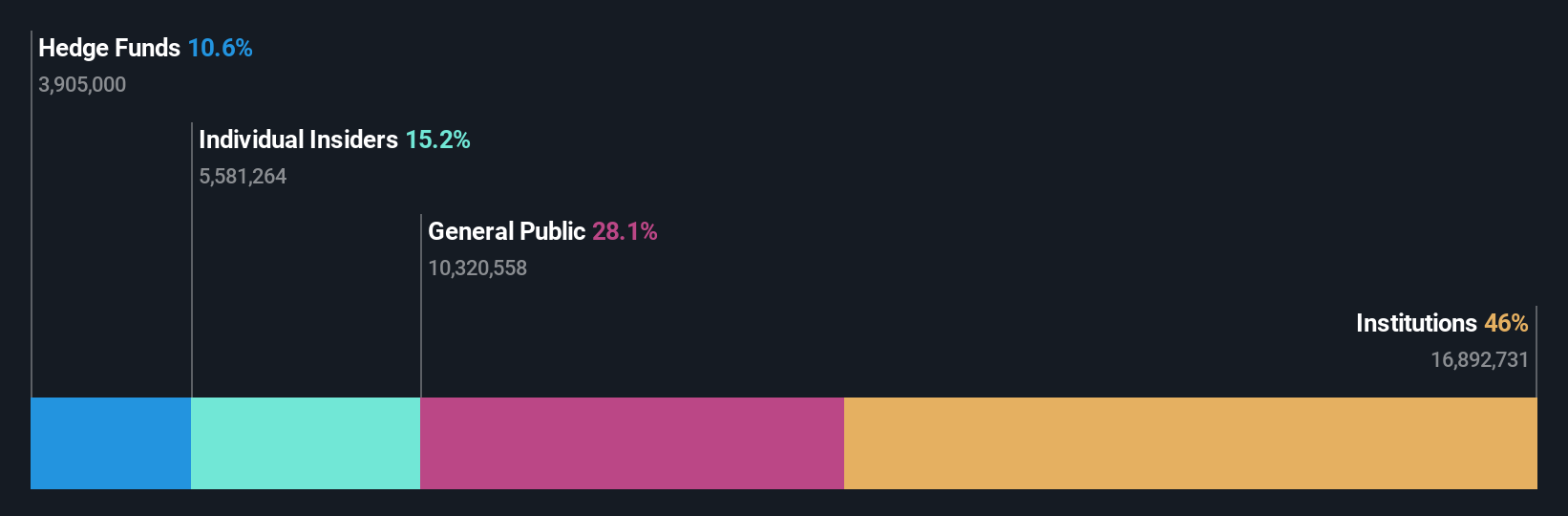

Insider Ownership: 14.3%

Harrow demonstrates significant growth potential with revenue forecasted to grow at 42.2% annually, outpacing the US market's average. Recent initiatives to enhance product accessibility and affordability, such as partnerships with GoodRx and Asembia, align with its strategic goals. Despite reporting a net loss of US$4.22 million in Q3 2024, Harrow's efforts to capture revenue slack and positive demand trends suggest a promising trajectory towards profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Harrow.

- Insights from our recent valuation report point to the potential undervaluation of Harrow shares in the market.

Innovid (NYSE:CTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovid Corp. operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $453.11 million.

Operations: The company generates revenue from its advertising and creative services segment, amounting to $151.56 million.

Insider Ownership: 10.7%

Innovid's recent acquisition by Flashtalking for approximately $510 million highlights its strategic value in the ad tech space. Despite a volatile share price, Innovid trades significantly below its estimated fair value and has demonstrated consistent earnings growth, with Q3 2024 net income reaching US$4.67 million. The company forecasts revenue growth of 9% annually, slightly above the US market average, and expects to achieve profitability within three years.

- Dive into the specifics of Innovid here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Innovid's current price could be inflated.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

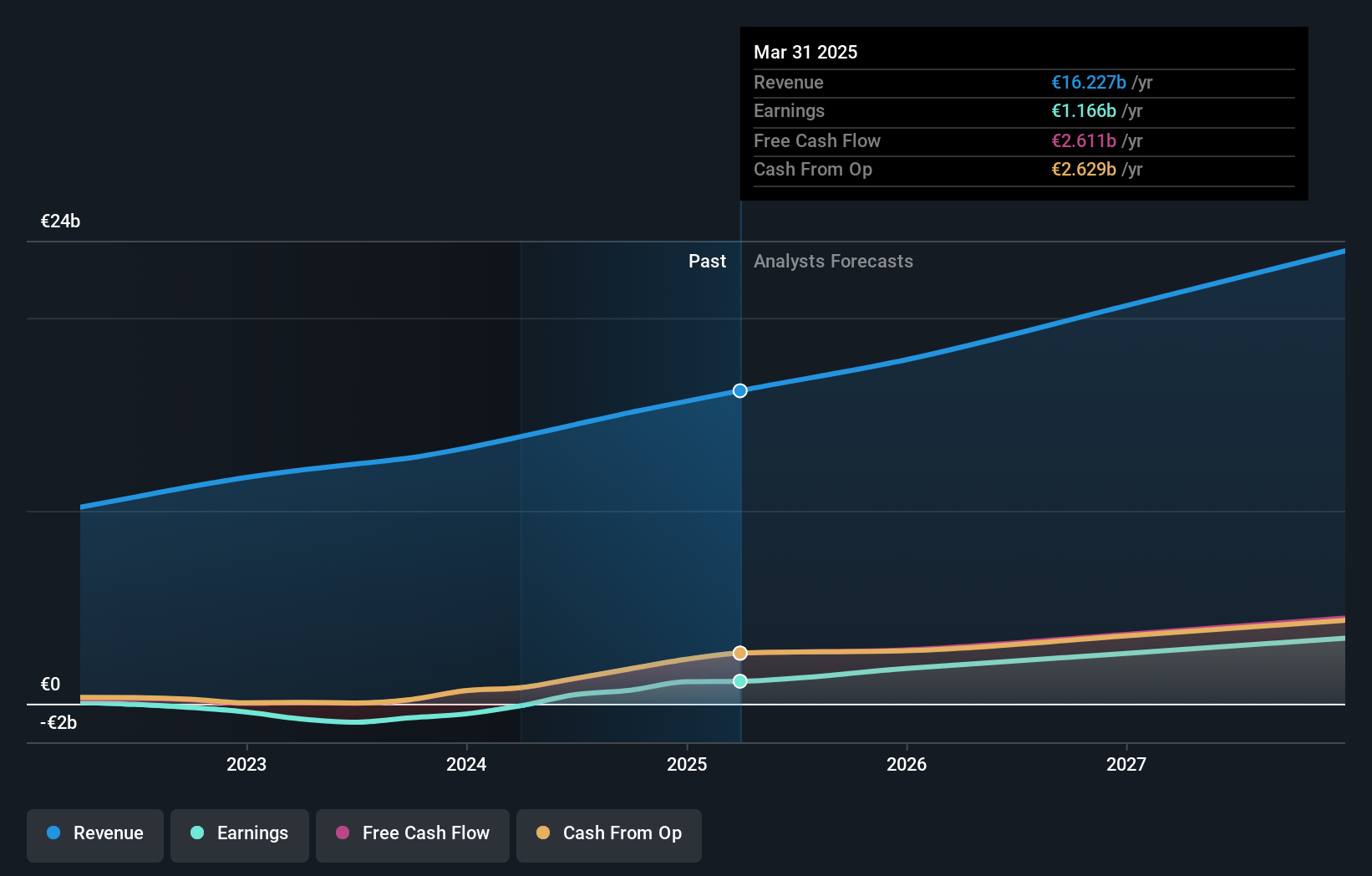

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $95.99 billion.

Operations: The company's revenue is derived from its Premium segment, generating €13.28 billion, and its Ad-Supported segment, contributing €1.82 billion.

Insider Ownership: 17.6%

Spotify Technology's recent partnership with Opera enhances its user reach by becoming the default streaming service in Opera One, potentially boosting engagement. The company reported significant revenue and net income growth for Q3 2024, with sales reaching €3.99 billion. Forecasts indicate Spotify's earnings and revenue will grow faster than the US market, despite past shareholder dilution. Earnings are expected to rise significantly over three years, though insider trading activity remains minimal recently.

- Navigate through the intricacies of Spotify Technology with our comprehensive analyst estimates report here.

- Our valuation report here indicates Spotify Technology may be overvalued.

Taking Advantage

- Click through to start exploring the rest of the 205 Fast Growing US Companies With High Insider Ownership now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and good value.