- United States

- /

- Entertainment

- /

- NasdaqGM:RSVR

Top Undervalued Small Caps With Insider Actions In The United States July 2024

Reviewed by Simply Wall St

As the first half of 2024 closes, the U.S. stock market has shown robust performance with the S&P 500 climbing nearly 15%. Despite this general uptrend, certain segments like small-cap stocks have not fully participated in the rally, as indicated by a modest increase in indices such as the Russell. In this context, identifying undervalued small-cap stocks with insider actions can be particularly compelling for investors looking to capitalize on potential growth opportunities that may have been overlooked in broader market movements.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.6x | 0.9x | 47.39% | ★★★★★★ |

| PCB Bancorp | 9.0x | 2.4x | 44.34% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 30.56% | ★★★★★☆ |

| AtriCure | NA | 2.6x | 49.22% | ★★★★★☆ |

| Titan Machinery | 3.7x | 0.1x | 29.89% | ★★★★★☆ |

| Franklin Financial Services | 9.1x | 1.8x | 36.83% | ★★★★☆☆ |

| Papa John's International | 20.4x | 0.7x | 35.48% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -154.60% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -139.07% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

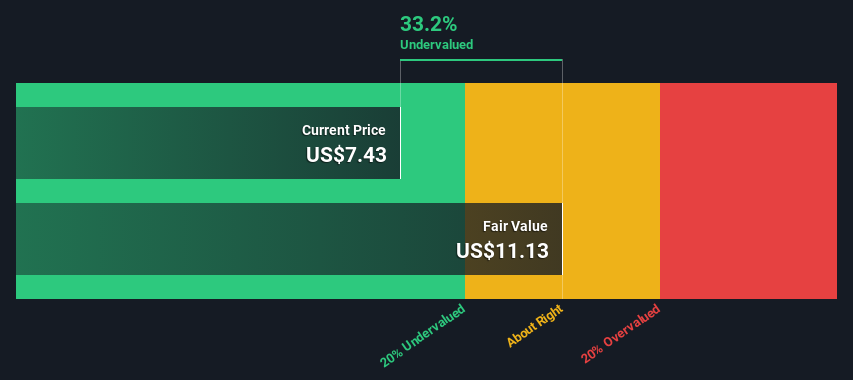

Reservoir Media (NasdaqGM:RSVR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Reservoir Media operates primarily in music publishing and recorded music, with a smaller segment in other related activities.

Operations: The company's revenue increased from $49.23 million in 2019 to $144.86 million by mid-2024, while its gross profit margin improved notably from 58.18% to 61.70% over the same period, reflecting enhanced efficiency in managing production costs relative to sales.

PE: 773.5x

Reservoir Media, reflecting a challenging fiscal year with net income dropping to US$0.64 million from US$2.54 million, still shows promise with projected revenue growth up to US$152 million by March 2025. Despite lower profit margins recently, insider confidence is evident as they recently purchased shares, signaling belief in the company's potential rebound. This action, coupled with strategic moves like a $100 million shelf registration for various securities, positions them intriguingly in their industry landscape for forward-looking investors.

- Click to explore a detailed breakdown of our findings in Reservoir Media's valuation report.

Evaluate Reservoir Media's historical performance by accessing our past performance report.

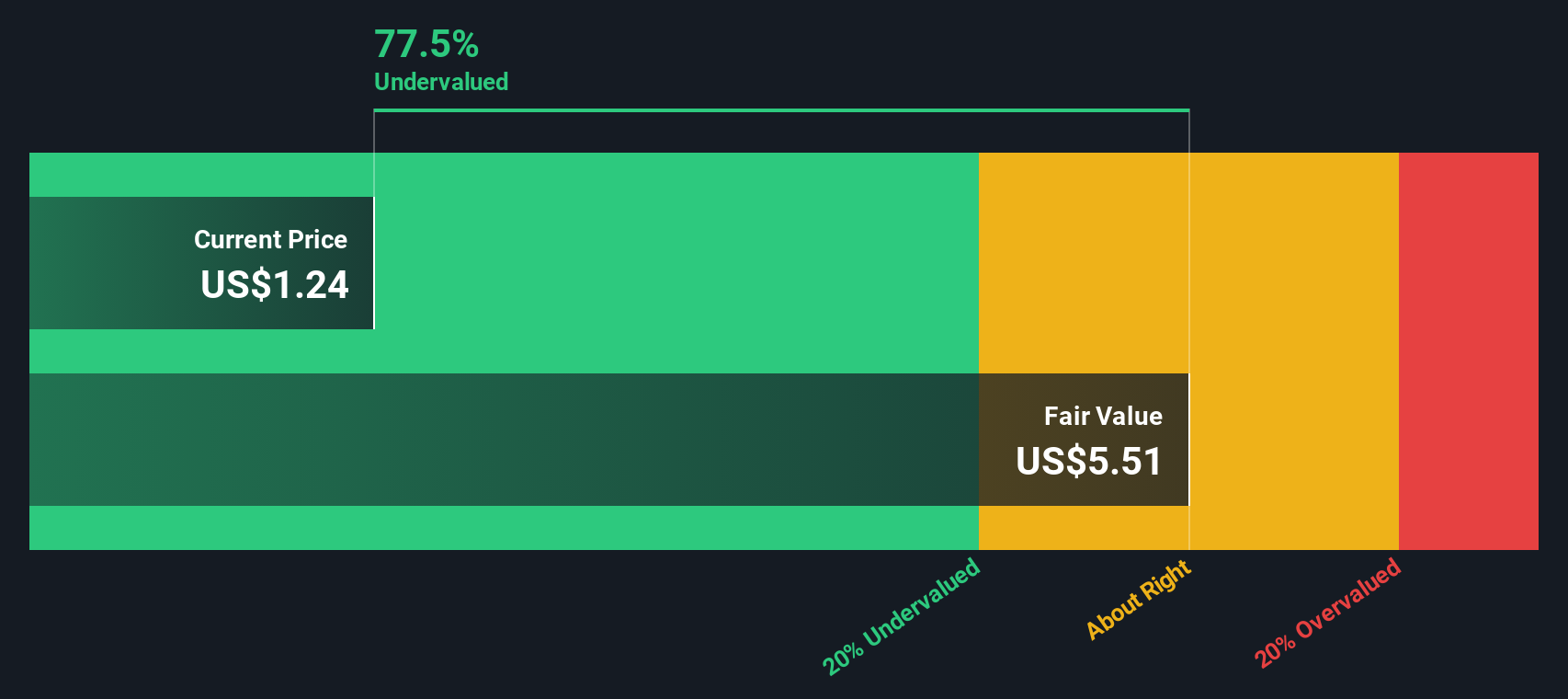

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company focused on the metals and mining sector, specifically in coal, with a market capitalization of approximately $699.84 million.

Operations: In the Metals & Mining - Coal sector, the company reported a revenue of $699.84 million, with a gross profit margin of 25.27% as of the most recent fiscal quarter. The net income for this period was $56.32 million, reflecting a net income margin of 8.05%.

PE: 13.2x

Amidst strategic leadership restructuring and auditor changes, Ramaco Resources recently showcased robust financial health with a notable increase in quarterly production by 13% and a solid cash dividend of US$0.1375 per share. Insider confidence is evident as they recently purchased shares, signaling belief in the company's prospects despite a slight dip in net profit margins from last year. With enhanced credit facilities supporting expansion, Ramaco stands out for its potential growth within the critical mineral sector.

- Click here and access our complete valuation analysis report to understand the dynamics of Ramaco Resources.

Examine Ramaco Resources' past performance report to understand how it has performed in the past.

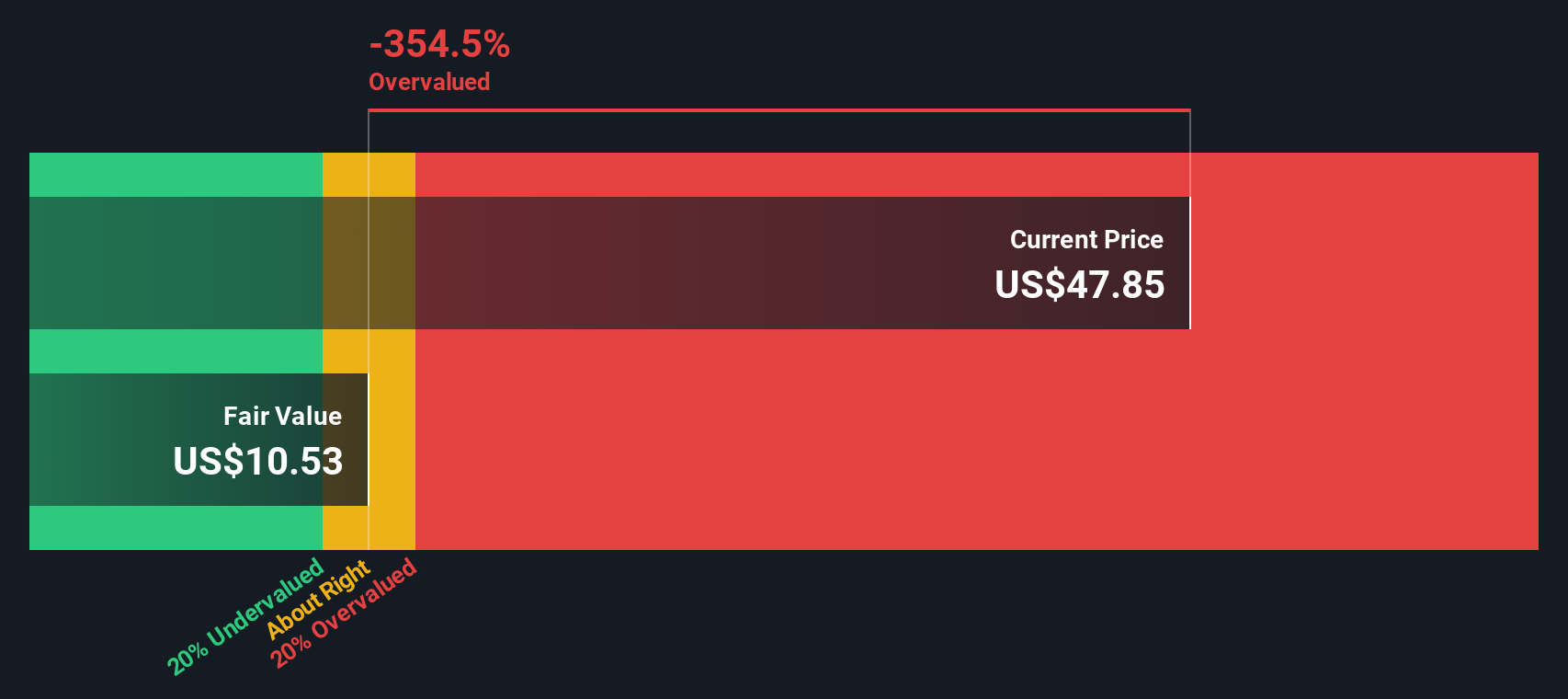

Clear Channel Outdoor Holdings (NYSE:CCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning airport ads, European and North American markets, with a market capitalization of approximately $0.65 billion.

Operations: Europe-north and America (excluding airports) are the primary revenue contributors, generating $630.45 million and $1.11 billion respectively, while Airports add another $334.74 million to the total income. The company's gross profit margin has shown fluctuations, with a notable figure of 47.32% in the latest period analyzed, indicating variability in cost management relative to sales revenue over time.

PE: -4.5x

Clear Channel Outdoor Holdings, recently bolstering its market position with a significant $64.74 million shelf registration, reflects a proactive stance in capital management amidst challenging financials, including a net loss increase in Q1 2024. Despite these hurdles and lacking profitability forecasts for the next three years, insider confidence remains evident as they continue to invest in company shares, underscoring belief in long-term potential. This aligns with their strategic adjustments to corporate governance aimed at enhancing operational flexibility and protection under Delaware law.

Next Steps

- Gain an insight into the universe of 62 Undervalued Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RSVR

Fair value with moderate growth potential.