- United States

- /

- Media

- /

- NYSE:CABO

How Investors Are Reacting To Cable One (CABO) Sluggish Subscriber Growth and Projected Sales Decline

Reviewed by Sasha Jovanovic

- Recently, news highlighted that Cable One is facing sluggish subscriber trends and a projected sales decline, pointing to deteriorating business performance in the most recent quarter.

- An important insight is that continued operational and financial headwinds, especially from weakening subscriber growth, have amplified investor concerns regarding the company's outlook and risk profile.

- We'll examine how these slowing subscriber additions and anticipated revenue declines may reshape Cable One's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cable One Investment Narrative Recap

To be a shareholder in Cable One, an investor must believe in the potential for long-term broadband growth in rural and underserved regions, and trust that management can overcome recent subscriber weakness. The latest news confirming sluggish subscriber trends directly impacts the biggest short-term catalyst, broadband adoption rates, and heightens the main risk: intensified competition eroding the core base. For now, these subscriber and revenue setbacks remain highly material when weighing ongoing investment risk versus recovery potential.

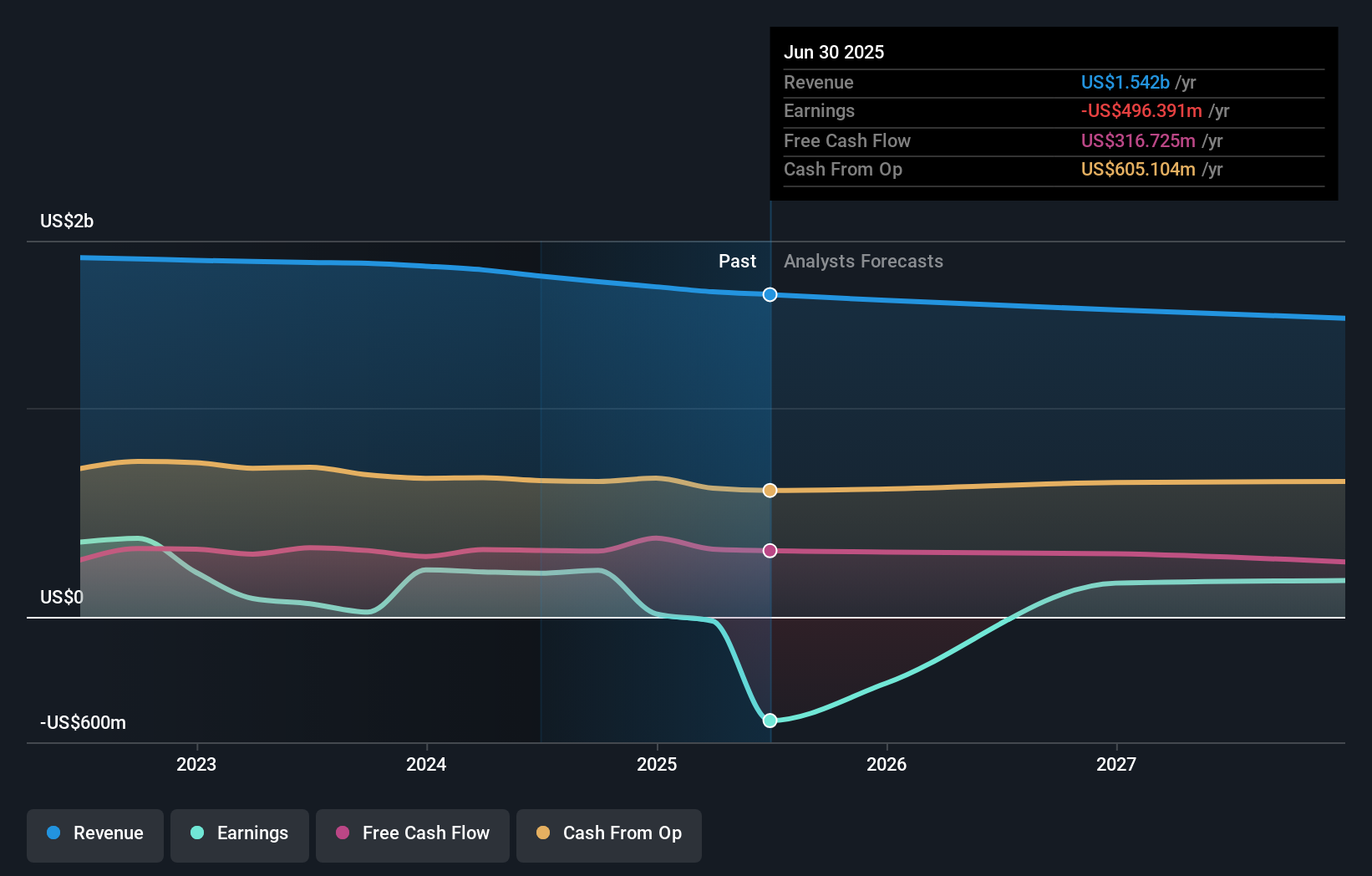

One of this quarter’s most relevant announcements is Cable One’s second-quarter financial report showing revenue declining to US$381.07 million, down from US$394.46 million the previous year, alongside a significant net loss. This result, following a similar drop in Q1, ties directly into concerns about subscriber churn and competitive pressure, putting immediate focus on the company’s ability to stabilize its customer base and restore profitability.

By contrast, investors should be aware of how elevated leverage from past acquisitions could...

Read the full narrative on Cable One (it's free!)

Cable One's outlook forecasts $1.4 billion in revenue and $152.3 million in earnings by 2028. This scenario assumes revenues will decline at a rate of 2.6% per year and marks a $648.7 million improvement in earnings from the current level of -$496.4 million.

Uncover how Cable One's forecasts yield a $213.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community pegged Cable One’s fair value from US$213.25 to US$381.98 per share. These estimates precede the increased subscriber and revenue risks that could reshape the company’s earnings potential. Check out community-driven valuations and differing outlooks for deeper context.

Explore 2 other fair value estimates on Cable One - why the stock might be worth just $213.25!

Build Your Own Cable One Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cable One research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cable One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cable One's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CABO

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives