- United States

- /

- Media

- /

- NYSE:CABO

Cable One, Inc.'s (NYSE:CABO) Popularity With Investors Under Threat As Stock Sinks 45%

The Cable One, Inc. (NYSE:CABO) share price has fared very poorly over the last month, falling by a substantial 45%. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

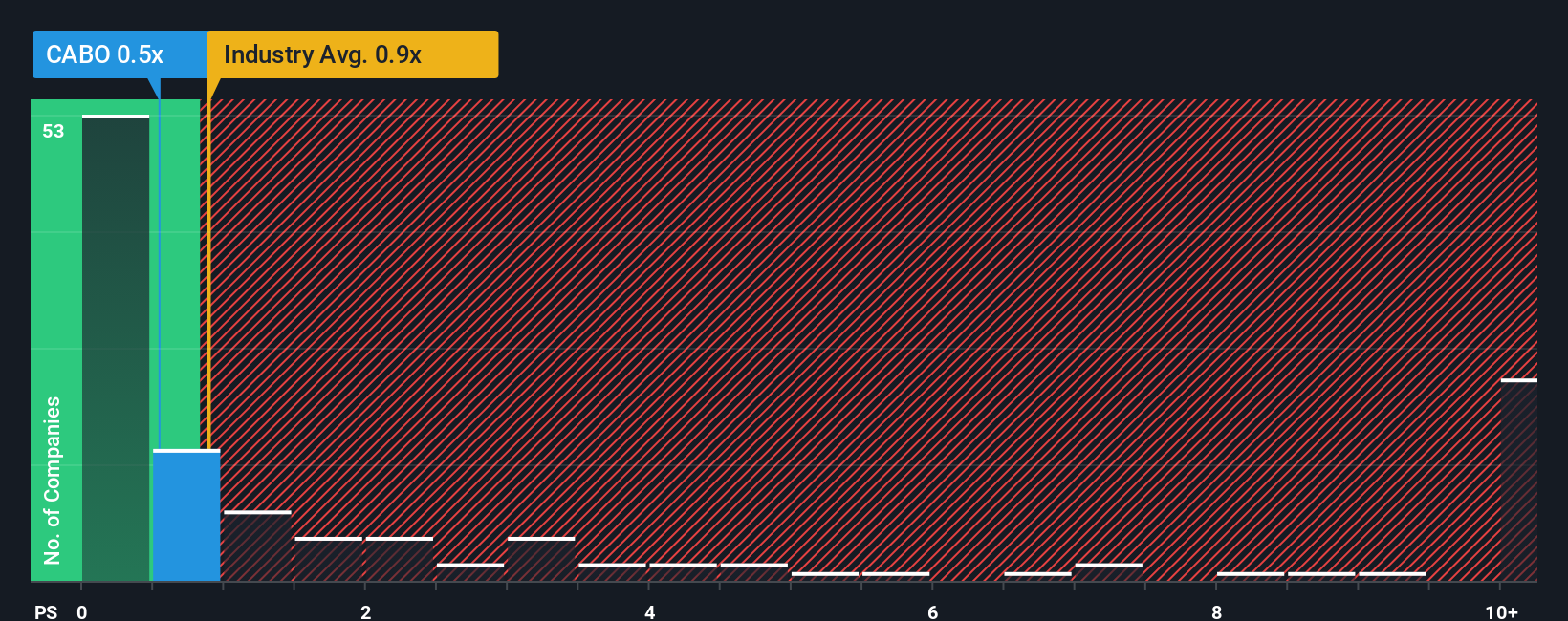

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Cable One's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Media industry in the United States is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Cable One

What Does Cable One's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cable One's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cable One.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Cable One would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. As a result, revenue from three years ago have also fallen 8.0% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.5% per annum during the coming three years according to the six analysts following the company. With the industry predicted to deliver 3.0% growth each year, that's a disappointing outcome.

With this information, we find it concerning that Cable One is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Cable One's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Cable One currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Cable One has 2 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of Cable One's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CABO

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives