- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GTM

The past one-year earnings decline for ZoomInfo Technologies (NASDAQ:ZI) likely explains shareholders long-term losses

Even the best stock pickers will make plenty of bad investments. Anyone who held ZoomInfo Technologies Inc. (NASDAQ:ZI) over the last year knows what a loser feels like. The share price is down a hefty 59% in that time. Because ZoomInfo Technologies hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 17% in about a quarter. That's not much fun for holders.

While the stock has risen 8.3% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for ZoomInfo Technologies

While ZoomInfo Technologies made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

ZoomInfo Technologies grew its revenue by 47% over the last year. That's a strong result which is better than most other loss making companies. In contrast the share price is down 59% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

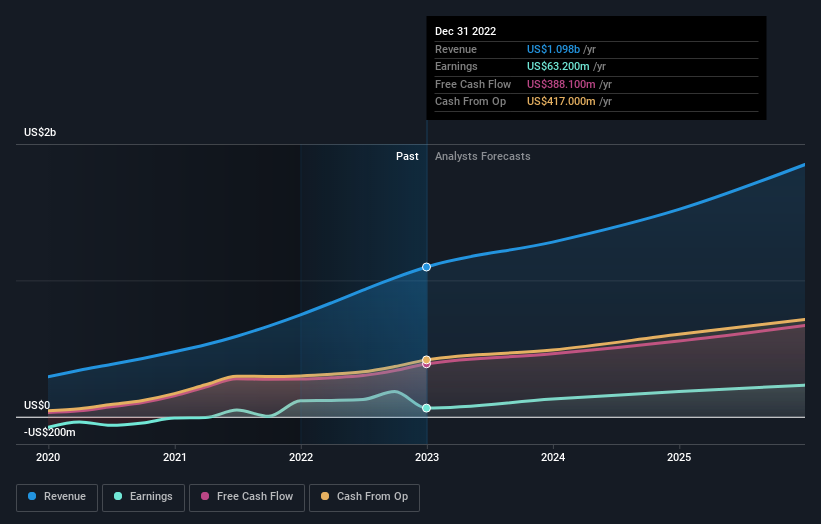

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think ZoomInfo Technologies will earn in the future (free profit forecasts).

A Different Perspective

ZoomInfo Technologies shareholders are down 59% for the year, even worse than the market loss of 10%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 17% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for ZoomInfo Technologies that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if ZoomInfo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTM

ZoomInfo Technologies

Provides go-to-market intelligence and engagement platform for sales, marketing, operations, and recruiting professionals in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026