- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:JOYY

JOYY Inc.'s (NASDAQ:YY) Prospects Need A Boost To Lift Shares

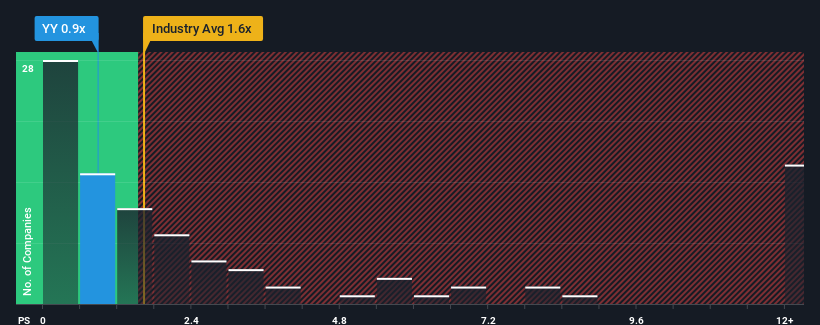

With a price-to-sales (or "P/S") ratio of 0.9x JOYY Inc. (NASDAQ:YY) may be sending bullish signals at the moment, given that almost half of all the Interactive Media and Services companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for JOYY

What Does JOYY's Recent Performance Look Like?

JOYY could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think JOYY's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as JOYY's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.8%. This means it has also seen a slide in revenue over the longer-term as revenue is down 49% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.2% per annum over the next three years. That's shaping up to be materially lower than the 12% per year growth forecast for the broader industry.

With this information, we can see why JOYY is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On JOYY's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that JOYY maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 1 warning sign for JOYY that you need to be mindful of.

If you're unsure about the strength of JOYY's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade JOYY, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:JOYY

JOYY

Operates social media platforms that offer users engaging and experience across various video-based social platforms.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives