- United States

- /

- Entertainment

- /

- NasdaqGS:WMG

Assessing Warner Music Group Stock After Recent Share Price Dip in 2025

Reviewed by Bailey Pemberton

If you have Warner Music Group on your radar, you are not alone. Investors weighing whether to hold, buy, or take profits know that stock picking is as much about gut instinct as it is about numbers. The recent moves in WMG’s price have certainly fueled the debate. After climbing to impressive highs over the last three years with a 47.5% return, shares have hit a bit of turbulence, down 4.6% in the last week and 3.1% through the last month, even as the music industry contends with evolving digital trends and shifting consumer appetites.

Of course, that doesn’t tell the whole story. Year-to-date, Warner Music Group is still sitting on a positive 4.3% gain, and in the past year, returns have added up to a respectable 7.7%. For anyone thinking about the long view, the five-year gain of 24.9% is even more reassuring, suggesting that despite short-term hiccups, there is a durable optimism about WMG’s role in a fast-changing industry. Recent price dips might represent risk reassessments as investors weigh potential competition and streaming dynamics, but they could also hint at unsung growth potential if the fundamentals hold up.

This brings us to what really matters in deciding what to do next: valuation. If we run Warner Music Group through six industry-standard checks to see if it is undervalued, the company gets a value score of 2 out of 6. It passes two undervalued benchmarks, but comes up short on the rest. But is that the whole truth? Next, we will explore the different valuation methods used, and reveal a smarter way to truly gauge Warner Music’s worth by the end of this article.

Warner Music Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Warner Music Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to present value. Essentially, this approach asks, "How much are all future cash streams from Warner Music Group worth in today's dollars?"

According to the latest figures, Warner Music Group (NasdaqGS:WMG) generated $455.75 million in Free Cash Flow over the last twelve months. Analysts project solid growth for the company, with forecasts suggesting Free Cash Flow will reach approximately $1.31 billion by 2029. While detailed analyst estimates usually cover the next five years, cash flows beyond that are extrapolated to extend the analysis further into the future.

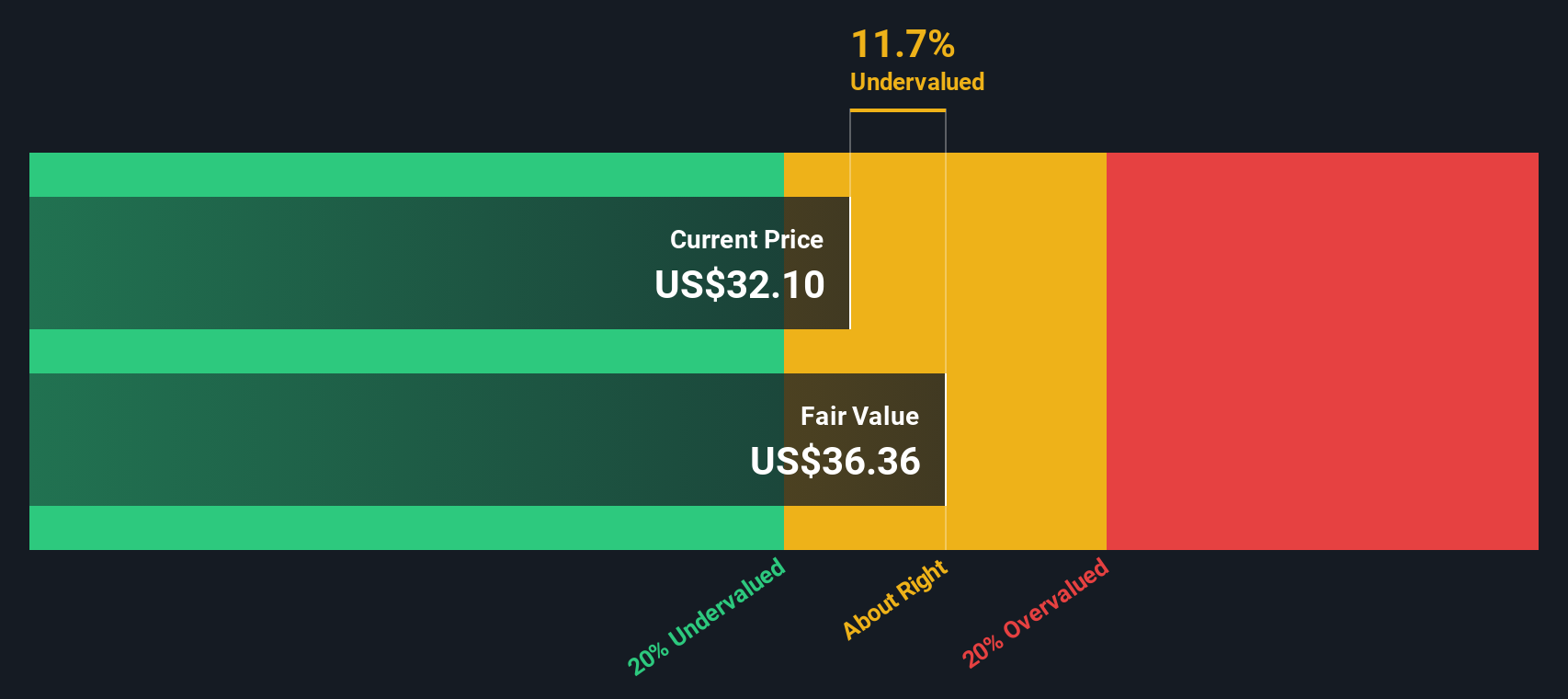

Based on the full ten-year projection, the DCF method calculates Warner Music Group's fair value at $36.41 per share. Compared to the current market price, this figure suggests WMG is trading at a 10.3% discount. This means investors are effectively paying less than the model's estimate of the company's intrinsic value, which may indicate an opportunity.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Warner Music Group is undervalued by 10.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Warner Music Group Price vs Earnings

When analyzing established, profitable companies like Warner Music Group, the Price-to-Earnings (PE) ratio is a valuable tool for assessing valuation. The PE ratio is widely used because it relates the company's stock price to its actual earnings performance, offering a quick sense of how the market values each dollar of profit the business generates.

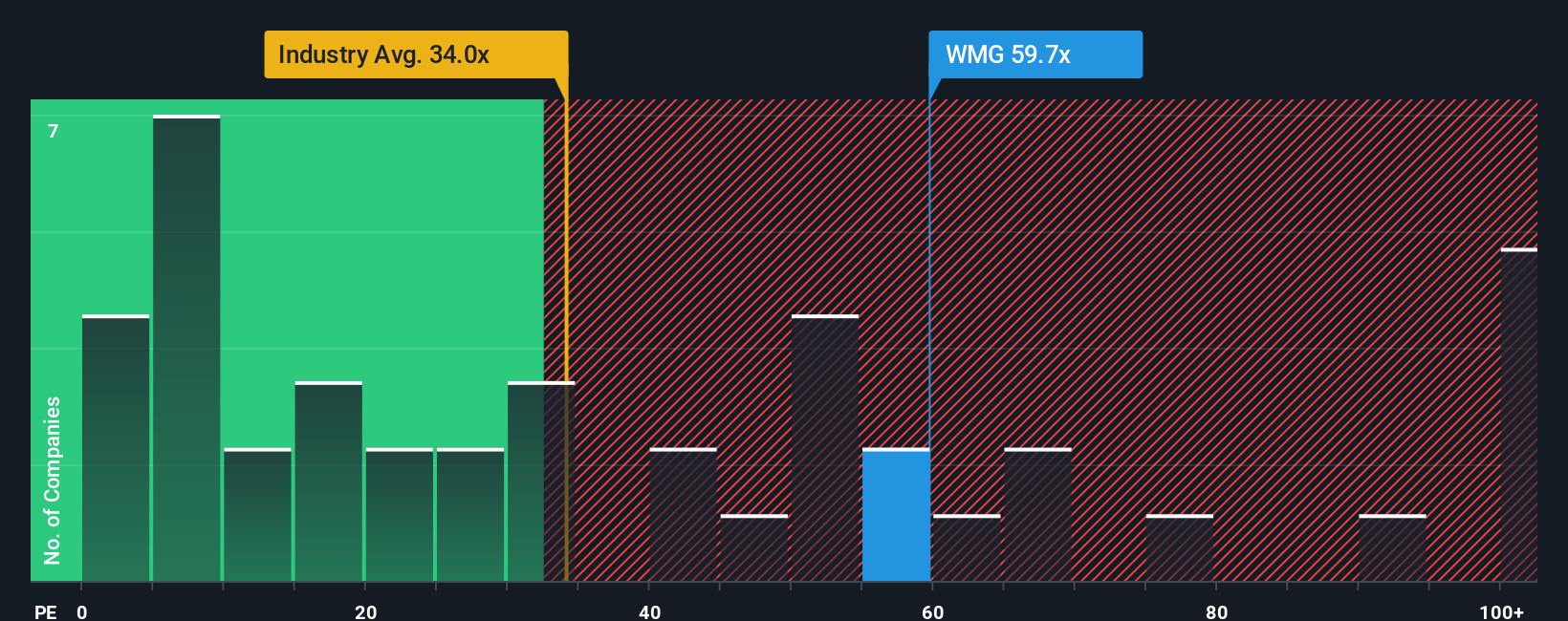

It's important to remember that what qualifies as a "normal" or "fair" PE ratio depends on factors such as growth expectations and risk. Fast-growing companies or those with lower perceived risk often command higher PE ratios, while slower growers or riskier firms might trade at lower multiples. Comparing Warner Music Group's current PE ratio of 58.1x to the industry average of 28.2x shows that the stock is trading well above the sector norm. It is also slightly below its peer average of 65.6x, indicating some caution but still reflecting a relatively elevated valuation.

To make sense of these comparisons, Simply Wall St offers a proprietary "Fair Ratio," in this case 33.5x, which is tailored to Warner Music Group's unique growth prospects, profit margins, industry, market cap, and risk profile. This metric provides a more relevant benchmark than industry or peer averages because it holistically considers the company’s circumstances and outlook.

Comparing the Fair Ratio of 33.5x to Warner’s current PE of 58.1x suggests that shares are trading well above what would be expected given its fundamentals. This points to the stock being overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Warner Music Group Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, a dynamic combination of your beliefs about Warner Music Group’s business drivers, your forecasts for future revenue and profits, and your own estimate of fair value.

Instead of relying only on static ratios or consensus targets, Narratives connect the company's story to a set of financial forecasts, then calculate a Fair Value based on your outlook. This approach helps investors move beyond the numbers to the big picture: what you think will shape Warner Music's future, and what that means for its share price.

On Simply Wall St, Narratives are quick to create and easy to update, used by millions on the Community page to see different perspectives from other real investors. Whenever news breaks or earnings are released, Narratives update so your investment thesis is always current and relevant.

By comparing your Narrative’s Fair Value with the current Price, you'll know exactly when you think Warner Music Group offers an opportunity or a warning sign. For example, one Narrative expects the company’s global expansion, digital innovation, and operational efficiency to push Fair Value as high as $46.00 per share, while another highlights execution risks and concentrated revenue, putting Fair Value closer to $30.00. What’s your story?

Do you think there's more to the story for Warner Music Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warner Music Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMG

Warner Music Group

Operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives