- United States

- /

- Entertainment

- /

- NasdaqGS:WBD

Warner Bros. Discovery (NasdaqGS:WBD) Jumps 15% Over Last Month

Reviewed by Simply Wall St

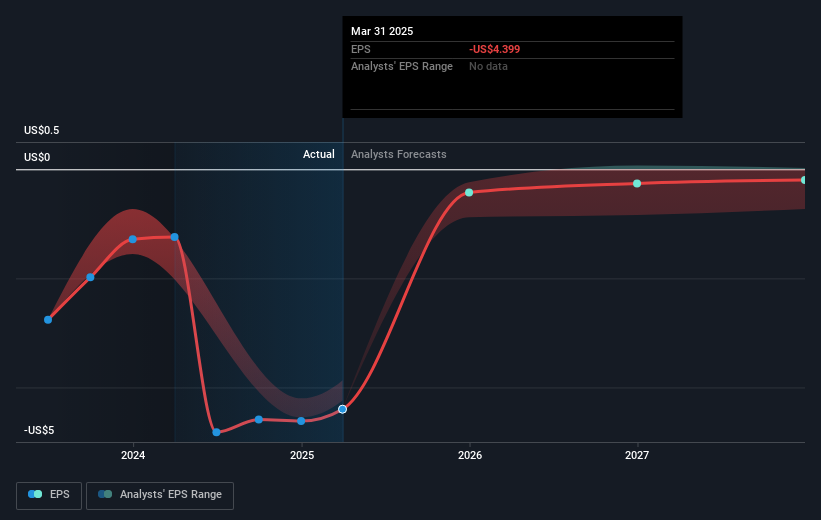

Warner Bros. Discovery (NasdaqGS:WBD) experienced a 15% increase in share price over the last month, amid ongoing M&A rumors and a recent earnings announcement. The ongoing discussions regarding a potential acquisition of BT Group's stake in TNT Sports and the company's narrowing net losses, despite a revenue decline, may have influenced investor sentiment. In a market shaped by strong Nvidia earnings and fluctuating trade policies, these developments likely complemented broader market trends, contributing to Warner Bros. Discovery's positive trajectory within a stable equity environment.

We've spotted 1 risk for Warner Bros. Discovery you should be aware of.

The recent 15% increase in Warner Bros. Discovery's share price, driven by acquisition rumors and narrowing net losses, has potentially brought renewed attention to the company's strategic goals. The narrative suggests that its ambitions in international expansion and greater integration of sports and news could significantly enhance subscriber engagement and direct-to-consumer revenue. This aligns with the company's forecast for reaching 150 million subscribers by 2026, which analysts anticipate will increase revenue and EBITDA. However, despite these developments, challenges in the television sector and rising costs related to sports rights may impact earnings growth in the near term.

Over the past year, Warner Bros. Discovery's total shareholder return, including share price and dividends, was 30.81%. Over a comparable period, the company's share performance shows a disparity when compared to the broader market and US Entertainment industry, which saw a return of 11.5% and 58.5%, respectively. This suggests that while the company has performed relatively well, there is room for improvement and potential for further growth.

The recent news regarding potential acquisitions and restructuring could influence future revenue and earnings forecasts, with analysts expecting a 1% annual growth in revenue contrary to an 8.6% market growth. With current earnings at US$10.80 billion, there is significant pressure to achieve better results. The share price is currently US$8.43, indicating a 36.1% discount to the consensus analyst price target of US$13.19. This gap highlights the potential upside if the company succeeds in its strategic goals and addresses the ongoing financial challenges effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warner Bros. Discovery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBD

Warner Bros. Discovery

Operates as a media and entertainment company worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives