- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:VMEO

Should Vimeo’s (VMEO) AI-Powered Upgrade and Earnings Miss Shape Investors’ Long-Term Perspective?

Reviewed by Sasha Jovanovic

- Vimeo recently unveiled a major update to its video platform, introducing advanced AI-powered creative tools and collaborative features at its second annual REFRAME conference in New York, while also reporting third quarter earnings showing sales of US$105.76 million and a shift to a net loss.

- This combination of transformative platform enhancements and subdued financial performance highlights both the company's push for innovation and the operational pressures faced during this transitional period.

- We'll explore how the rollout of AI-powered video capabilities at REFRAME could reshape Vimeo's longer-term investment narrative and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Vimeo Investment Narrative Recap

To be a Vimeo shareholder today, you need to believe the company's push into AI-powered video tools will ultimately outpace current subscriber and revenue pressures, with innovation driving meaningful adoption. While the REFRAME conference showcased ambitious new features, these announcements do not materially offset the biggest near-term catalyst, proving that product rollouts can halt or reverse subscriber and enterprise churn, and do little to mitigate the core risk of slow underlying growth masked by prior price increases.

The introduction of Vimeo’s next-generation AI platform at REFRAME is the most relevant update, highlighting efforts to transform passive video libraries into interactive, searchable assets for businesses and creators. This evolution aims to broaden Vimeo’s value proposition for enterprise customers but comes at a time when financial discipline and meaningful customer acquisition are crucial for stabilizing recurring revenue.

Yet, when the excitement of new features fades, investors should pay close attention to whether recurring revenue growth is truly sustainable in the face of...

Read the full narrative on Vimeo (it's free!)

Vimeo's narrative projects $493.0 million revenue and $36.5 million earnings by 2028. This requires 5.9% yearly revenue growth and a $23.6 million earnings increase from $12.9 million today.

Uncover how Vimeo's forecasts yield a $7.23 fair value, a 7% downside to its current price.

Exploring Other Perspectives

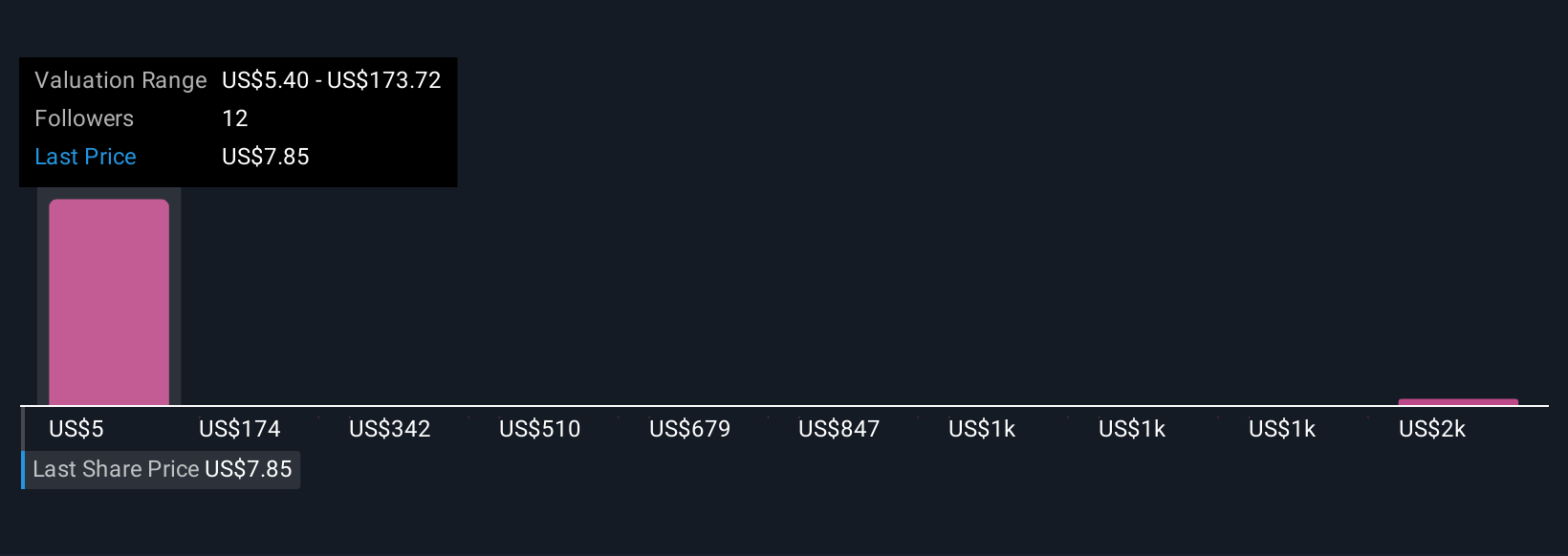

Four fair value opinions from the Simply Wall St Community range from US$5.40 to a striking US$1,688.63 per share. Even with this staggering diversity, the risk remains that if innovation fails to drive real subscriber or enterprise retention, future revenue could remain under pressure. Explore how your view compares with these varied perspectives.

Explore 4 other fair value estimates on Vimeo - why the stock might be worth 31% less than the current price!

Build Your Own Vimeo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vimeo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vimeo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vimeo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VMEO

Vimeo

Provides video software solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)