- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive Software's (NASDAQ:TTWO) investors will be pleased with their respectable 51% return over the last year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Take-Two Interactive Software, Inc. (NASDAQ:TTWO) share price is 51% higher than it was a year ago, much better than the market return of around 20% (not including dividends) in the same period. So that should have shareholders smiling. Unfortunately the longer term returns are not so good, with the stock falling 25% in the last three years.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Take-Two Interactive Software

Take-Two Interactive Software isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

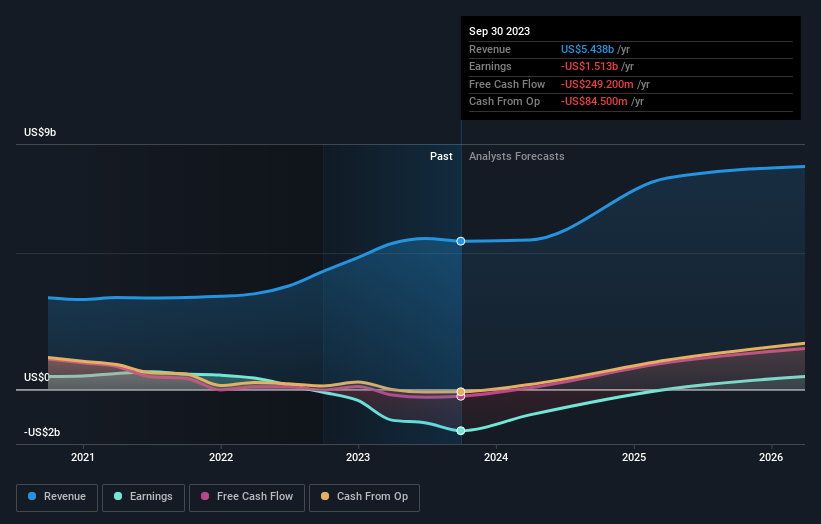

Take-Two Interactive Software grew its revenue by 26% last year. That's a fairly respectable growth rate. Buyers pushed the share price 51% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Take-Two Interactive Software will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Take-Two Interactive Software shareholders have received a total shareholder return of 51% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Take-Two Interactive Software better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Take-Two Interactive Software you should know about.

Of course Take-Two Interactive Software may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential very low.