- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Earnings Update: Take-Two Interactive Software, Inc. (NASDAQ:TTWO) Just Reported And Analysts Are Trimming Their Forecasts

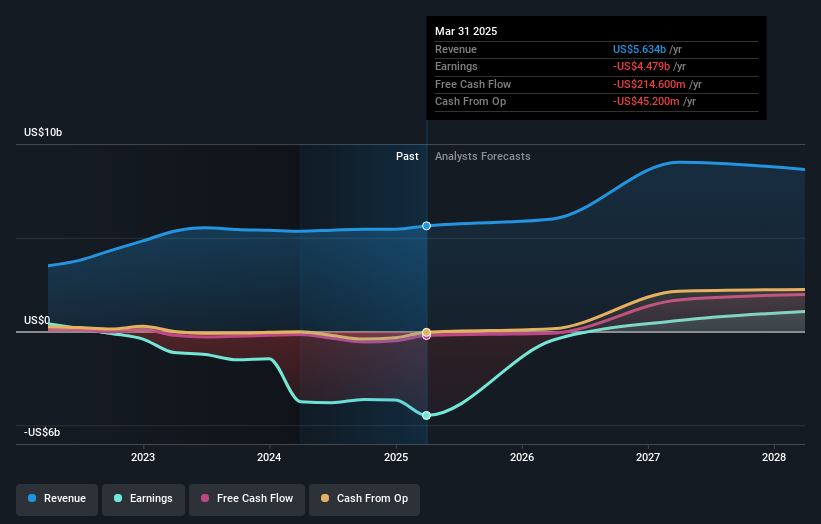

Take-Two Interactive Software, Inc. (NASDAQ:TTWO) shareholders are probably feeling a little disappointed, since its shares fell 2.7% to US$226 in the week after its latest annual results. It was a pretty bad result overall; while revenues were in line with expectations at US$5.6b, statutory losses exploded to US$25.58 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Following the latest results, Take-Two Interactive Software's 23 analysts are now forecasting revenues of US$6.00b in 2026. This would be an okay 6.5% improvement in revenue compared to the last 12 months. Per-share statutory losses are expected to explode, reaching US$2.55 per share. Before this earnings report, the analysts had been forecasting revenues of US$7.79b and earnings per share (EPS) of US$0.96 in 2026. So we can see that the consensus has become notably more bearish on Take-Two Interactive Software's outlook following these results, with a pretty serious reduction to next year's revenue estimates. Furthermore, they expect the business to be loss-making next year, compared to their previous calls for a profit.

View our latest analysis for Take-Two Interactive Software

The average price target lifted 7.5% to US$243, clearly signalling that the weaker revenue and EPS outlook are not expected to weigh on the stock over the longer term. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Take-Two Interactive Software at US$275 per share, while the most bearish prices it at US$137. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Take-Two Interactive Software's revenue growth will slow down substantially, with revenues to the end of 2026 expected to display 6.5% growth on an annualised basis. This is compared to a historical growth rate of 14% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 9.8% annually. Factoring in the forecast slowdown in growth, it seems obvious that Take-Two Interactive Software is also expected to grow slower than other industry participants.

The Bottom Line

The biggest low-light for us was that the forecasts for Take-Two Interactive Software dropped from profits to a loss next year. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Take-Two Interactive Software. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Take-Two Interactive Software analysts - going out to 2028, and you can see them free on our platform here.

You can also see whether Take-Two Interactive Software is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Investing in the future with RGYAS as fair value hits 228.23

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!