- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (NasdaqGM:TTD) Sees 12% Weekly Dip As Vivek Kundra Becomes COO

Reviewed by Simply Wall St

The recent leadership changes at Trade Desk (NasdaqGM:TTD), such as the appointment of Vivek Kundra as COO and Preetha Athrey as Director of Brand Marketing, coincide with a 12% decline in the company's stock price over the last week. The adoption of Unified ID 2.0 by a key client and the partnership with Cineverse aim to bolster operational efficiency and user trust, yet these positive developments occur amidst a broader market downturn. Global trade tensions have driven the Nasdaq into bear territory, with significant impacts on technology stocks, contributing to the overall pressure on Trade Desk's share price performance.

Buy, Hold or Sell Trade Desk? View our complete analysis and fair value estimate and you decide.

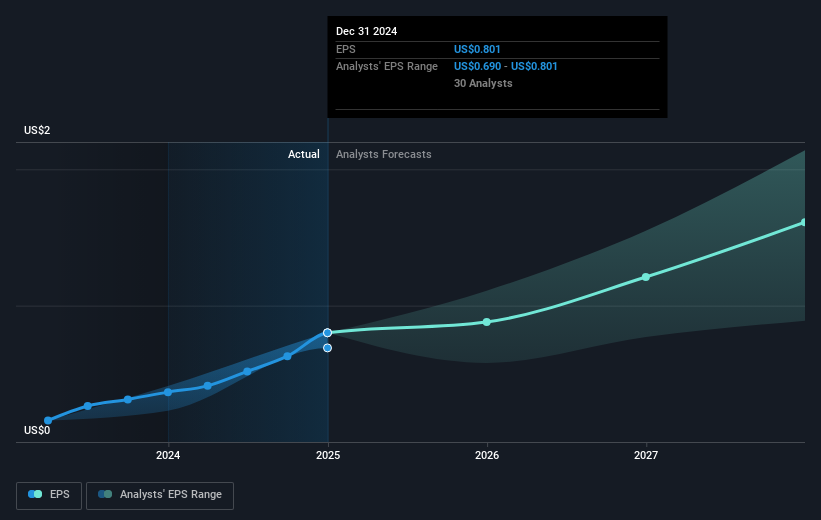

Over the last five years, The Trade Desk has delivered a total return of 129.60%, reflecting strong shareholder value amidst various industry challenges. This performance stands in contrast to its annual earnings growth of 11.6% during the same period, driven by strategic client partnerships and technological advancements. The February 2025 earnings report showed significant profitability improvement, with net income increasing to US$182.23 million. In early 2025, Trade Desk expanded its share buyback program, repurchasing 687,693 shares, illustrating confidence in its market position. However, a recent securities fraud class action lawsuit filed by Saxena White P.A. presents potential risks.

Recent growth is partly attributed to strategic partnerships, such as integrating OpenPath with Cineverse's C360 ad tech platform, enhancing transparency and ad-targeting prowess. This, alongside transitioning to the Kokai platform with robust AI capabilities, has fortified client relationships. Despite these advancements, Trade Desk stock underperformed the US Media industry over the past year, highlighting challenges in maintaining investor sentiment amidst broader market pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Trade Desk, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives