- United States

- /

- Media

- /

- NasdaqGM:TTD

Is Trade Desk a Bargain After Its 69% 2025 Share Price Slide?

Reviewed by Bailey Pemberton

- If you are wondering whether Trade Desk is a beaten down bargain or a value trap at current levels, this article will walk through what the numbers actually say so you can decide with more confidence.

- The stock has slid sharply, with shares down about 8.5% over the last week, 16.3% over the past month, and 68.9% year to date, which has dramatically reset expectations and risk perception around the name.

- Recently, the market has been digesting a mix of macro headwinds in digital advertising and heightened competition in programmatic ad tech, both of which have weighed heavily on sentiment toward Trade Desk. At the same time, ongoing industry shifts toward connected TV, retail media, and cookie less targeting continue to position the company at the center of long term structural trends that could matter far more than the latest sell off.

- On our framework, Trade Desk currently scores a 2 out of 6 on valuation checks, indicating it screens as undervalued on only a couple of key metrics. Next we will unpack what different valuation approaches are telling us about that score and, by the end, explore an additional way to think about what the stock may be worth.

Trade Desk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Trade Desk Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today, using a required rate of return.

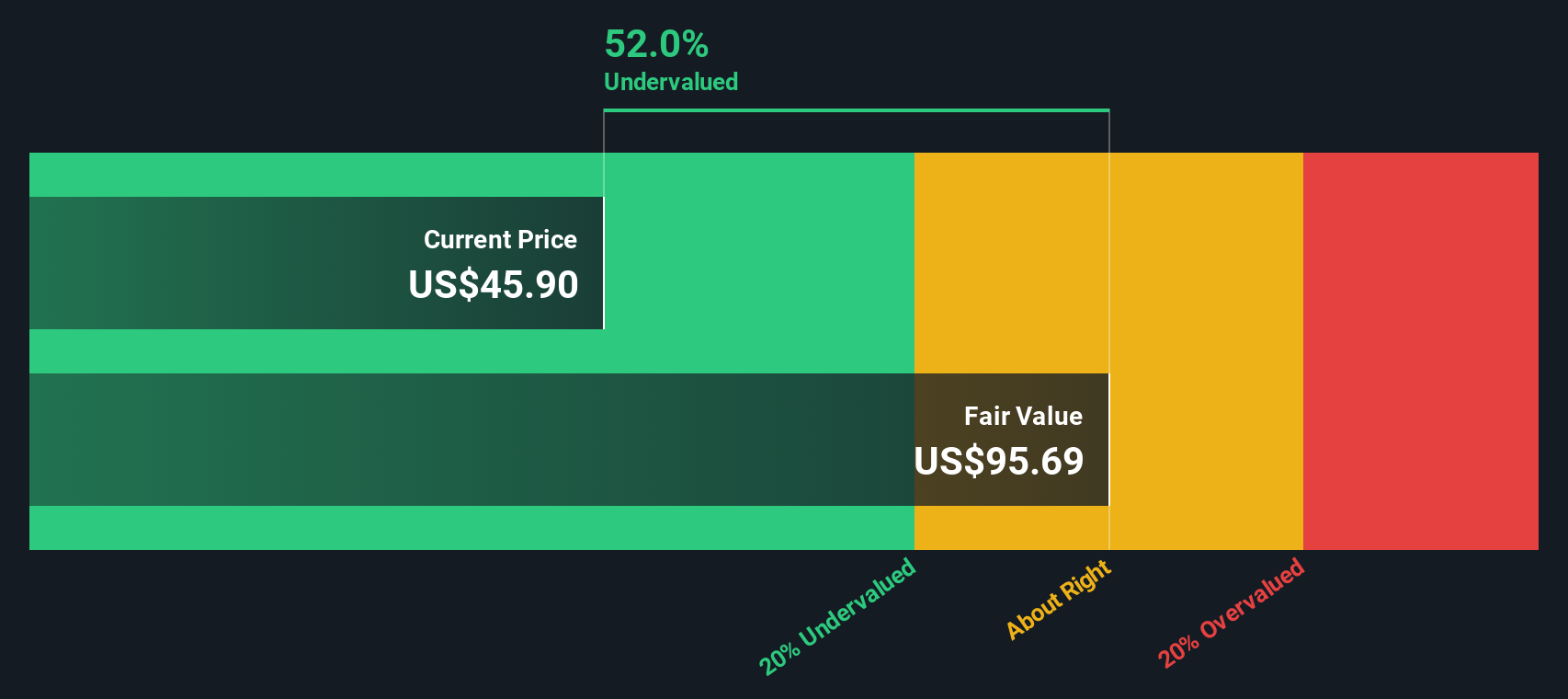

For Trade Desk, the model starts with last twelve month free cash flow of about $722.5 million. Analyst estimates and Simply Wall St extrapolations then project this to reach roughly $2.0 billion in free cash flow by 2035, with interim projections such as $1.38 billion in 2029. These cash flows are discounted back using a 2 stage Free Cash Flow to Equity approach to reflect both near term growth and a slower, more mature phase.

On this basis, the intrinsic value comes out at about $81.63 per share in $. Compared with the current market price, the DCF implies that the stock is trading at a 55.1% discount.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trade Desk is undervalued by 55.1%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Trade Desk Price vs Earnings

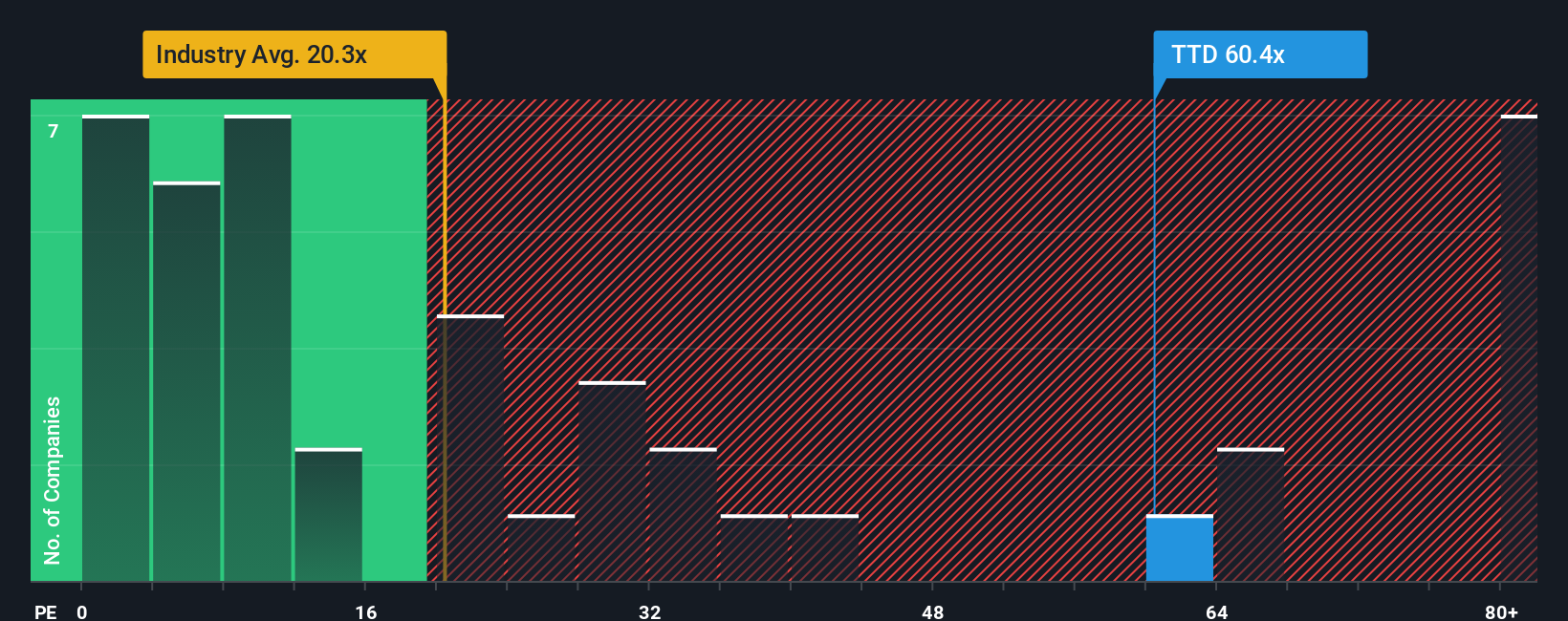

For a profitable business like Trade Desk, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or elevated risk usually mean a lower, more conservative multiple is appropriate.

Trade Desk currently trades on a PE of about 40.4x. That is well above the broader Media industry average of roughly 16.0x and also higher than the 33.9x average of its peer group, which at first glance can make the stock look expensive. However, Simply Wall St uses a proprietary Fair Ratio framework that estimates what a reasonable PE should be for Trade Desk, given its earnings growth outlook, profit margins, size, industry, and risk profile.

On this Fair Ratio basis, Trade Desk screens at around 26.2x. This means the current 40.4x multiple sits notably above what these fundamentals would justify. Because the market is paying a premium well beyond this fair level, the PE based view suggests the shares are trading on the rich side.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trade Desk Narrative

Earlier we mentioned that there is an even better way to understand valuation, and on Simply Wall St that starts with Narratives. You pair your view of Trade Desk’s story with a concrete forecast for revenue, earnings, and margins, link that forecast to a Fair Value estimate, and then compare it with today’s price to decide whether you think the stock is a buy or a sell, all inside an easy to use Community page that millions of investors already rely on. Each Narrative automatically updates as new news, earnings, or guidance comes in. The Trade Desk bull who believes that accelerating connected TV adoption, Kokai driven performance gains, and disciplined buybacks can justify a Fair Value near the top of the current analyst range around $135 will naturally reach different decisions from the skeptic who sees regulatory risk, intense competition, and growth uncertainty capping Fair Value closer to the low end near $34. Narratives lets you see both perspectives side by side and choose which one you think is more probable.

Do you think there's more to the story for Trade Desk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)