- United States

- /

- Media

- /

- NasdaqGM:TTD

A Fresh Look at Trade Desk (TTD) Valuation Following New AI Tools and DIRECTV Smart TV Partnership

Reviewed by Kshitija Bhandaru

The Trade Desk (TTD) is making moves that caught the market’s attention lately. By introducing Audience Unlimited to help advertisers use high-quality targeting data and announcing a strategic smart TV OS partnership with DIRECTV, TTD is adapting to shifting industry currents.

See our latest analysis for Trade Desk.

Despite rolling out new features like Audience Unlimited and partnering with DIRECTV on a smart TV OS, Trade Desk’s share price return year-to-date stands at a sharp -55.5%, reflecting continued challenges in digital ad spending. Still, momentum may be stabilizing given the strong 13.5% share price return in the past month. Over the last three years, total shareholder return remains slightly positive at 3.5%, a sign that investors are weighing recent setbacks against pockets of long-term promise.

If you’re searching for what’s next in tech and media, now’s a good time to check out the full list of innovative companies in our See the full list for free..

With the stock heavily discounted from its highs and new AI-driven products and partnerships taking shape, investors must decide whether The Trade Desk’s transformative bets signal an undervalued opportunity or if the market has already factored in future gains.

Most Popular Narrative: 24.7% Undervalued

Trade Desk’s fair value estimate according to the most popular narrative stands significantly above its latest closing price, suggesting a potential disconnect between market sentiment and future earnings outlook.

The continued rapid shift of ad spend from linear TV to connected TV (CTV) is driving significantly faster growth for Trade Desk's highest-margin channel. Deepened relationships with leading CTV and streaming content partners (Disney, Netflix, Roku, LG, etc.) position Trade Desk to capture an outsized share of the expanding premium digital video ad market, which should accelerate revenue and earnings growth as CTV penetration increases globally.

Want to know what’s propelling this premium valuation? The secret sauce: bold forecasts on revenue, profit margins, and a high multiple that rivals Silicon Valley’s favorites. Curious what makes analysts so confident? Dive in and find out which levers could pull shares dramatically higher.

Result: Fair Value of $69.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory challenges and intensifying competition from tech giants could quickly change the story if Trade Desk fails to meet escalating expectations.

Find out about the key risks to this Trade Desk narrative.

Another View: Multiples Paint a Pricier Picture

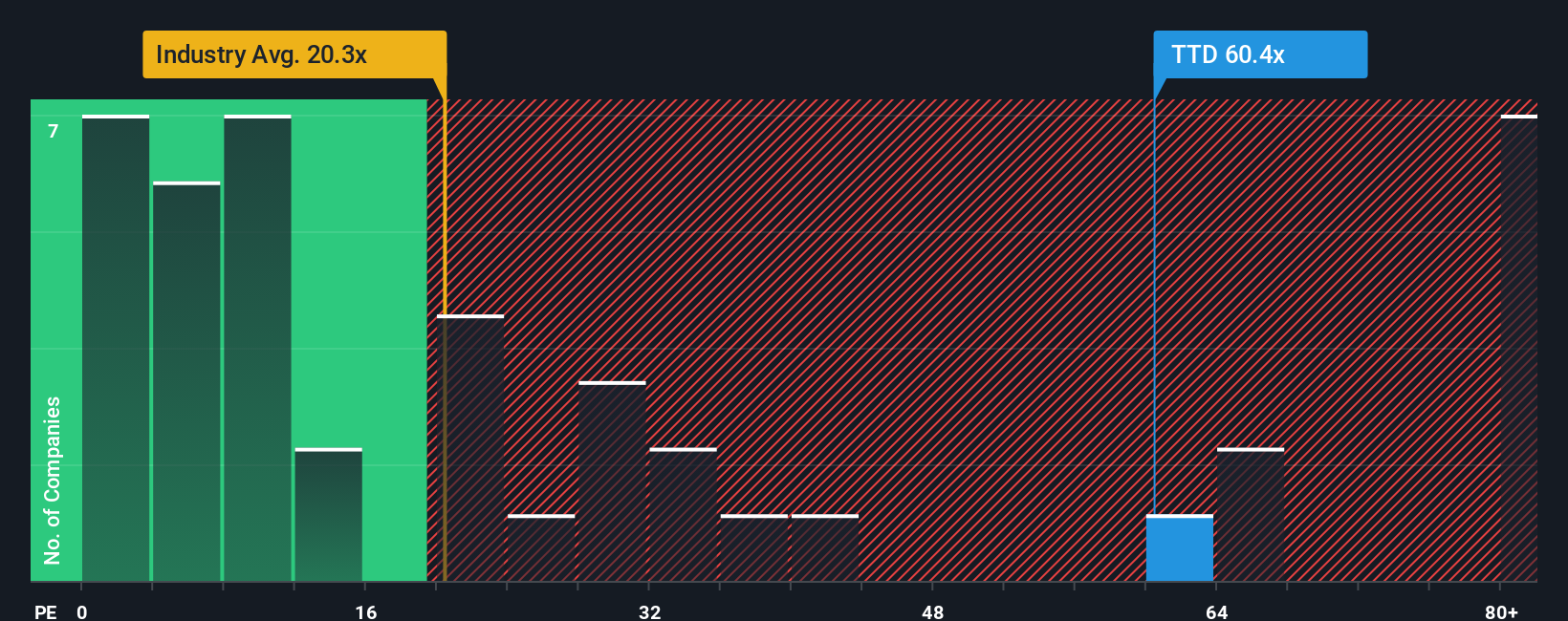

While fair value estimates suggest Trade Desk is undervalued, a closer look at its price-to-earnings ratio tells a different story. Trading at 61.4x earnings, the stock is far more expensive than both its peers (31.1x) and the broader US Media industry (19.7x). This steep premium may signal greater risk if growth does not accelerate and could challenge investor confidence in the current price. Will the premium prove justified or become an anchor on future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trade Desk Narrative

If you have a different perspective or want to analyze The Trade Desk’s story with your own approach, you can dig into the numbers and build your own viewpoint in just a few minutes. Do it your way

A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means seizing unique chances before the crowd does. Power up your search with these smart investment themes trusted by savvy investors worldwide.

- Tap into real growth potential by targeting these 898 undervalued stocks based on cash flows that could be overlooked by the market right now.

- Uncover future industry leaders when you review these 3581 penny stocks with strong financials backed by strong financials and resilience.

- Secure consistent income by selecting these 19 dividend stocks with yields > 3% with attractive yields and stable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives